A Guide to Post-Reorgs

Investment themes Pt. 3 = post-reorg equities; emerged from bankruptcy, now what?

We’re onto day 3 of 15 investment themes.

Day 1 covered beaten down stocks, a fruitful universe for idea generation and equity research.

Day 2 covered spin-offs, likely the most actionable bucket for new investments.

Now we’re onto Day 3, post-bankruptcy equities..

3) Post-Reorg

Another one from the Greenblatt You Can Be A Stock Market Genius playbook. The Chapter 11 bankruptcy process is designed to keep businesses alive with shifts in ownership; generally transferring debt investors to equity investors (or some combination of new debt and equity). Previous equity holders are usually (but not always) wiped out in the process. A business coming out of bankruptcy whereby all, most, or some of that company’s debt or liabilities are eliminated can be quite lucrative. Businesses go into bankruptcy for various reasons and these impact the attractiveness of the reorganized equity.

Some notes and things to watch for:

Frequent mispricing — The new equity from bankruptcy usually goes to the creditors (banks, bond funds, trade claims, etc.) who can’t or don’t want to hold these stocks for the long-run. So they’re typically looking for a quick exit. Coverage is also thin and liquidity is low. That combo creates bargains.

Capital structure issues — The phrase “getting ahead of your skis” happens all too often in the corporate world. Heavily debt-funded acquisitions plus a minor bump in performance can quickly send any business toward bankruptcy. The good news is that there might be an attractive underlying business if the debt weren’t there. The bankruptcy process can clean up these capital structures and make for great equity investments. (Good business, bad balance sheet.)

Business model or industry issues — It’s hard to distinguish the bad business/industry + too much debt situations, but these are the ones to steer clear of. Some coal and energy businesses dealt with this in the 2010’s. They’re on better footing now, but when oil fell from $100+ in 2014 to $40 by 2015, the combo of high debt and poor economics forced many of these businesses into bankruptcy. Some went through bankruptcy twice. Things to watch for: commodity price environment, melting ice cubes, pre-reorg performance, etc.

Did they actually fix the balance sheet — Avoid situations where the reorganized comes out of bankruptcy with still too much debt or other obligations (leases, environmental, etc.) plus industry economics are still poor (i.e. debt is high relative to mid-cycle EBITDA). Ultra Petroleum emerged in 2017 and filed again in 2020 for this reason. Gymboree had the same fate even though term debt was lower and stores were closed (still had tons of leases and mall exposure).

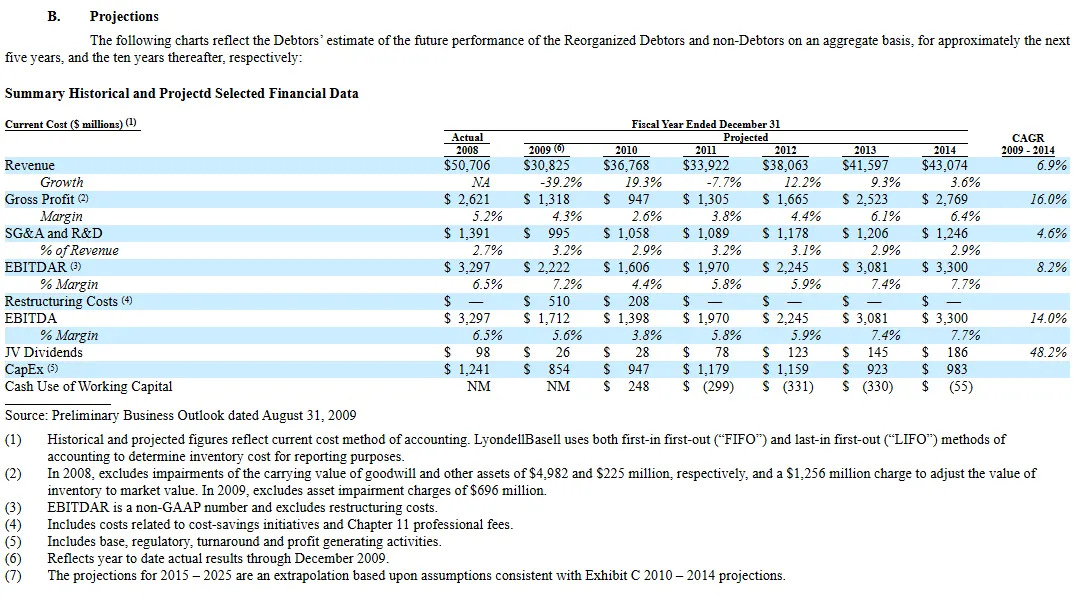

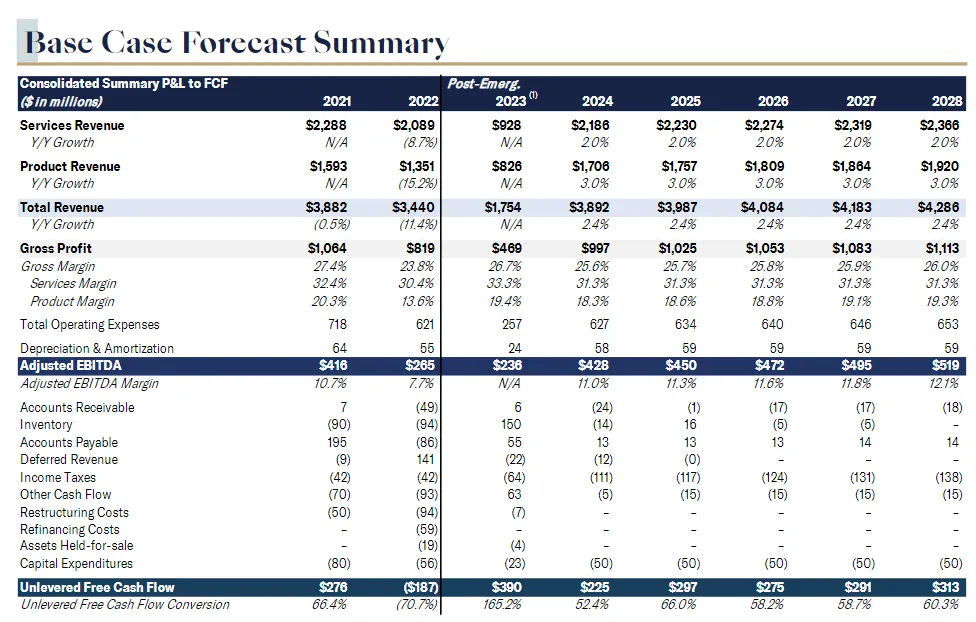

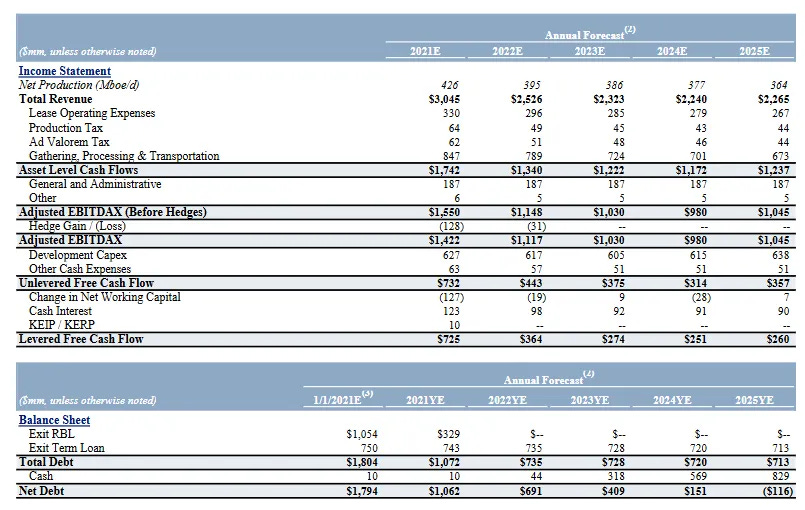

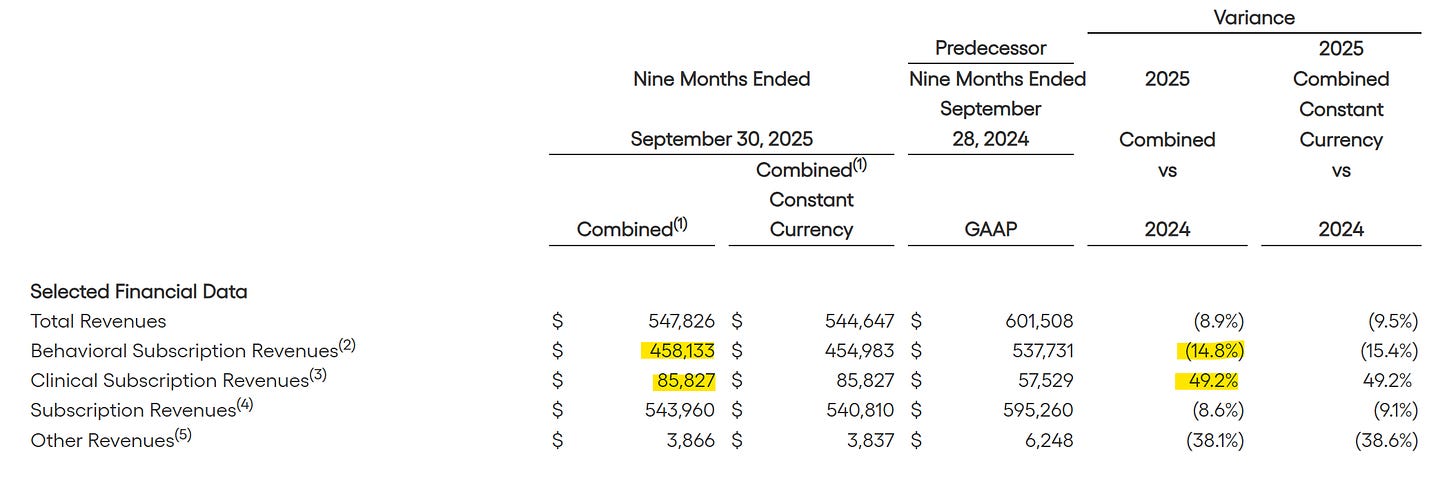

Analyze the reorg documents — These are cumbersome to navigate. The 2 key documents are the “disclosure statement” and “plan of reorganization” which include summarized historical financial information, pro-forma projections several years into the future (see below), and details on the new capital structure / ownership.

Examples of post-reorg equities & their projections:

LyondellBasell (LYB) — highly levered from the 2007 merger between Lyondell and Basell plus industry downturn for petrochemicals during GFC. Emerged with a much cleaner balance sheet (nearly $20bn less debt).

Diebold (DBD) — another example of a company with too much debt in a weak market (ATM sales and services). Here’s my write-up on this one from 2023.

WW International (WW) — Years of declining revenue + high debt led to a 2025 bankruptcy filing for WeightWatchers. This post-reorg equity is still a work in progress as revenue continues to decline.

Chesapeake Energy — high debt + falling energy prices during COVID led to this bankruptcy in 2020. Emerged in 2021 and merged with Southwestern Energy to become Expand Energy (EXE).

Environmental liability bankruptcies — W.R. Grace (asbestos), PG&E (California wildfires), and Garrett Motion (asbestos + spin liabilities)

Other post-bankruptcy examples include — Talen Energy (TLN), Hertz (HTZ), American Airlines (AAL)

Multiple-filers — not every reorg is successful… Ultra Petroleum, Party City, and Tuesday Morning emerged from bankruptcy and filed again a few years later

Where to find post-bankruptcy situations — These require a bit of extra work. Either following the news, or saved searches / feeds for disclosure statement documents.

Current post-reorg ideas

This is a bucket producing relatively few investment opportunities per year, but they’re all worth at least a cursory review given the dynamics laid out above.

WW International (WW, $25) — Emerged from bankruptcy in June 2025 with $1.15bn less debt on the balance sheet.

Guidance for 2025 is right in-line with the bankruptcy projections ($700m revenue and $145m EBITDA). There are ~10m shares outstanding ($250m market cap) and $300m net debt = $550m enterprise value. This is clearly very cheap (~3.5x EV/EBITDA), but revenue is declining 9-10% YoY.

Analysts expect revenue and EBITDA to decline in 2026 before starting to grow in 2027, but the “growth” portion of the business (clinical) is ~15% of total sales. So if this is a GoodCo / BadCo situation, then the crossover point might be pretty far away still.

I’d rather buy this at a price 50% higher with better conviction on the return to growth. Maybe I’m more of a skeptic on the GLP-1 benefit for this company.

Need to do some more work on this.

There is a very nice write up of value investigator about WW. Thanks for your article!

Solid framework for post-reorg screening. The LYB case really nails the importance of seperating balance sheet problems from business model problems, petrochemicals were beat up but not broken, so slashing $20B in debt basically unlocked massive value. The trickier part is catching the repeat filers early, like checking whetehr pro-forma leverage is actually sustainable given mid-cycle earnings.