Quick Value 10.18.21 ($BWA)

BorgWarner - Auto supplier trading at 11x earnings; how will EVs impact this industry?

Market Performance

Market Stats

Yield curve has widened considerably in the past year and now sits right at the 10-year average level of ~1.15%… Spreads are reaching levels not seen since 2016-2017… (A positive for banks and financials)

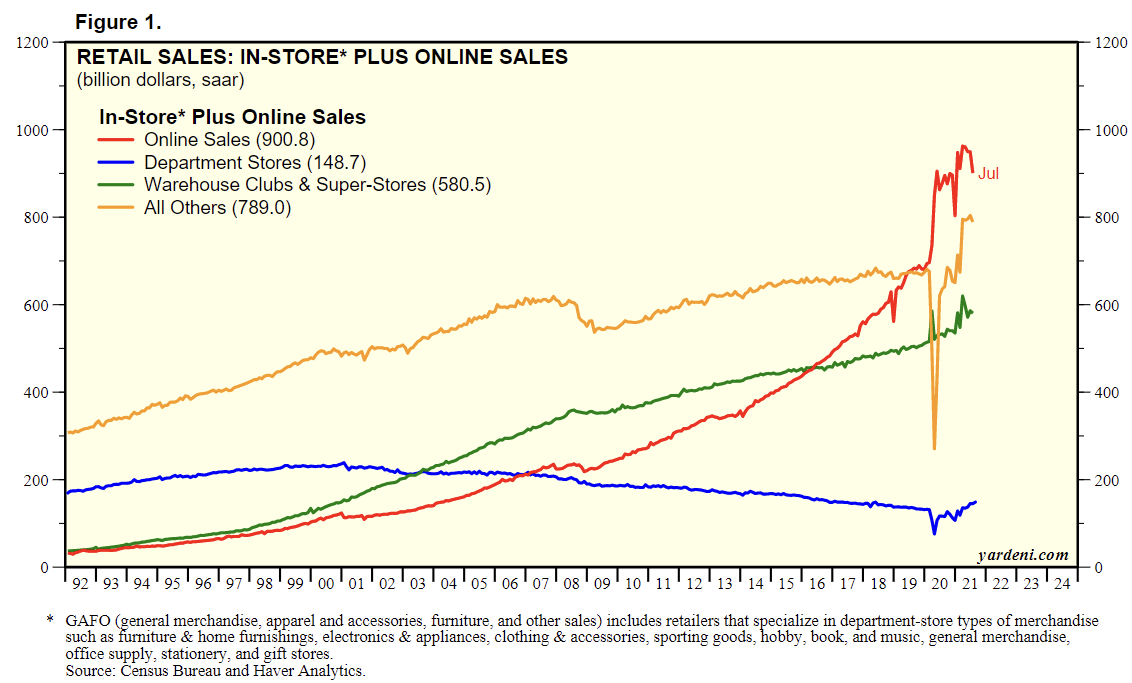

Online sales

Inflation grew another 5.4% YoY in September with plenty of categories exceeding that rate… excluding food and energy, inflation was up 4% YoY

Quick Value

BorgWarner Inc ($BWA)

I’m on a bit of an auto supplier kick lately so there may be a few reviews of these names in the coming weeks as I try to unpack the industry… For my premium subscribers, I own a small auto / industrial supplier on this list.

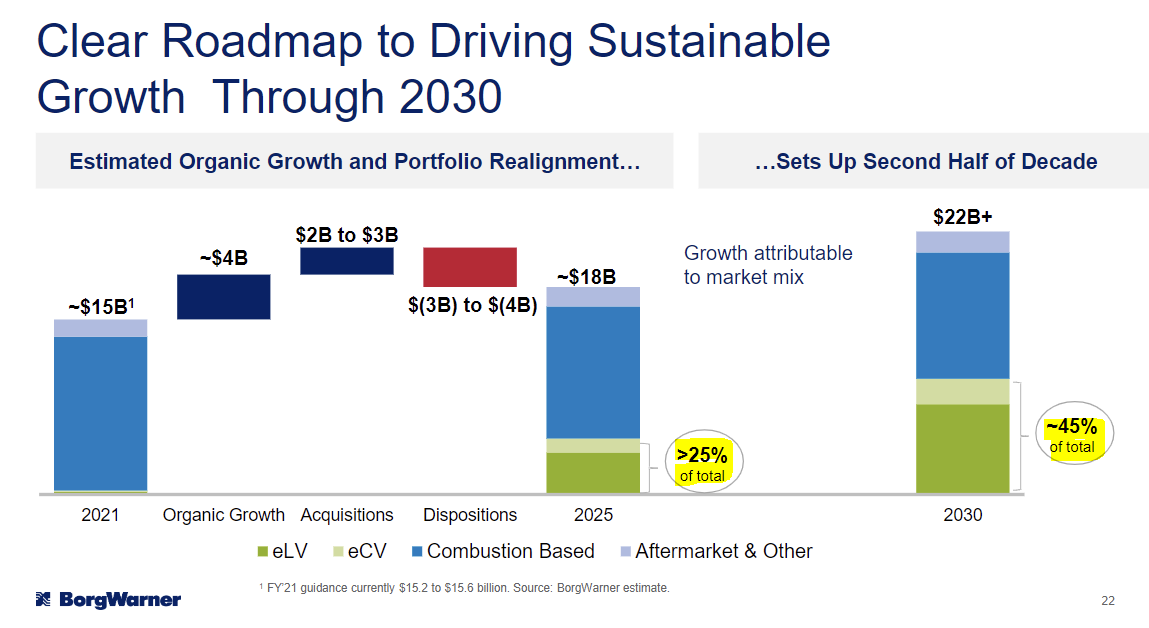

Most, if not all, of the auto suppliers trade depending on how they’re positioned for a future electric vehicle / autonomous vehicle world. Many of them have a slide laying out this path over the next decade… BWA currently gets a negligible amount of sales from EVs and has a plan to get to $10bn / 45% of total by 2030.

There’s a lot of change going on in the automotive marketplace which makes it tough to know what things will look like in a decade and who winners/losers will be. Even within the transition away from combustion engines, a lot will depend on the future for electric vs. autonomous vehicles — i.e. will there be fewer or more cars per household, fewer or more miles driven, etc.

So it’s no wonder that most of these stocks trade at low(ish) multiples of earnings and EBITDA. Granted, many of them have always traded at low multiples.

Beyond the EV/AV long-term risks, there’s the well-known challenge around auto production, chip shortages, etc. which have led to plant shutdowns at the major manufacturers. Vehicle sales have fallen off a cliff in 2021 and are quick approaching COVID lows.

One positive is the upside potential as future EV product/programs gain some traction and stabilize. BWA management indicates current profitability levels already reflect high R&D spending for EV products.

So BWA is a $47 stock with 240m shares outstanding = $11.3bn market cap. Net debt is $2.8bn. Management guided to ~$4.30 in EPS for 2021 compared to $2.76 in 2020 and $4.13 in 2019. So earnings are starting to grow (a bit) off of 2019 levels.

This industry still has some big cash generators and BWA is one of them. From 2018-1H21 — BWA generated $2.1bn in FCF. Of that amount, they spent $466m on stock buybacks, $509m on dividends (currently a ~1.5% yield), $1.2bn on M&A, and borrowed $1.2bn. The remainder was built up as cash on the balance sheet.

At a glance, it looks like the future is going to be heavily skewed toward M&A… BWA is touting $7bn in cash sources from 2021-2025 ($4.5bn from operations) and earmarking $5.5bn of that for acquisitions… Likely a big requirement to reach their goal of 45% sales exposed to EVs.

BWA looks to be trading right in-line with its own historical averages (11-12x earnings / FCF) so perhaps this isn’t a unique opportunity at the moment. It looks like there are some pockets of earnings upside (R&D easing) but also long-term risks with adoption of EVs… These could create some interesting opportunities in this industry if one can determine how industry changes might play out…