Market Performance

Market Stats

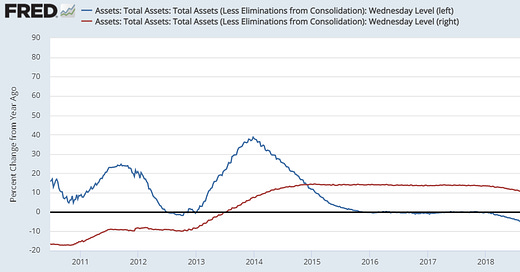

Fed balance sheet is still ticking higher (red line) but the relative change is just as important, indicated by YoY growth rate (blue line)

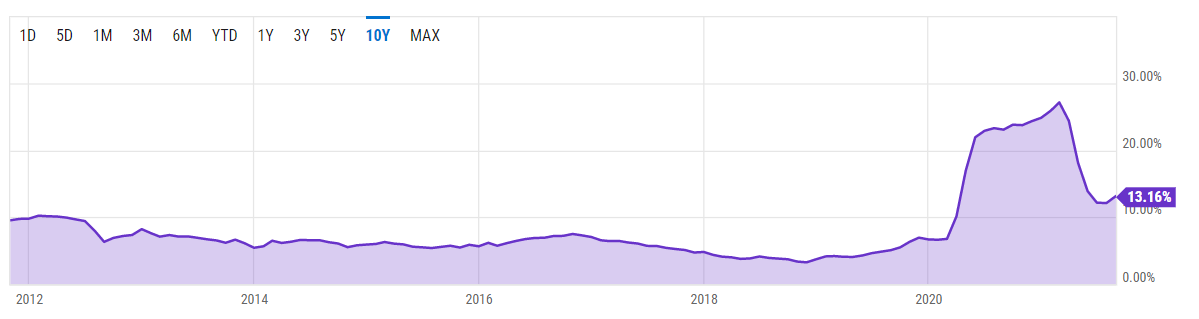

Money supply growth is still >2x long-run average levels… This metric went to a monthly reporting frequency so September data will come this week… It moves roughly in-line with Federal Reserve balance sheet as seen above…

One takeaway is that while money is still loose, it has obviously tightened quite a bit from earlier “free-flowing” levels of growth…

Quick Value

Garrett Motion ($GTX)

Garrett Motion is an automotive parts supplier making turbochargers and electric-boosting products. Similar to last week’s post on BorgWarner (a competitor), this is a business heavily tied to internal combustion engine (ICE) vehicles… a (potential) long-term risk as the world transitions to electric vehicles.

Stepping back for a moment, GTX was a division of Honeywell and was spun off in 2018. Honeywell left the company with debt and asbestos liabilities which, coupled with COVID, forced GTX to file for bankruptcy in 2020. The reorg was complicated (you can read about it in Note 2 of the latest 10-Q) but it left GTX with 2 sets of preferred shares, one set owned by Honeywell payable over several years and the other set owned by shareholders which are convertible into common stock in a year or so.

From Q2 results — Garrett has $1.2bn in debt, $400m in cash on hand. The Series B Preferred Stock (owned by Honeywell) totals $835m but is recorded at present value ($585m as of Q2). Honeywell has the ability to put these shares back to GTX once trailing EBITDA hits $600m (set to happen by end of 2021); so it’s possible they’ll need to draw some funds to get this repaid.

Not reflected on the balance sheet above is the Series A Preferred Stock (publicly traded as $GTXAP). Under certain circumstances, these preferred shares will convert to ~248m common shares… Likely on 4/30/2023. Until then, GTX will have to pay/accrue 11% dividends on this $1.3bn balance ($143m per year).

This makes for a messy and confusing capital structure! But with $600m in EBITDA and $350m in free cash flow, shares look really cheap… Let’s assume that the business remains flat heading into 2023 ($600m EBITDA / $350m FCF), the Series B shares are taken out with debt ($835m) and Series A converts to 248m shares + $180m dividends… That would leave $1.4bn or so in net debt and 318m or so shares outstanding… That gets a 6.3x EV/EBITDA multiple and 6.7x P/FCF with low leverage (2.3x).

That still leaves GTX needing to solve the long-term problem of reducing their dependence on ICE vehicles (much like BorgWarner is pursuing).

Exposure to electric vehicles is nonexistent and the majority of sales actually come from diesel passenger vehicles (a declining portion of the market).

GTX management is positive on the outlook for turbocharger growth / penetration and a continued robust market for non-electric vehicles.

Shares certainly look cheap even when factoring in the cleanup of the preferred shares. How they’ll navigate a changing market will be the next focus to get a re-rating of the stock…

Disclosure: I own shares of $GTX.

This deserves a closer look. With a capital structure that complicated, it's no wonder the market doesn't want to touch it. Lots of work...but the more complicated it is, the more chance there is value inside. Time to take a dive

Looks very inexpensive, thanks for the idea. Capex has been around $130 mil so with an EV of ~US$2 billion, looking at EV/EBIT of 5x roughly speaking.

In Asia, I know that Mitsubishi Heavy has exposure to turbochargers and trades at a much higher multiple.