Quick Value 10.10.22 ($SWK)

Stanley Black & Decker - severely beaten up industrial at 10x earnings

Market Performance

Market Stats

S&P 500 at various levels and ratios over the past 2 decades…

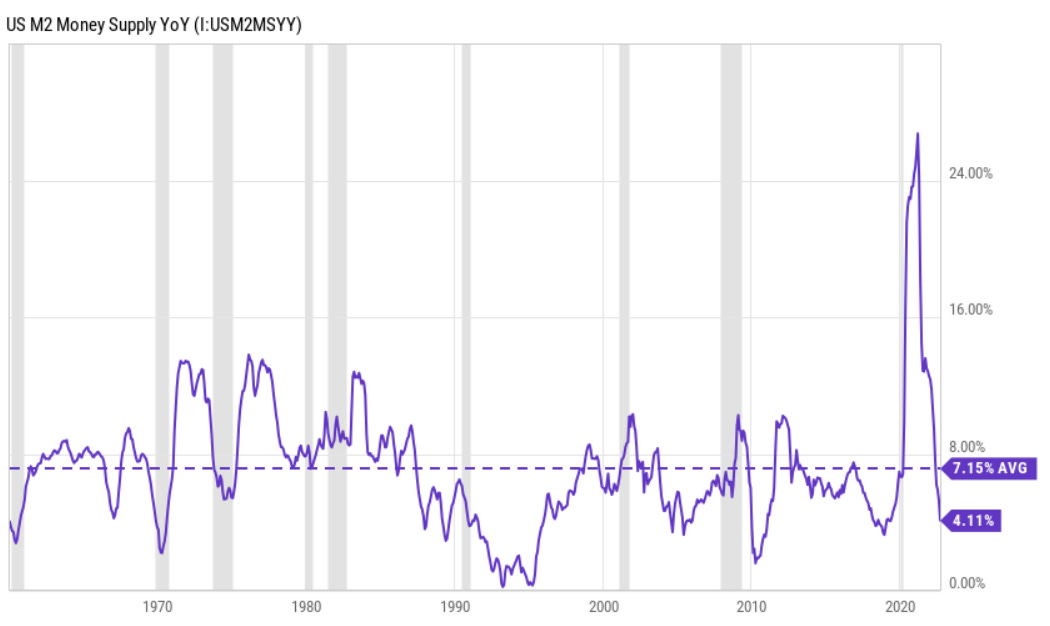

Quantitative tightening (QT) is in early innings and expected to pick up the pace over the next few years

Money supply growth has dropped substantially as monetary policy has tightened (from QT)… growth rates have not gone negative

Quick Value

Stanley Black & Decker ($SWK)

There are plenty of beaten up stocks out there right now but it’s particularly interesting to come across big losers in large-cap land. SWK is a well-known industrial company and shares are down close to 60% YTD and almost 70% off 2021 highs.

What they do…

SWK operates 2 segments:

Tools & Outdoor — This segment serves both professional and consumer markets with products like levels, drills, wrenches, screwdrivers, saws, lawn and garden equipment, mowers, etc. All have well known brand names like Stanley, Black & Decker, Craftsman, DeWalt.

Industrial — Serving the business segment, these products include industrial fasteners and hydraulic tools. It’s much smaller piece of the overall business and has lower margins than the tools segment.

Why it’s interesting…

Let’s set aside the fact that shares have blown up lately and find a few other notables for the stock.

Cash flow — SWK was averaging $1.3bn in free cash flow from FY2016-2020… 2021 saw a big outflow for working capital and then again during the 12-months ending 2Q22. It’s highly likely the company will “catch up” on working capital and begin generating substantial amounts of cash.

Sale of security business and big buyback — In addition to the ugly looking operating cash flow situation above, SWK was in the process of selling their security business for $3.5bn in cash proceeds which just closed following 2Q22 results (i.e. proceeds not yet reflected in financials). Instead of waiting for the sale to complete, management executed a $2.3bn share buyback earlier in the year using debt to fund it… in hindsight, this was a pretty bad move since shares were repurchased at >2x the current share price.

String of acquisitions — SWK spent nearly $3.5bn in acquisitions since FY2020 in a major portfolio shift. The latest series of deals have added to the company’s outdoor business and industrial/aerospace exposure. Management still anticipates large cost savings from integrating these businesses.

As usual, a stock down this big must have something going on to cause it…

Earnings are expected to decline 40-50% from $10/share in FY21 to $5-6/share in FY22, mostly from a big hit on cost inflation and big declines in consumer demand causing revenue to drop in the core tools business.

There are 148m shares outstanding at 2Q22 and a $77 share price = $11.4bn market cap. The net debt balance is huge at the moment totaling ~$10.9bn… This doesn’t count the recent divestitures which, along with second half FCF, should bring in $3.5-4bn in cash. Call it $7.5bn in net debt for a $19bn enterprise value.

EBITDA had been >$2.5bn since 2019 but could take a year or 2 to recover back to that level. Analyst estimates in 2023 call for $7 in EPS and $2.2bn in EBITDA. That would mean ~10x earnings vs. >15x 5-year average.

While certainly in the crosshairs of inflation and consumer demand, these are pretty stable and iconic brands that will be around for a long-time to come… With shares down so much, it could be worth keeping on the watchlist while the company navigates this turnaround effort…