Quick Value 10.19.20 (BAYRY)

Bayer AG (BAYRY)

Market Performance

Markets essentially flat last week…

Market Stats

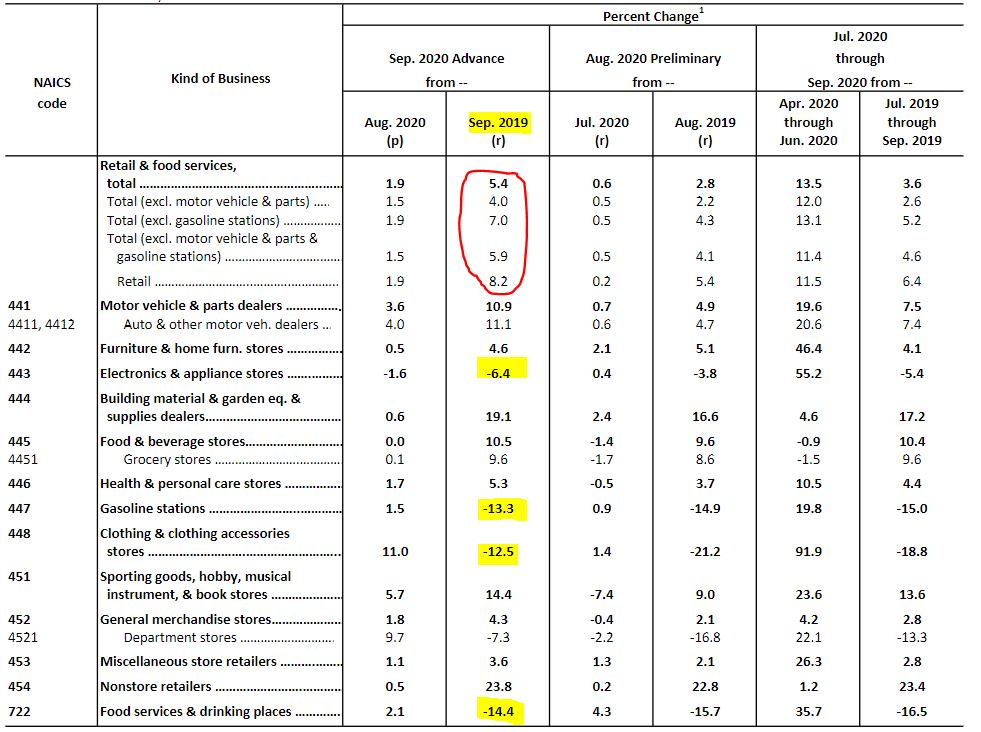

Retail sales were very strong in the month of September, up 5.4% from last year (seasonally adjusted). The headlines tend to focus on month-over-month performance so you’ll probably see it as a 1.9% gain.

I’ve highlighted the categories that still seem to be struggling like restaurants, clothing stores (i.e. malls!), and gas stations. On a month-over-month basis, clothing stores are starting to rebound as are department stores — both at-or-near double digit growth from August.

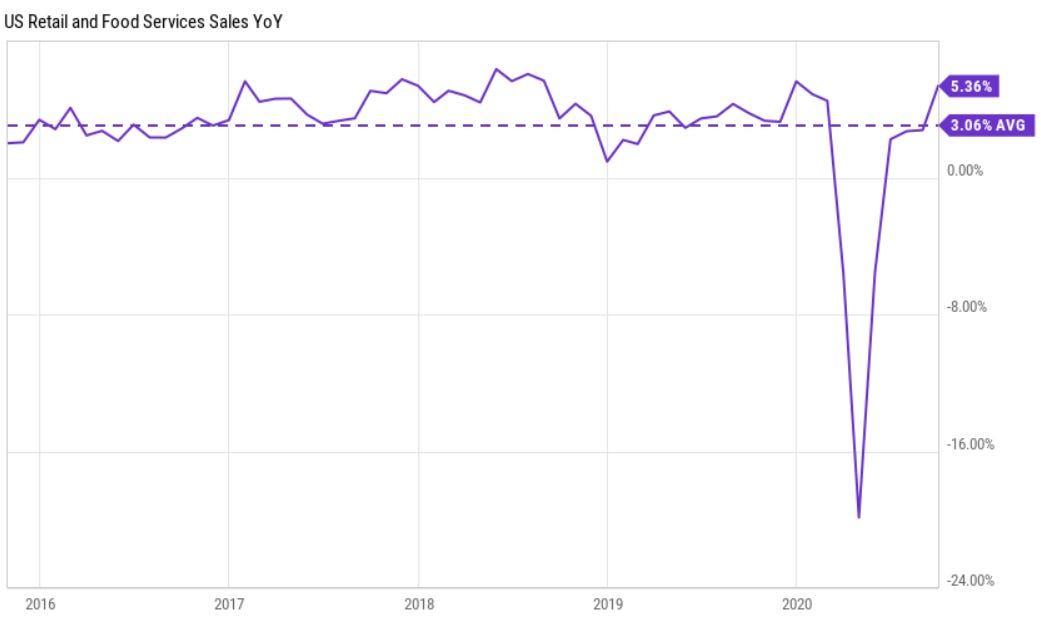

From June-August, YoY growth had been between 2-3% so September is a meaningful jump. Notably, retail sales are running above the 5-year average growth rate of 3% or so.

Consumer credit is looking healthy — unusual for a recession.

In other economic areas, initial jobless claims rose from the previous week and looks to have leveled out at a still-elevated 800-900k mark.

Pretty amazing the spending figures considering how many unemployed are still out there.

Quick Value

Bayer AG (BAYRY)

Remember back in 2018 when Bayer completed its mega-acquisition of Monsanto for $65bn or so?

The market hasn’t been too kind to the share price of Bayer since then — taking it from 100+ Euros to 45 today…

Starting with the ugly:

A lot of the share price collapse centered around the legal issues from Roundup cancer allegations. Bayer recently announced it will pay ~$11bn to settle some 125,000 lawsuits.

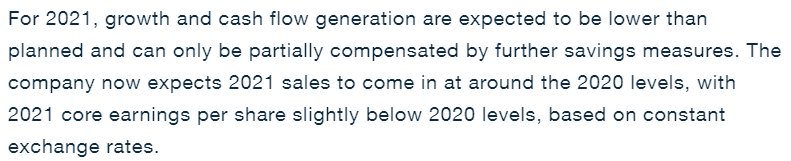

To make matters worse, Bayer just announced that it was cutting its outlook for 2021 and launching a large scale restructuring program given the challenging environment.

There are reasons to like the business though…

For starters, Bayer consists of a few different businesses:

Crop Science — (This is where Monsanto resides.) Crop protection and seeds through brands like Roundup, Dekalb, etc.

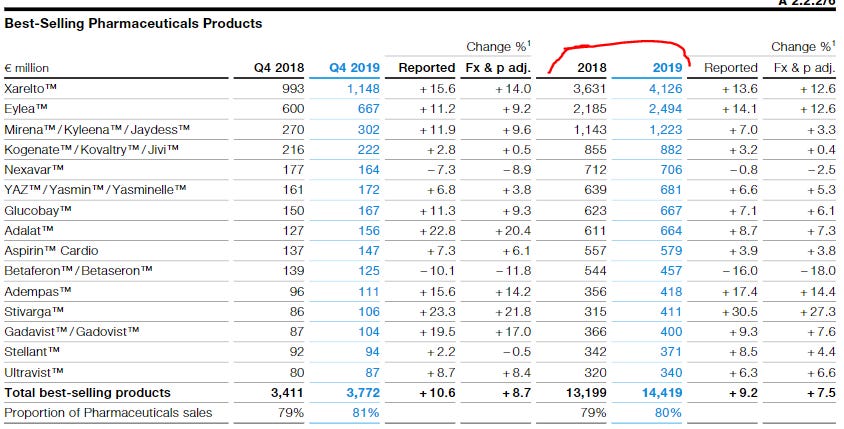

Pharmaceuticals — Prescription drugs like Xarelto and Eylea. Not much concentration here either with Xarelto at 23% of pharma revenues.

Consumer Health — Over-the-counter consumer products like Aspirin, Aleve, and Alka-Seltzer. Vitamins, supplements, skincare products, etc.

Some stats — There are 980m shares outstanding x 45 Euro share price = 44bn market cap. Bayer has 36bn in net debt for an enterprise value of 81bn. Free cash flow in 2019 was ~5.5bn (8x) and earnings are estimated to be about 6.50 per share in 2020 (7x).

Leverage doesn’t seem all that crazy with EBITDA at 11-12bn… just shy of 3x — this is high for Europe but not so much in the US. The Roundup settlement also shouldn’t create a huge issue for Bayer following the sale of their animal health business to Elanco for 5bn Euros and 72.9m shares of Elanco.

COVID has had an impact on the crop business but it appears the share underperformance is mainly driven by the Roundup litigation. Once that clears, this should still be a major player (read: #1) in the ag industry. In fact, #2 player Pioneer (owned by Corteva) trades >10x EBITDA compared to all of Bayer at 7-7.5x.

Long-term, the ag business should be fine.

It’s unclear whether there are any major blockbusters in the pharma pipeline but the 2 largest drugs (Xarelto and Eyelea) have patent protection until 2023-2025. Hard to tell what this would be worth relative to other pharma companies as valuations can vary widely.

The consumer business has some high-quality brand name products and would probably be a >10x EBITDA business on a standalone basis. Another consumer health business, Reckitt Bensicker, trades >10x.

There’s still plenty to review here. Especially with the complicated legal matters from Roundup. By no means is the $11bn settlement figure thrown out the “worse case” scenario.