Happy ThirdFederals-giving!

TFSL - super cheap bank (pre thrift conversion) with 8% yield

Happy Thanksgiving!

With the recent release of TFSL’s latest annual report, I thought I’d share some notes on reviewing the 10-K of a favorite holding of mine… (First: subscribe! Then: Enjoy!)

Third Federal ($TFSL) is a plain vanilla bank offering residential mortgages and HELOCs mainly in Ohio and Florida through a network of 37 branches. A quick word on share count — it “looks” like there are 280m shares outstanding but in reality, 227m are held by the Third Federal MHC, these shares are excluded when considering ratios like EPS, book value per share, or dividends — the true share count is around 53m; at $14/share = $740m market cap. I won’t get into thrift/mutual conversions but this is what’s known as a first step mutual conversion and is primarily owned by depositors via unissued MHC shares.

Here are some notes on my review of the 10-K for the period ending 9/30/22:

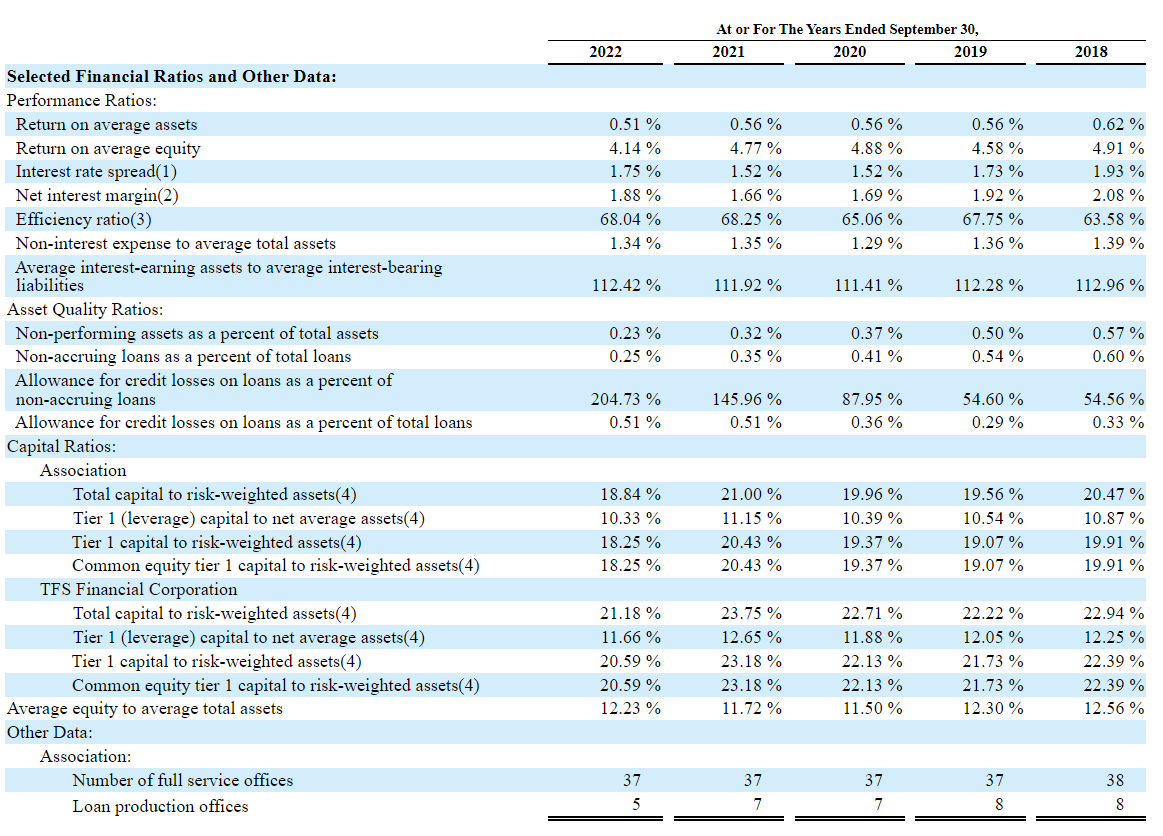

1) 5 year financial data — I was pissed when the SEC did away with the “Selected Financial Data” reporting requirement. These 5 year tables had key financial information and often some non-required KPIs that helped to understand where a company had been lately. Fortunately, TFSL kept this going! Here are those 5 year selected data tables:

Some random bullets on reading these metrics:

Net earnings have been very consistent between $75-85m from 2018-2022

Dividend increases slowed as rates compressed net interest income (NII)

2022 saw big jump in NII (+15% YoY) as interest rates went up… TFSL should be positioned to grow with rates

Along with that NII increase, net interest margins are on the rise

Non interest income spiked in 2020-2021 thanks to gain on sale activity from crazy real estate markets (TFSL is not a big non interest income generator)

Expense base sits at ~$198m and has grown at <1% per year

Loans have grown 2.5%/year since 2018 and deposits by 1%/year

Equity to assets stable around 12% (i.e. conservative amount of leverage)

Book value has grown a smidge from 2018 to 2022

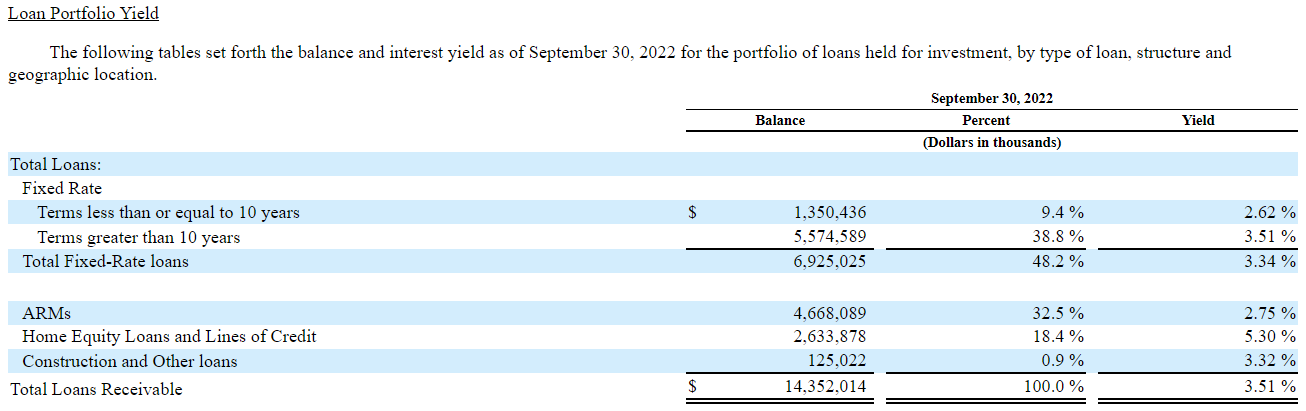

2) Asset mix — TFSL skews short duration and adjustable rate loans with >30% of total loans as ARMs and 18% of loans as HELOCs. There are very few commercial loans so this is entirely a residential lender.

Over half of the entire loan portfolio is variable rate… TFSL is well positioned to grow earnings in a rising rate environment. Big interest rate resets are set for 2026-2027 as $3.3bn of the $4.7bn ARM balance resets.

The securities portfolio is so small it’s not really worth mentioning… ~$460m on a $16bn balance sheet or less than 3% of total assets. It’s not a key earnings driver.

3) Liability mix — Deposits total ~$9bn and haven’t been growing much. TFSL is a heavy user of FHLB borrowings to fund loans, totaling $4.8bn at 9/30/22.

TFSL doesn’t have much in non interest bearing liabilities and the funding costs are likely to move up in tandem with earning assets (though at a slower pace).

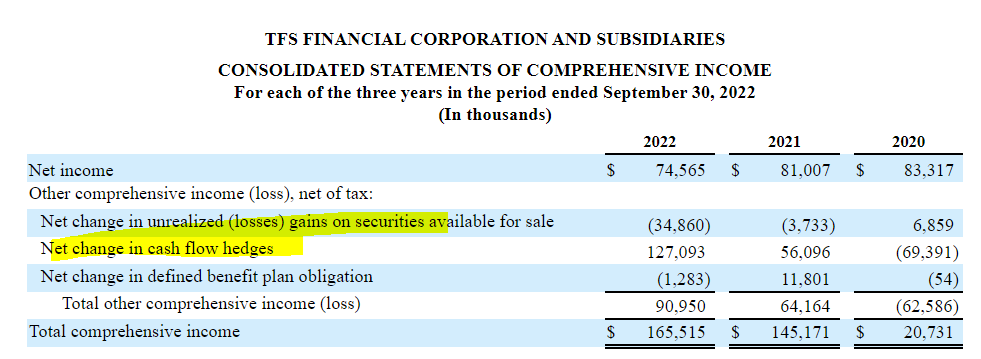

4) Interest rate sensitivity — I’ve seen a few other financials reporting big losses in their available for sale securities portfolio (rates up, value of securities down). TFSL has most of their assets in loans so the securities portfolio didn’t harm the balance sheet all that much in 2022. On top of that, they had positioned the balance sheet with some rate hedges that paid off in a big way in 2021-2022.

Again, the loan book is highly variable so they’re setup for earnings growth in a rising rate environment.

5) Capital allocation — Capital allocation is almost entirely focused on the dividend at this point, and why not when the CEO owns 530k shares and bags $600m a year on dividend income alone. The dividend costs TFSL $55-60m per year and net earnings are $75-85m (likely on the rise too) so the yield is well covered. They’re retaining very little earnings each year and that’s OK since they have so much equity. Frankly, they could be shrinking the balance sheet and returning additional capital to shareholders; but why bother when things are going just fine, this is a very conservatively run business almost akin to a family company.

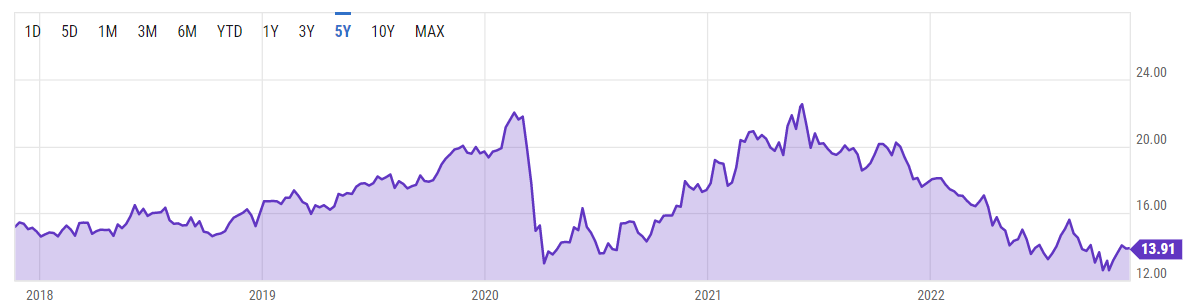

6) Valuation — Net earnings are $75-85m per year; on 53m shares that’s $1.40-1.60/share. On a $14 stock, it’s trading at 9-10x earnings. Historic averages are closer to 12-13x.

The dividend yield has been >8% for most of 2022 which last happened as the pandemic started in 2020. At the 5yr average yield of 5.8%, it’d be close to a $20 stock.

Last is book value… at $1.8bn it’s nearly $35/share in book value. So 0.4x P/B.

Altogether that’s 9-10x earnings, 0.4x book value, and 8% dividend yield; with potentially growing earnings in 2023-2024 from rising rates… That seems like a decent setup compared to other more complicated banks/financials. It’s not the most exciting stock but I like it.