Quick Value 10.12.20 (BV)

Brightview Holdings (BV)

Time for the obligatory pitch on my premium offering… A glimpse at past posts can be seen on my website here. The quick summary — sharing my personal portfolio and activity, at least 2x write-ups each month, and ongoing coverage/updates of core holdings.

Give it a try… Back to today’s post…

Market Performance

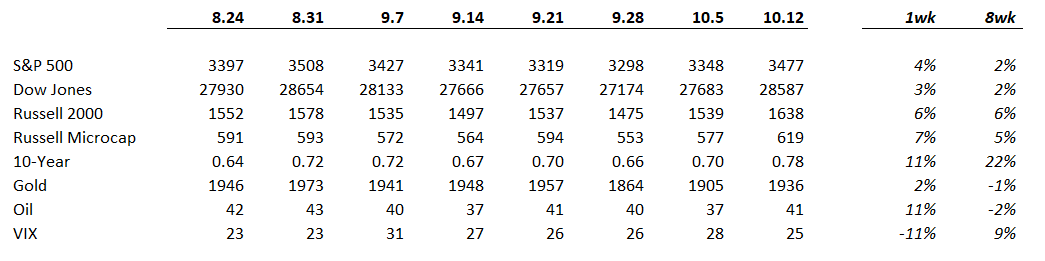

Say goodbye to all of your bargain stocks! Markets had a strong week and have once again surpassed pre-COVID levels.

Interestingly, the VIX remains pretty high >25 despite hitting new highs in equities. Still some concerns around future volatility…

Market Stats

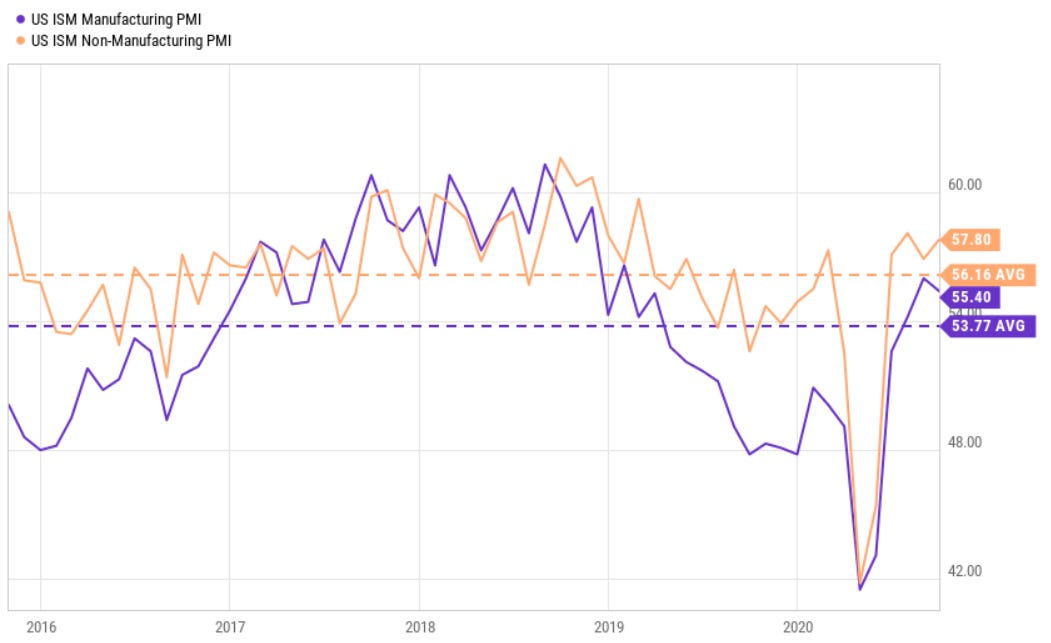

Economic activity as measured by the Purchasing Managers Index for both manufacturing and non-manufacturing sectors has and remains above 5-year averages…

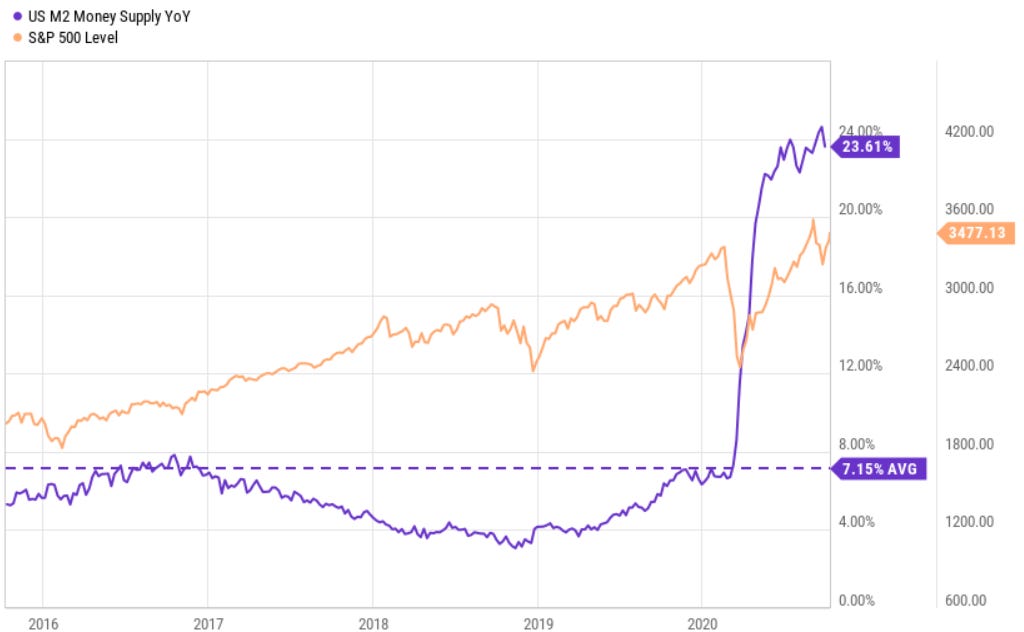

Stimulus efforts at the consumer level are grabbing all the attention right now but the Fed has kept the spigot flowing when it comes to money supply… This has certainly had a stimulating effect on the economy.

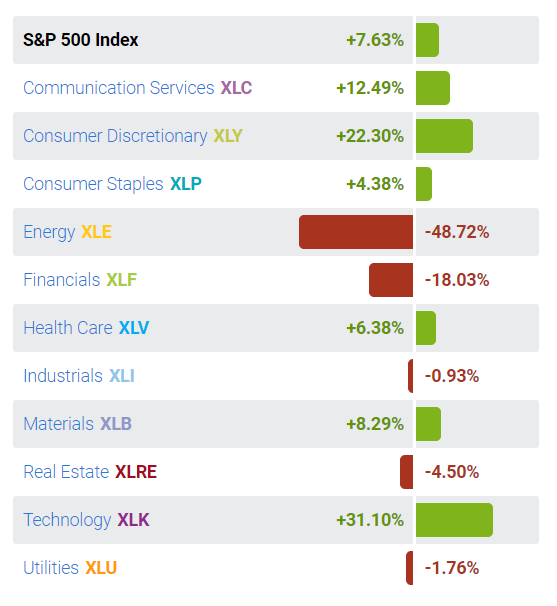

Year-to-date, most every sector is solidly in positive territory with the exception of energy, financials, real estate, and utilities…

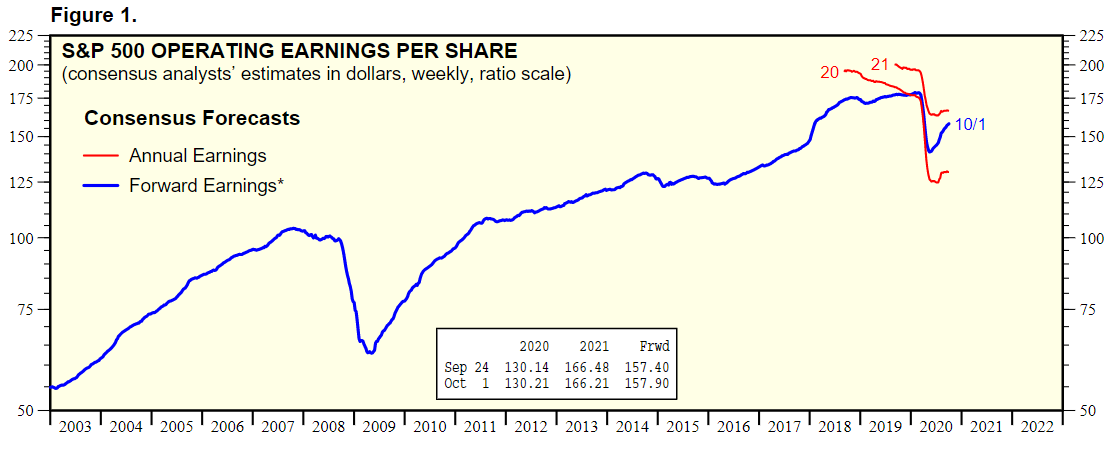

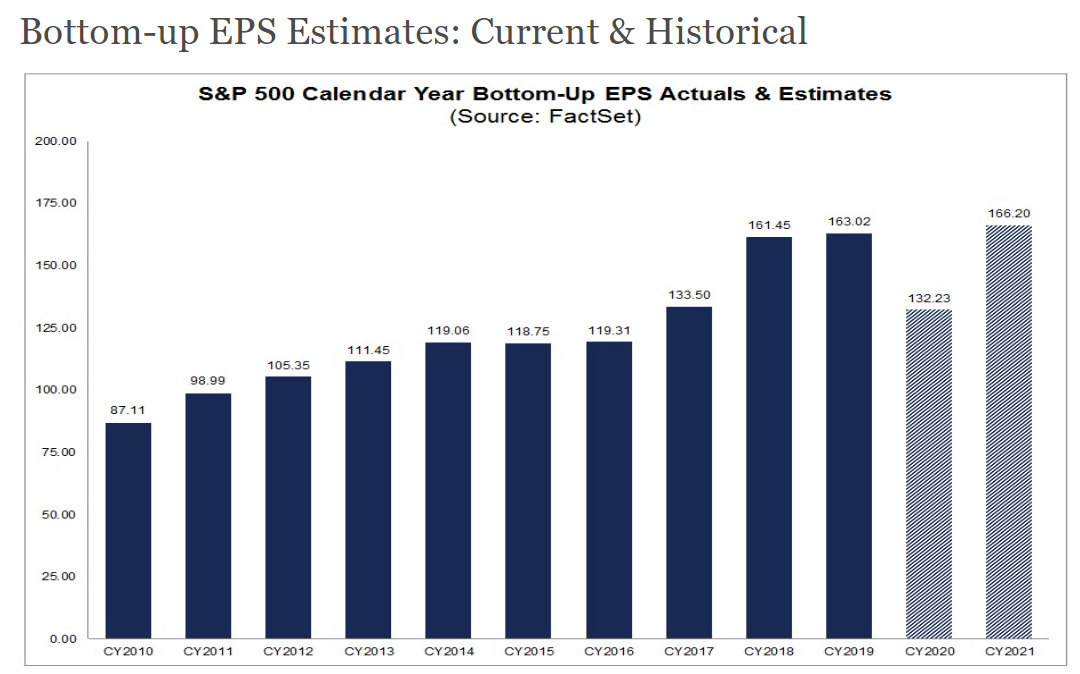

Estimates are starting to turn upward…

Based on the 166 estimates for 2021 from both FactSet and Yardeni, the S&P is currently trading at about 21x 2021 earnings. That’s an earnings yield of about 4.7% compared to a 10-year treasury yield at <1%.

Quick Value

Brightview Holdings Inc (BV)

Sparked by my love for not mowing the lawn each week coupled with a recent move into a home with a much more demanding landscape… It felt like a good time to take a quick look at Brightview…

Brightview was formed in 2014 from the combination of KKR-owned Brickman Group and ValleyCrest to create the largest commercial landscaping company.

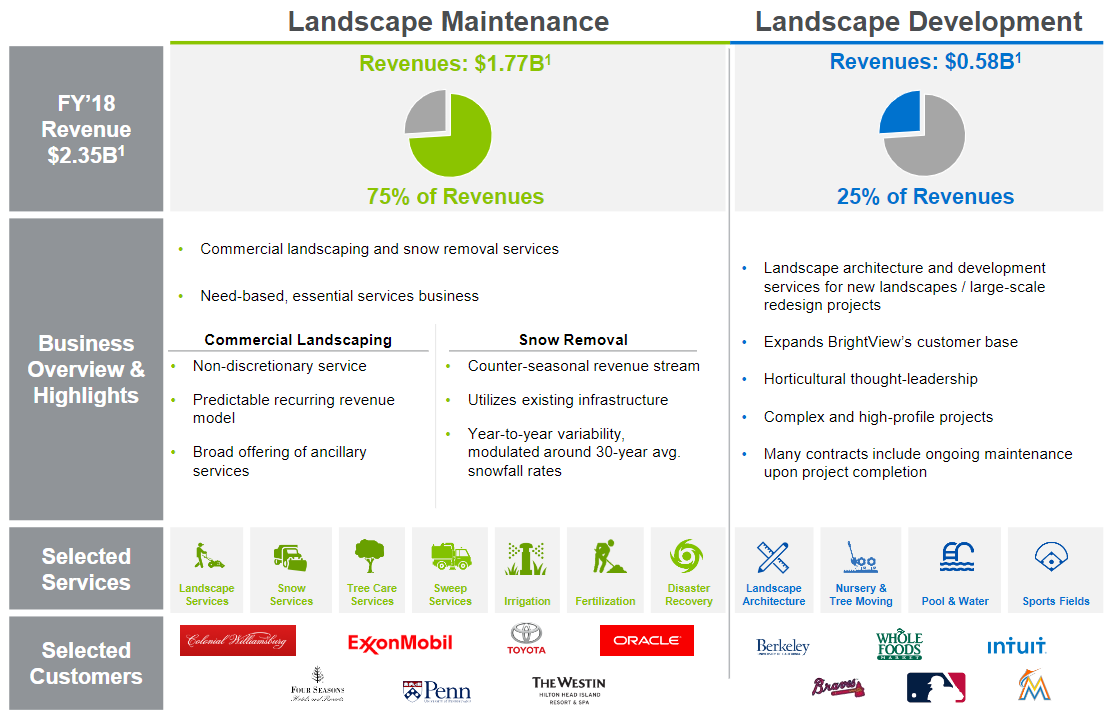

This is the very unsexy business of commercial lawn mowing and snow removal. There are some other pieces to the service offering

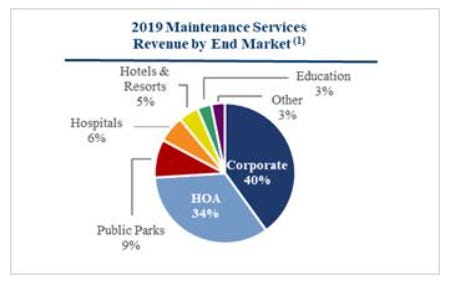

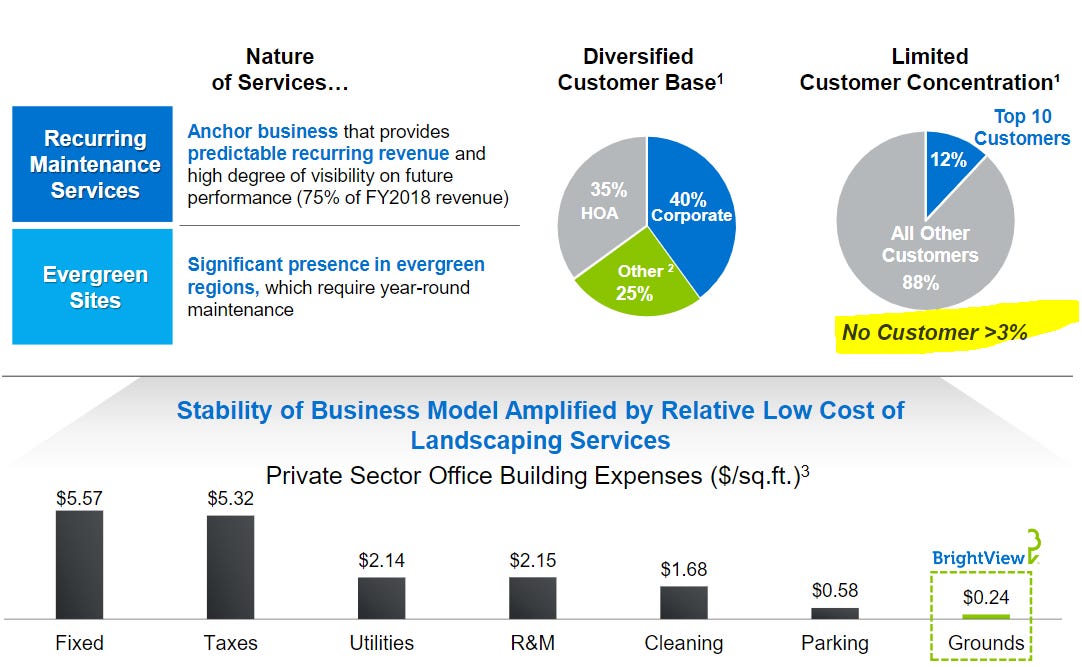

Most customers are on short-term contracts that renew at a pretty good rate. Customers on these contracts are typically Fortune 500 businesses in large offices, HOAs needing neighborhood or apartment work, public parks, hospitals, etc.

There’s no real customer concentration risk here as most of the contracted work is pretty small in nature for each customer. They’re also not entirely exposed to the future of office space / commercial real estate with a large showing from HOAs, parks, hospitals, etc.

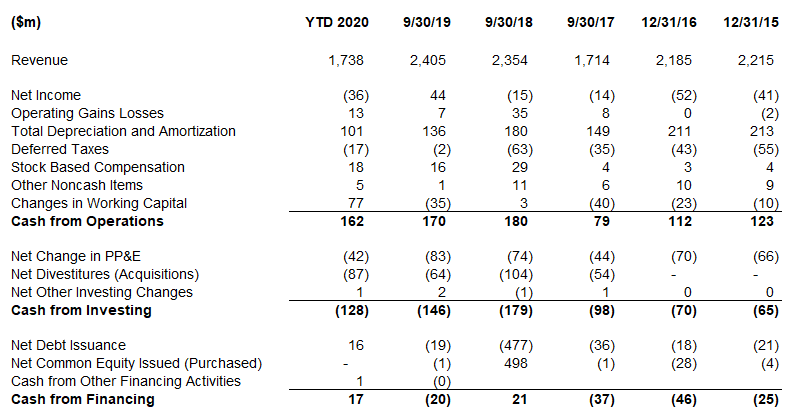

As with other stocks I like to look at, BrightView generates plenty of cash! Over the past 2.75 years they’ve generated >$500m in operating cash flow. Of that, $200m went to capex (net of disposals), $255m went to M&A, and the rest to some modest debt paydown / cash build.

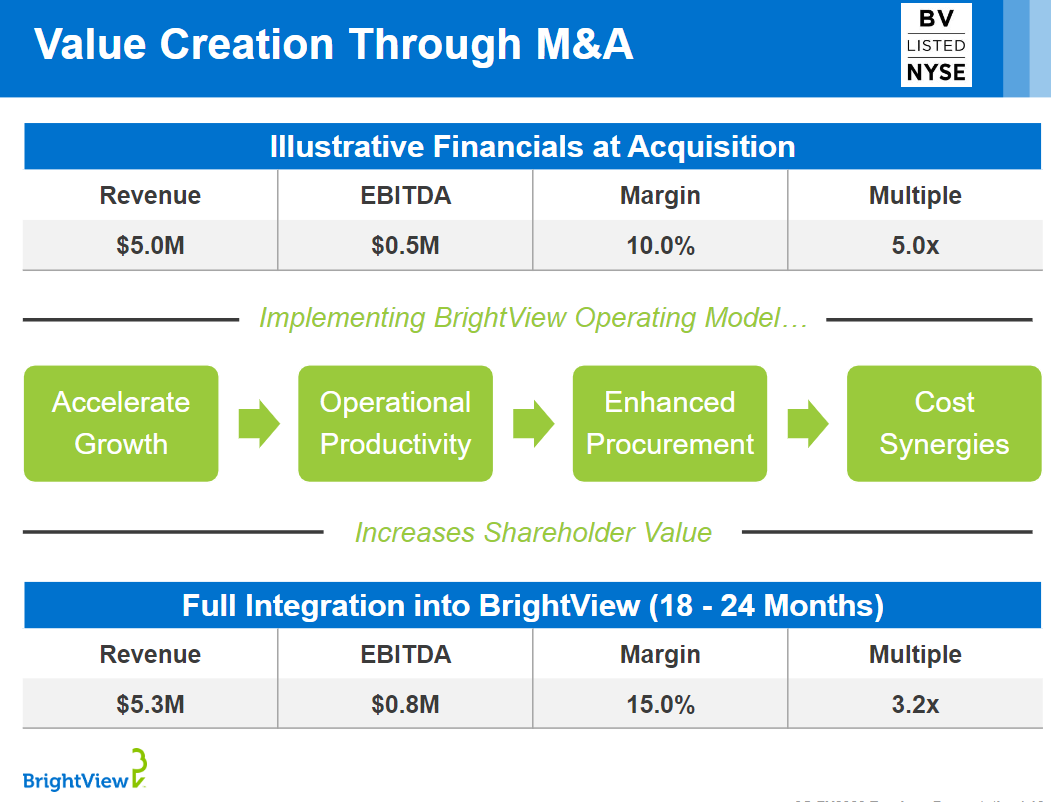

BrightView prides itself on its tuck-in acquisition program so it’s probably safe to say this will continue to be a big part of the future capital deployment plans…

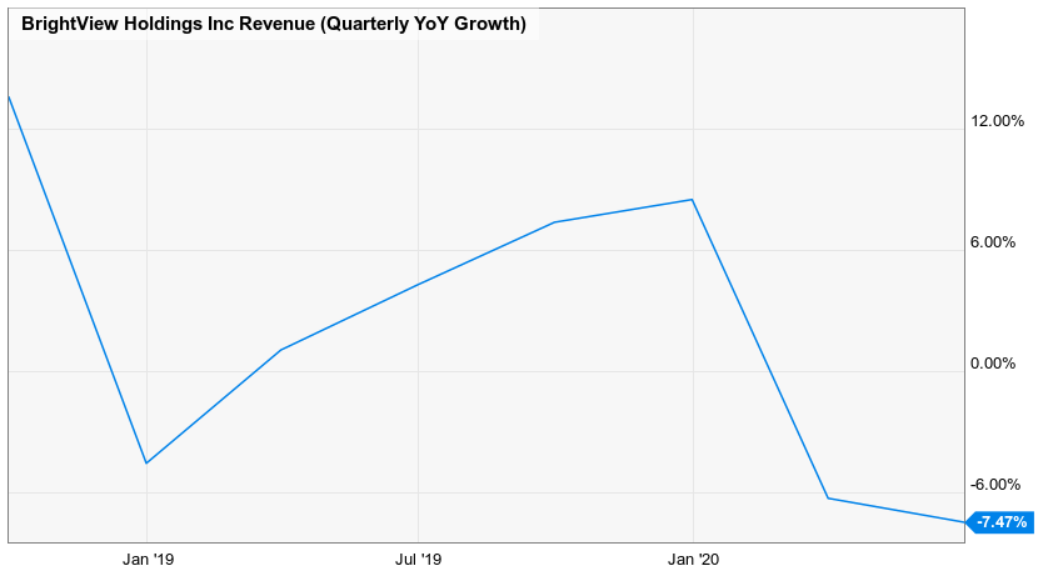

How about revenue performance during the COVID environment? Revenues dropped ~7.5% in the latest quarter and management expects another 2-6% revenue decline in the upcoming quarter… These are “essential” services that are easy to perform in a socially distant manner (not a ton of interaction with the guy cutting your lawn).

For the financial side of things…

There are 105m shares outstanding (and this hasn’t changed much at all since going public in 2018) x $13 stock price = $1.37bn market cap. Net debt is $1.1bn. Trailing EBITDA is $274m so we have leverage at 4x and the stock trading at 9x.

There’s a decent amount of debt here but it’s a pretty straightforward business operating in a market with very little change over time (pretty low chance for disruption). Make your own assumption about the changing corporate office landscape. It’s inexpensive but maybe not growing all that much either as management has been chasing small M&A in lieu of cleaning up the balance sheet. This is a business that will probably be around 10-20 years from now but what will it look like then?