B Riley ($RILY) - A "Short" Rebuttal

I’ve followed the story and covered the stock for many years… I own some shares and want to dig a bit deeper to understand what to do with my stake in the company (sell, add, or swap into other securities like bonds)…

While it’s gotten a bit more complicated, not much has changed so consider this a free flowing stream of consciousness as I review the short thesis, latest results, and the most recent 10-Q…

As a reminder, this is: 1) a collection of wholly owned operating businesses; and 2) an investment portfolio of public securities, private companies, and loans receivable. RILY earned >$22/share in GAAP net income during 2020-2021, lost $6/share in 2022 and is roughly breakeven so far in 2023. Suffice to say it’s been a wild ride.

The Short Bet…

RILY is a fraud

If not a fraud, they are degenerates

Brian Kahn is a fraud and by association, so is Bryant Riley

Bryant Riley has a margin loan on his shares and he’s about to get called

Bryant Riley knew about Kahn’s fraud and continued to make loans/investments

“Investments” held by RILY are low quality, worthless, or fraudulent(?) companies as well

Getting more granular with the short arguments, I’ve seen comments that several RILY investments — Babcock & Wilcox (BW), bebe stores (BEBE), Franchise Group (FRG) — are either going bankrupt, severely impaired, or are outright frauds. I’ve also read that the capital markets / investment banking division is more-or-less a bucket shop run by degenerates.

A lot of these arguments are non-fundamental in nature.

I’ll cover the investments in a moment but let’s start with the actual businesses they own.

Operating businesses…

Let’s start with what RILY owns…

Capital Markets — Hardest segment to handicap/value. It was formed through a string of acquisitions (FBR & Co, Wunderlich, National Holdings, etc.) and profit spiked during COVID as capital markets activity picked up.

Wealth Management — Formerly a segment within Capital Markets (pre-2020) but formed out of the National Holdings acquisition. Over 90% of revenue is from fee-based AUM as opposed to commissions or transactional fees.

Auction & Liquidation — Countercyclical (and very lumpy) asset sales of bankrupt/liquidating businesses (mainly retailers).

Financial Consulting — This is an absolute crown jewel of a business and probably sources a decent amount of deal flow to the mothership. There are some recently added services around restructuring and advisory but the real gem is the appraisal business. Appraisals are done for lenders, PE firms, etc. centering around inventory, equipment, business value, etc. It’s a recurring business with steadily increasing profitability for more than a decade.

Communications — A roll-up of stale telecom brands… started as United Online, then they added magicJack, then Lingo and BullsEye. This would certainly be a low multiple business as a standalone company but they wring out stable cash flow from it.

Consumer — 2 main business lines: 1) Targus, a global retailer of consumer products like bags, packs, chargers, docking stations, etc.; and 2) a portfolio of retail brands, some majority owned and others minority (including Hurley and Justice).

A few additional notes on the operating businesses… the figures above include interest income from the loan book (but not gains/losses on fair value), they exclude corporate overhead and dividend income from minority investments like Hurley/Justice.

Here’s a reconciliation between segment EBIT and GAAP pre-tax income…

Generally disclosures are pretty good but I find it helpful to reorganize some items to simplify the picture.

Here’s another clarifying picture of cash flow — I’ve stripped out the securities purchases into investing cash flow to get a better feel for actual operating cash flow each year. Trading gains/losses would still flow through net income for 2022-2023.

Investment portfolio…

As of Q3, the investment portfolio totals ~$1.75bn ($1.2bn equity/debt securities and $550m loans receivable).

The latest 13-F as of 9/30 calls out $296m in publicly traded equity value. Aside from the 13-F, the 10-Q calls out $601m in minority investments marked at fair value… that doesn’t tally up to the $1.088bn listed equity securities so I’m not sure where the differential sits. But I do find it interesting that the vast majority of the investment portfolio sits in privately marked investments…

There are 4 big controversies in the portfolio:

1) Franchise Group (FRG) — RILY spent $281m to acquire a 31% voting interest in the FRG take-private transaction. FRG’s CEO, Brian Kahn, rolled his ~11.5m shares at $30 and RILY helped syndicate the rest.

Post-close that’s ~$900m total equity and total debt of probably $2.1-2.2bn (35m pre-close shares less 11m owned by Kahn x $30 buyout price = $720m + $1.4bn pre-close debt).

Here are the numbers on FRG’s various businesses:

I’ve seen comments implying they are playing games with the equity stake since they invested $281m out of ~$560m raised which is >50% and therefore should consolidate FRG in RILY’s financials; but that ignores Kahn’s rollover equity (it was a management buyout). So the math is pretty simple that RILY invested $281m from their balance sheet and therefore own 31% of FRG.

Kahn’s fraud situation is his situation. Unless there are some facts that surface, anything tying Kahn’s antics to RILY’s improper ownership of FRG is conjecture. Maybe Kahn’s defrauded investors wind up getting his shares in FRG?

The main takeaway on FRG is that the buyout took place in the midst of a very tough rent-to-own market… Other RTO companies like Buddy’s, Rent a Center, and Aaron’s have all been struggling post-COVID (an obvious stimulus hangover affecting lower income consumers). American Freight and Badcock went from profitable businesses to loss-making. There’s a lot of upside to the equity when/if those businesses normalize in 2024-2025.

Aside from RTO… all other businesses owned by FRG are stable cash generators… I wouldn’t be surprised to see them sell off 1-2 businesses to repay a big portion of debt. Pet Supplies Plus and Sylvan Learning alone could likely be sold at a price equal to FRG’s entire debt balance.

2) Babcock & Wilcox (BW) — B&W is a 150+ year old company and well known in the engineering/construction industry.

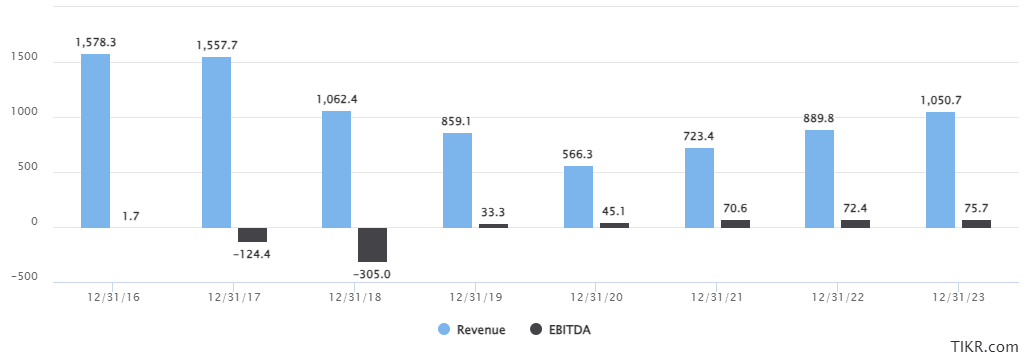

They spun off their nuclear division (BWXT) in 2016 and were left with the E&C division… previous management nearly bankrupt the company in 2017-2018. RILY provided rescue financing (debt, equity, and preferred) and also controls the CEO spot (Ken Young is an employee of RILY and acts as CEO of BW).

They’ve grown revenue and EBITDA but it isn’t spitting out cash flow — a key point for the bear case.

On the latest earnings call BW announced they were winding down the money-losing solar construction division and stepping back from new build projects to focus on aftermarket parts and service. That will help margins and cash flow but most importantly they’ll be able to wind down expensive bank letters of credit. Otherwise, their debt is almost entirely baby bonds maturing in 2026… that doesn’t translate to imminent bankruptcy.

I see a business with GAAP operating income and growing EBITDA. Interest expense is misleading with the posted letters of credit but that should ease up in 2024 with some capital coming back to the company too.

Guidance calls for ~25% EBITDA growth in 2024… net debt is ~$335m or 3.35x on $100m of 2024 EBITDA. Almost all of that debt consists of baby bonds maturing in 2026. That’s a lot of runway to continue growing the business and start generating some cash.

As for RILY — the key takeaway is that it will likely take a few years for this to play out… the only real path to recoup their investment in BW is an outright sale of the entire company, a not so farfetched idea.

3) bebe stores (BEBE) — Again, BEBE has exposure to the RTO industry through ownership of several Buddy’s franchise locations (yes, it’s a related party deal since RILY owns FRG now).

Those RTO earnings went from positive in 2021-2022 to negative in 2023 and should normalize sometime in 2024-2025. Until then, BEBE is earning close to $0.40/share and at $3 that’s a sub-8x P/E with significant upside to earnings over the next 2-3 years. Hardly overvalued, if not substantially undervalued.

RILY bought shares in October and will consolidate BEBE starting 4Q23 which should be a boost to earnings of $1-2m per quarter.

4) Loans receivable — The loan book is getting smaller with Badcock receivables going away… excluding that, there is $578m principal value marked at $549m as of 9/30/23… here are what I see as the biggest pieces of that $578m:

AREN — $103m

XELA — $75m (?)

CORZQ — $42m

Torticity LLC — $15m

APLD — $5m

That totals $245m… I think several of these should work out fine… Bitcoin miner, CORZQ, is now generating cash and exiting bankruptcy, comments below:

Arena Group (AREN) is wrapping up a cash infusion from 2 large investors as part of an acquisition. That should lower RILY’s outstanding balance here soon. Xela looks headed for bankruptcy but might otherwise be an OK business with a bad balance sheet. I don’t know anything about Torticity LLC other than it’s a related party transaction. And APLD is too small to matter. The rest of the loan book is undisclosed but we know they don’t consist of any other related party transactions.

5) Brand minority investments (i.e. Hurley and Justice) — No one seems to talk about this bright spot in the portfolio. Brand partner Bluestar Alliance owns and manages these brands and RILY collects dividend checks. Overall net income is consistently >$60m per year (acquired in late 2020) and return on assets >30% with virtually zero leverage. Revenue is growing another 14% so far in 2023. This single asset (2 brands) could be worth more than half of the entire RILY investment balance

Valuation thoughts…

Debt — For starters, the balance sheet has $2.36bn in gross debt (most of which are baby bonds maturing over the next few years).

Assets & earnings — Supporting that debt are $1.2bn in securities, $550m in loans receivable, $5250m in cash, and a collection of operating businesses kicking off $256m in trailing EBIT.

Other expenses — Interest expense is $180m annually and the dividend runs another $120m annually. Taxes and working capital are minimal but they chip in another $10m or so.

That leaves RILY in a delicate balance with “leftover” earnings running at maybe $40m annually ($1.30/share). Not much to work with when it comes to tackling upcoming debt maturities ($140m in 2024, $146m in 2025, and the bulk due in 2026-2028).

Bryant already commented that they don’t plan to rollover the baby bonds. Instead, they’ll use balance sheet assets to repay debt as it matures. Cash and other short term stuff should cover 2024 and likely 2025 but the big question is what this stuff is worth.

Without the investments at fair value, they’d absolutely need to eliminate the dividend to cover debt maturities. But writing the investment portfolio down to zero is unrealistic.

My take on a “worst case” scenario?

13-F equity holdings worth at least $100m — ALTG, DDI, and BW (at $1/share); with everything else marked at zero

Loan book worth $250m — CORZQ, AREN, and a 65% markdown on everything else

Corporate bonds worth $66m fair value

Privately marked equity holdings worth at least $730m (though not liquid) — this represents $280m invested in FRG at cost and $450m for the ~42% stakes in Hurly/Justice, which are generating >$60m annually in net income

That gets me $1.15bn fair value or roughly 68% of balance sheet value. If RILY used that to repay all debt except the longest dated baby bonds, we’d bring debt down to $1.2bn and interest expense below $80m; leaving them moderately levered and the dividend decently well covered.

My guess is Bryant feels the entire investment portfolio is massively undervalued though. He’s probably right in a few areas (FRG, brands, BW) and wrong in a few others (certain loans, and half the 13F holdings).

Thoughts…

RILY has been expanding the collection of businesses and investments for several years now and the opportunity in small caps is still pretty rich… it feels like they’ve overextended the balance sheet and need to go into harvest mode.

They’re getting a bad rap on the investment side since they’ve harvested a lot of winners the past few years; but the track record is pretty good…

Consider this — GAAP trading gains since 2018 total $194m or ~$6.50/share (that excludes any interest income from loans receivable)

What about some of the winning equity/loan investments that no one talks about? Tile Shop (TTSH), Select Interior (SIC), Harrow Health (HROW), Faze (yes, I consider this a win), Hurley/Justice and other retail brands, the entire communications business, etc.

Still a lot to unpack… I don’t want to dismiss shorts’ arguments but it feels like a lot of self-fulfilling fear mongering. Maybe hiding out in the shorter maturity baby bonds are a safer play? The 2 nearest maturities look relatively attractive given the cash position, historical 4th quarter cash generation, and positive segment earnings…

Bryant,

If you wind up reading this and want to fight back against these short seller arguments… some thoughts:

Consider selling 2 or 3 of your more valuable assets like some brands or Pet Supplies Plus within FRG

Take some deleveraging actions like buying back debt at deep discounts to par

Disclose some thoughts/plans around minority investments where you aren’t receiving regular cash flow — a key theme to shorts’ thesis is RILY levered up to pay for the FRG equity which itself is a highly levered entity… how/when will RILY eventually recoup some of that?

Expand disclosure on the loan book — cumulative track record, what’s in the non-disclosed portion of the book, what are your plans for tackling the distressed situations?