An update on B. Riley (RILY)

Taking a look at what's going on here...

What’s going on here?

I've been tracking this company and periodically owned shares for ~five years now. With the short thesis proving accurate so far, the narrative around the company is heating up…

To be clear, I'm not suggesting it's a buy at the current price, and I don’t have a position in the stock. I’m simply taking a closer look to see what’s happening behind the scenes.

Here are the major events taking shape (in no particular order):

RILY spent $281m to acquire a minority stake in the Franchise Group (FRG) LBO — a controversial deal that is now imploding as their core business (American Freight) is seeing accelerating losses

The investment portfolio ($1.4bn at Q1 and $860m at Q2) just took a $330-370m write-down on FRG and a loan tied to former FRG CEO

Acquired consumer product business Targus for $248m in 4Q22 and subsequently wrote-off $97m — management was expecting ~$50m EBITDA annually but the business is producing losses of $8-10m annually

Operating EBITDA at RILY’s wholly-owned businesses are declining from $90m per quarter in 2023 to $66m in 1Q24 and $50-55m in 2Q24 — the culprits likely being interest income from the loan book and the struggling Targus business

Intention to sell the Great American Group auction/liquidation/appraisal business doing $35m per year in EBITDA

SEC investigations are intensifying for the company and CEO related to past dealings with FRG former CEO Brian Kahn and his various misdealings

A wall of debt maturities are coming due over the next few years — totaling $2.16bn as of Q2 — with 2026 being a key year at $723m in maturities

As a result, the dividend was suspended to focus on paying down debt

There are 4 main problems as I see it:

1) Leverage — The math is starting to get simpler (and more dangerous)… let’s assume Q2 operating EBITDA of $50-55m is a good run-rate and interest expense is ~$43m per quarter. At $220m annual EBITDA with $2.16bn debt, RILY is levered nearly 10x. It’s a tad less if you include cash but I’d caution against netting the entire investment portfolio. It’s hard to repay $2.16bn debt with ~$40m annual FCF.

2) Monetizing investments — RILY made several investments over the past few years with the goal of monetizing them over time (FRG, loans, BW, etc.). With the picture above, they’ll need to pull forward that schedule; and at a time when some of those investments are weak. To compensate, they’re looking at selling entire business units starting with the Great American appraisal and liquidation business. I wouldn’t be surprised if others come on the block too.

3) Valuation double-dipping — You can’t give them valuation credit for both the asset value (i.e. loan investments) and the earnings value (i.e. loan interest income). So if you’re using operating EBITDA as a valuation metric, then you need to exclude the asset values of those items from the investment portfolio. This includes brand investments, the loan book, and probably a few other holdings. As of 2Q24, they have ~$860m of investments (net of cash) and I’d argue it’s likely half that amount when excluding holdings generating an income stream to RILY. For example: if they sold the brand portfolio, it would reduce the investment portfolio balance and reduce earnings from dividend income.

4) Black swan risk — An SEC investigation into dealings between RILY and former FRG CEO Brian Kahn is widening with subpoenas to both the company and RILY CEO. Aside from the leverage, an unexpected fine, court case, fraud exposure, etc. could set this off.

A few other notes:

I’m eager to see the 10-Q and get an update on operating business performance — as of Q1, the loan book and consumer businesses (Targus) were acting as a major drag on EBITDA. Which is unfortunate given the turnaround taking shape in the capital markets and wealth management businesses.

As for the investment portfolio… There are 2 buckets when thinking about “monetizable” assets on their balance sheet — 1) investments that could be sold without impacting EBITDA; and 2) investments that would impact EBITDA.

We have limited information without the 10-Q, but assuming FRG and the Kahn loan are worthless, there are maybe $200-300m worth of investments that could be sold without impacting EBITDA? Again, wouldn’t be surprised if many of these are sold to cover near-term debt maturities.

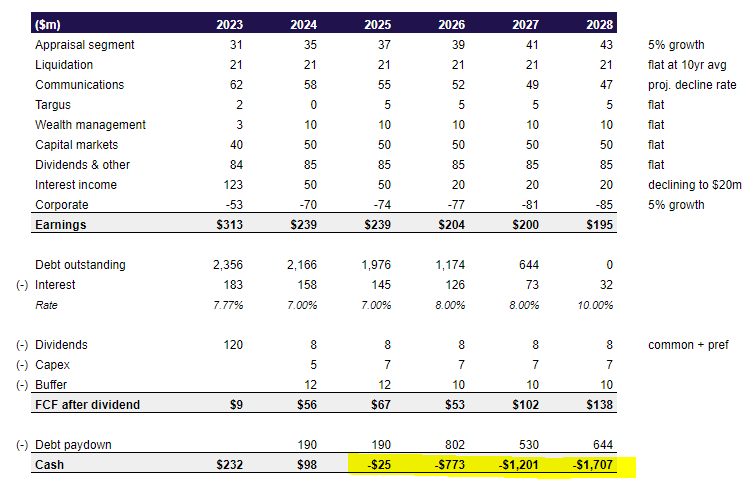

Here’s a simplistic model as to how the next few years could play out… cash generated from RILY’s operating businesses could potentially get them through 2025. But it’s like walking a tightrope. After that, assuming no black swan legal issues, you’d need investment sales to cover the balance. Even if they sold a major business unit and maintained 2x leverage, the math is tough.

I’ve been dead wrong on this one as the story morphed over the years to become more of a levered bet on levered investments. Perhaps they wouldn’t be in this position had they kept some of the cash generated during the SPAC boom in 2020-2021…

Maybe (big maybe) there’s a price where it gets interesting as a call option on selling off pieces of the business to realize a SOTP value.

Disclosure: No position.

Value Don't Lie - Can we get an update on this topic based on the two business sells that were announced?

You've mentioned that if FRG is worthless, which, likely because of the Badcock and CONNs bankruptcy and American Freight downturn, is probably taking a haircut in value. They still have the other pieces like Pet Supplies Plus and Vitamin Shoppe. If these are sold at the valuation multiples that RILY had outlined in their deck, wouldn't that eliminate most of the debt that FRG and RILY have? You mentioned that in your stack last year, so was curious why this wasn't part of the writeup this time around. I agree though, if they are writing off all of FRG and assuming it's worthless/can't sell the parts there's little chance for a turnaround and bankruptcy will be around the corner.

Of course, without a 10-Q, everything is just speculation. I don't think bankruptcy is on the cards or table until at least 2025 with a GAG sale, they should have enough cash on hand to pay out liabilities and maybe wait around for the FRG SOTP sale.