Further thoughts on Walgreens (WBA)

Some additional thoughts and notes on the Walgreens (WBA) situation…

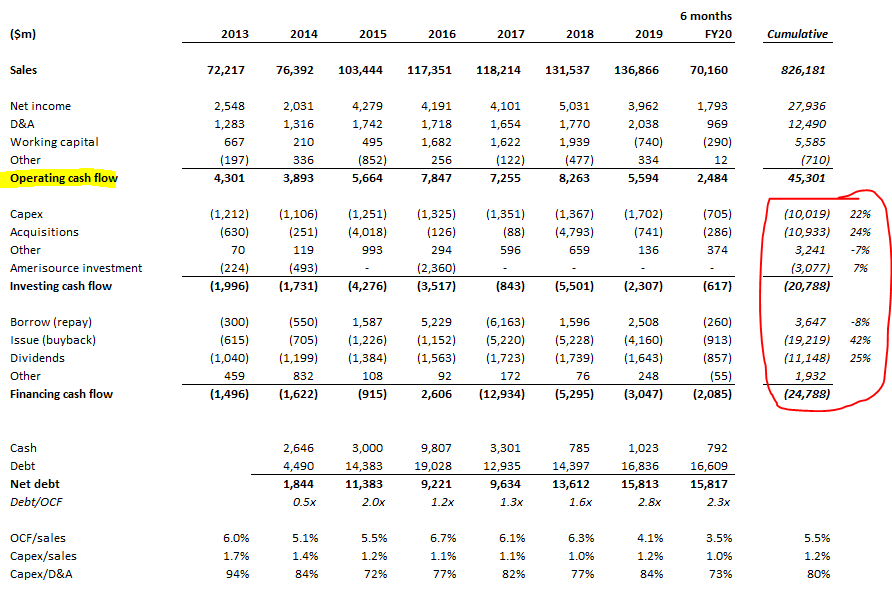

Sources & Uses of Cash

Here are the sources and uses of cash over the past 7.5 years (2013-2020):

So much talk about capital allocation out there but the best way to truly understand it is to actually look at what a company has been doing for a long period of time (assuming a consistent management team that is)…

In our case, Stefano Pessina has been the Walgreens CEO for nearly the entire period above — so we have consistent management. Trends have changed over the period but here are some takeaways:

Operating cash flow — has been consistent but I wouldn’t call it trending higher… no real spike came from the Rite Aid stores acquired in 2018 though this was the beginning of the cost saving program (mentioned below)

Working capital — it amazes me that working capital has been a net cash contributor for so long in such an inventory-centric business… this surely cannot last?

Capital returns — nearly 70% of cash flow at $30bn though this ramped heavily in 2017-2019

M&A — there were 2 spikes in 2015 and 2018 for the Alliance Boots and Rite Aid deals but nothing “transformational” for the most part… about 25% of cash flow has been spent on acquisitions

Other “stuff” —

modest increase in debt which came in the past 3 years as they levered up for buybacks

$3bn invested in an equity stake of AmerisourceBergen (ABC)

consistent capex of $1.2-1.5bn per year or ~1.2% of sales

Pretty wild they repurchased nearly $15bn in stock from 2017-2019 given the current market cap is only ~$41bn.

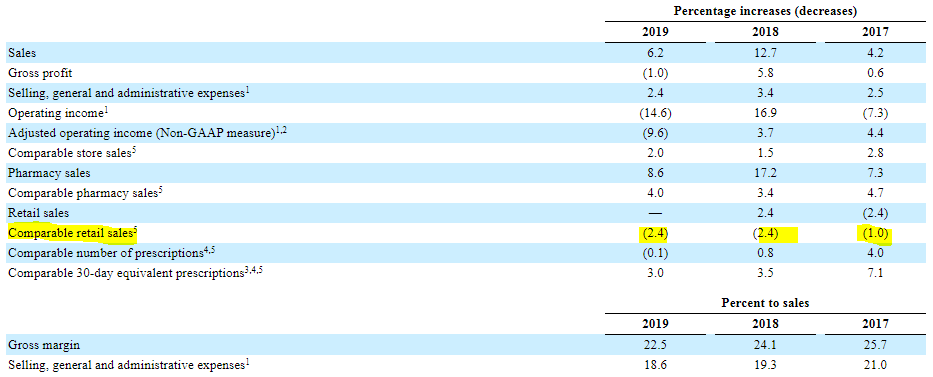

Why are shares sucking wind?

Retailers typically get pegged to their same-store sales growth. Both retail sales and number of prescriptions have been falling the past few years with pharmacy sales offsetting.

Retails comps the past 3 years

2017 — (1.0)%

2018 — (2.4)%

2019 — (2.4)%

1H20 — (1.2)%

Probably doesn’t help that rival CVS has been outselling Walgreens right across the street…

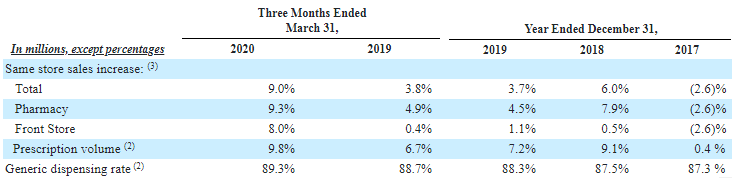

For now, sales have been growing through the pharmacy side of the business — prescription drugs and healthcare services (i.e. “minute clinic”). Does Walgreens need to find new ways to attract customers to its stores?

Would a “vertical” acquisition help in this?

CVS acquired Aetna in the hopes that its millions of health insurance members would flock to CVS stores for prescriptions and health services while also buying front store items such as food, drinks, toiletries, and beauty supplies. This seems to be playing out so far in 2019-2020…

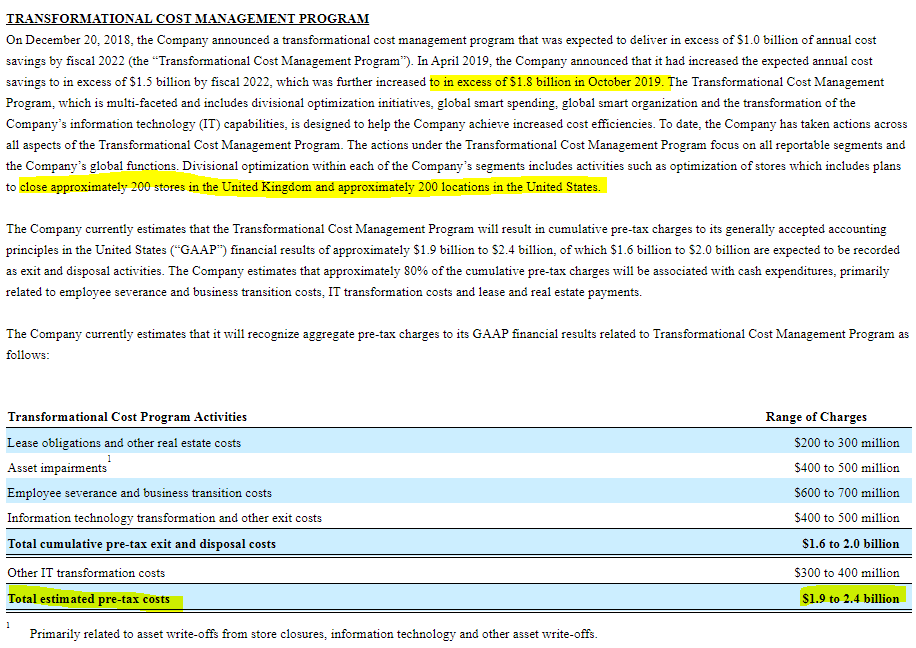

Cost Saving Program

These cost saving plans are generally a mixed bag and I feel like they rarely result in the net improvement in earnings they advertise. But this one is significant so its worth mentioning…

Originally penned at $1bn in cost savings which grew to $1.8bn in cost savings by FY2022 (starting point of ~1/1/19… they’ve already incurred $0.7bn of the estimated $1.9-2.4bn cost to achieve these savings…

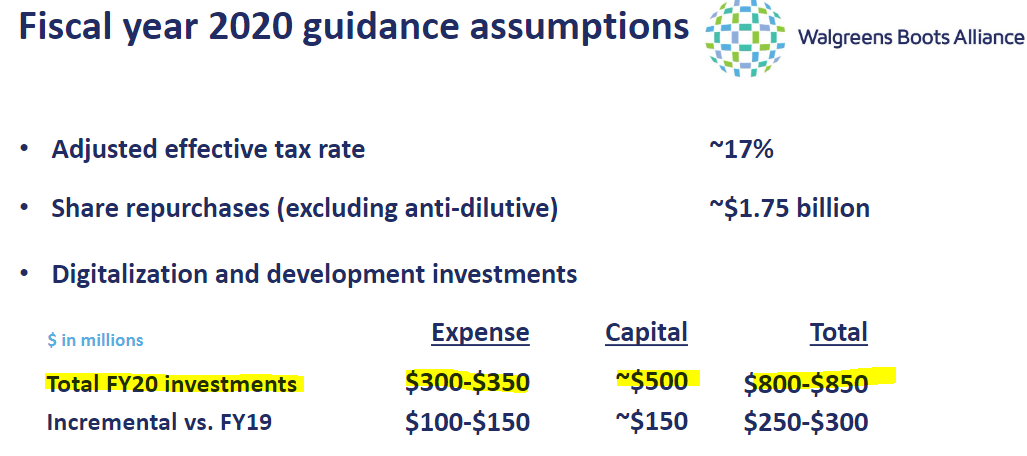

FY2020 is a year of heavy investment in these cost saving initiatives for Walgreens which is leading to significantly lower share repurchases ($1.75bn) relative to the past few years at $4-5bn.

What about AmerisourceBergen (ABC)?

Walgreens owns some 57m shares of Amerisource for a roughly 28% equity stake in the company. It’s treated as an equity method investment on the balance sheet marked at $5.2bn as of 2Q20.

Here’s some background from a WSJ article a few years back — link.

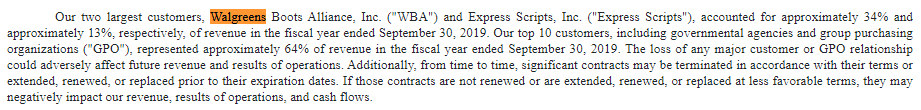

Amerisource is a distributor of drugs and supplies. Walgreens is currently the largest customer at 34% of sales with Express Scripts (recently acquired by Cigna) as #2 at 13% of sales.

Owning Amerisource would give Walgreens (more) access to cheaper drugs as they would be able to capture margin on one of their key costs. Distributors are already pretty heavily exposed to drug stores given it’s the primary channel for filling prescriptions so a deal wouldn’t reduce the risk to drug store traffic all that much. It’s also unclear whether a deal would drive additional traffic to stores.

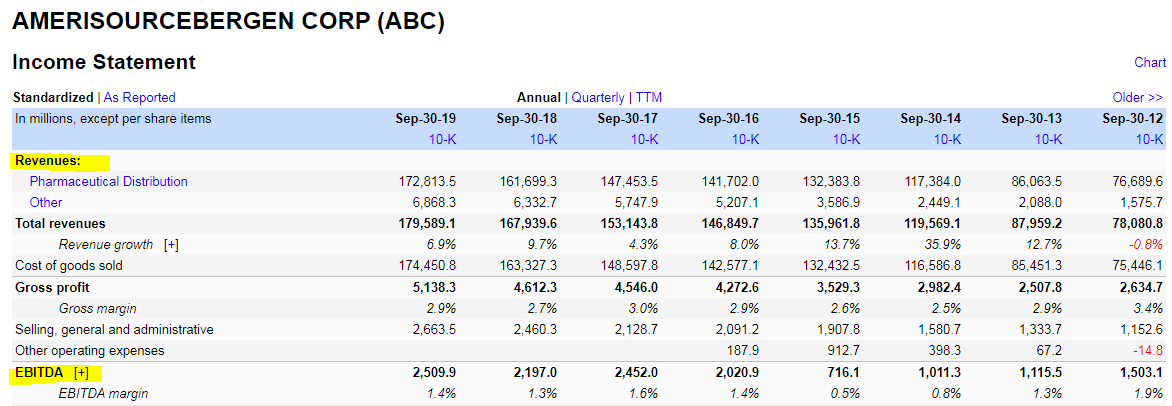

Amerisource has had a good run of its own over the past few years…

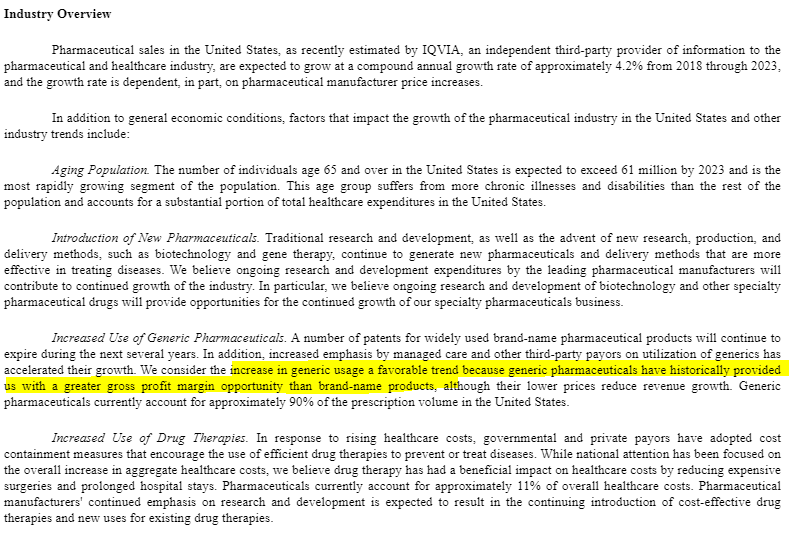

These businesses (distribution) benefit from increasing use of prescription drugs, trends toward generics, and an older population… all of which should continue playing out for years to come.

So Walgreens already owns 28% of this $21bn market cap = $15bn remaining to acquire. Call it a 25% premium and they’d have to pay $18.75bn to own the rest of the company. EBITDA for Amerisource is about $2.5bn per year so tack that onto the $8bn or so that Walgreens generates = $10.5bn combined EBITDA. If a deal was done entirely with debt that would leave $35bn or so in net debt for a 3.3x leverage ratio… certainly not outrageous…

But what would that combined company be able to do differently/better than either one as a standalone?

The alternative is that Walgreens could sell the $5.2bn stake back to Amerisource (and perhaps their small European drug distribution segment as well) to raise cash for buybacks, dividends, or other investments?

The cash investment in Amerisource only produces modest dividends and equity income so it would have minimal impact to financials. Meaning they could use that cash (after taxes) as desired…

Last few thoughts…

It’s hard to say what the combination of above items (cash flow, retail comps, cost savings, Amerisource) will do for Walgreens over the next few years.

On the plus side, this is still a very profitable business with ample room on the balance sheet. On the downside, cost saving plans won’t reverse their fortune in retail traffic/sales…

What to do?