Quick Value 10.17.22 ($CASH)

Pathward Financial - unique bank at 1.5x P/B and 7x earnings

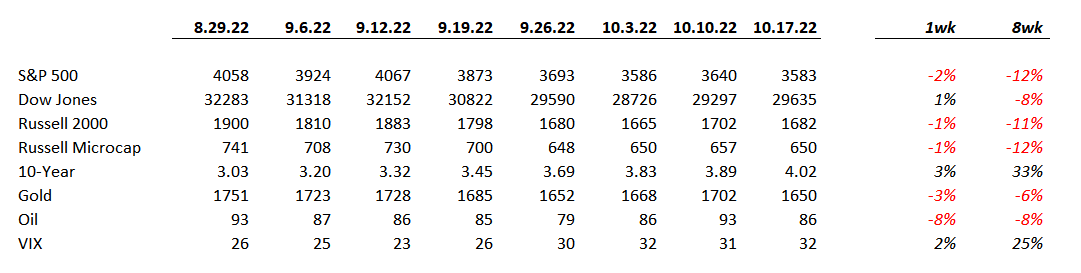

Market Performance

Market Stats

Analysts concerned that inventory growth / excess inventory could lead to oversupply and future earnings risks from discounting… (source)

Inventory levels have exploded since the pandemic began

Quick Value

Pathward Financial ($CASH)

What they do…

Pathward Financial (formerly known as Meta Financial) is a unique bank with $6.7bn in total assets at 6/30/22. They operate in 3 segments: Consumer, Commercial, Corporate.

Consumer division is the Banking-as-a-Service (BaaS) platform formerly known as Meta Payment Systems — It’s mainly a deposit gathering business focused on prepaid debit cards. They “white label” traditional bank accounts/cards for fintech companies that do not operate under a bank charter. The key with this segment are the large debit card fees (non interest income) + non-interest bearing deposits creating a low cost funding model.

Commercial division is focused on deploying assets into loans/leases of varying kinds — term loans, asset based loans, receivables factoring, leases, SBA lending, etc.

Corporate holds a few income generating assets and overhead expenses.

Why it’s interesting…

1) Zero cost deposits — The secret sauce at CASH is the stockpile of non-interest bearing deposits. The company has a low/negative-cost source of funding to make loans and grow revenue. Prepaid cards do not earn interest and the rise of “virtual cards” and fintech offerings has grown the deposit base substantially over the years. Nearly all of CASH deposits are non-interest bearing.

2) Fee revenue — Next is the large and growing fee revenue base. They collect debit card fees when prepaid cards are used. Banks with total assets under $10bn are not subject to what’s known as the Durbin Amendment which caps the allowed fees for using these cards. (Note this is a major risk should regulatory changes limit these fees OR if CASH were to grow beyond the $10bn mark.)

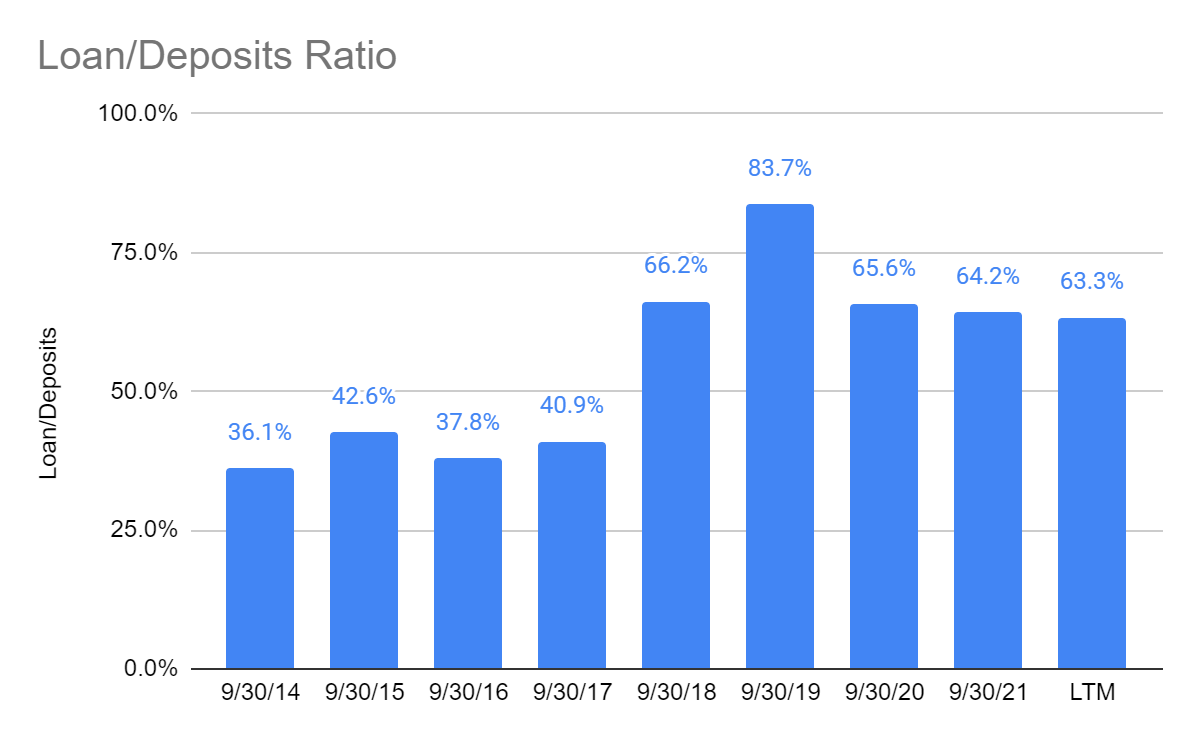

3) Expanding income generating assets — Historically, CASH has operated with a very low ratio of loans and leases to total deposits. They made an acquisition in the Commercial segment to begin a concerted effort to expand interest income. These efforts are starting to bear fruit and earnings are expanding but a large portion of the balance sheet is still parked in securities/MBS.

4) Capital allocation — Beginning in FY19 and picking up steam in 2020-2022, management has been allocating most of earnings to buying back stock. The share count is down ~30% during this period. As a result, earnings have expanded considerably and guidance for next year (FY23) calls for $5.10-5.60 in EPS.

5) Valuation — CASH and competitor TBBK have consistently traded >1.5x book value thanks to the high ROEs from fee revenue. Buybacks at share prices >1x cause per share book value to decline; thus, CASH is trading close to its average book value multiple. BUT, with the focus on growing earnings and correcting the asset side of the balance sheet, the stock is trading well below average earnings multiples.