Quick Value 10.26.20 (SSNC)

SS&C Technologies (SSNC)

If you like these posts — consider subscribing to the premium offering…

Market Performance

Again, markets are mostly flat over the past week and the past 2 months… Smaller companies (Russell) are starting to stage a comeback.

Some notable YTD index performance:

S&P +9%

S&P equal-weight +0.5%

S&P value -8%

S&P growth +24%

R2k -0.6%

Micro -0.5%

Market Stats

I mentioned previously that one prediction through this COVID experience was that certain industries will likely be changing in significant ways…

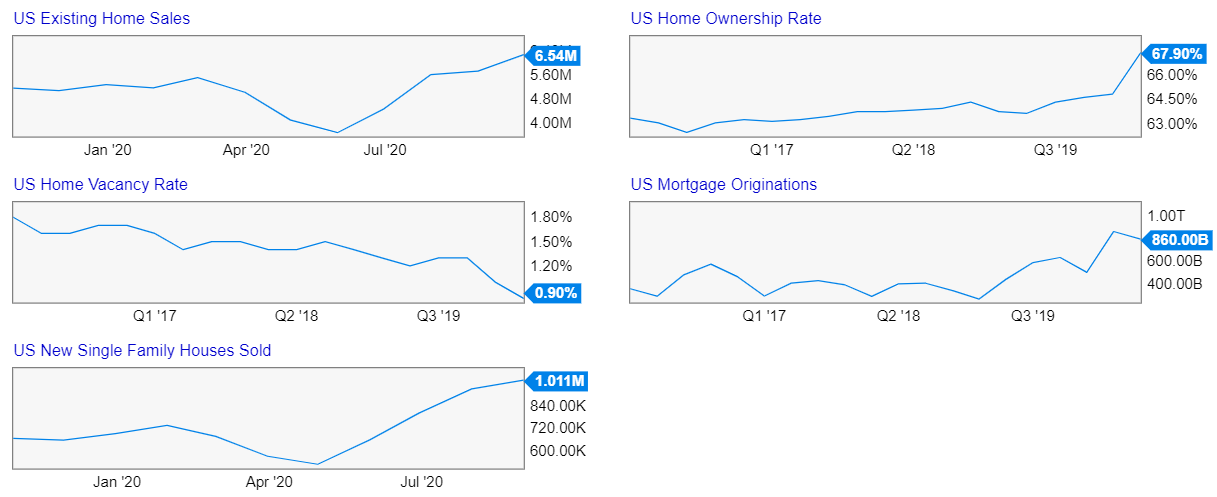

One sector that has seen a massive uplift throughout this period is the housing market…

Virtually every indicator in this industry is up in a major way over the past few years (even with a brief dip during the lockdowns earlier this year):

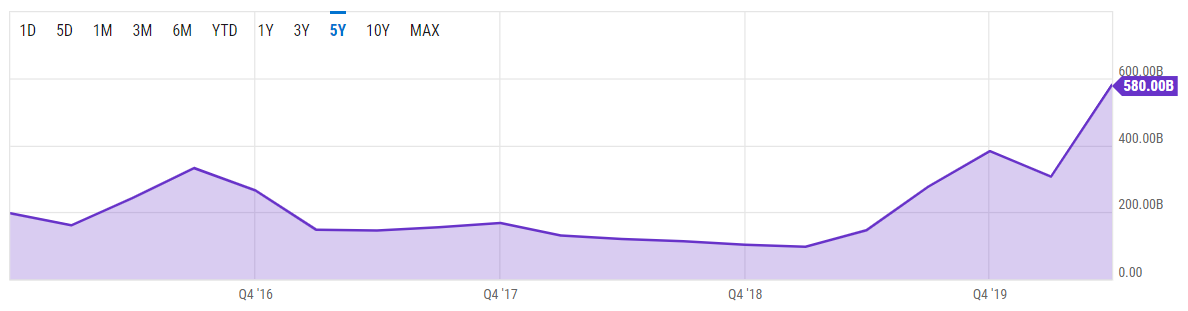

Historically low rates are also causing a spike in refinancing activity.

Homebuilding is also still climbing back to pre-COVID trendlines…

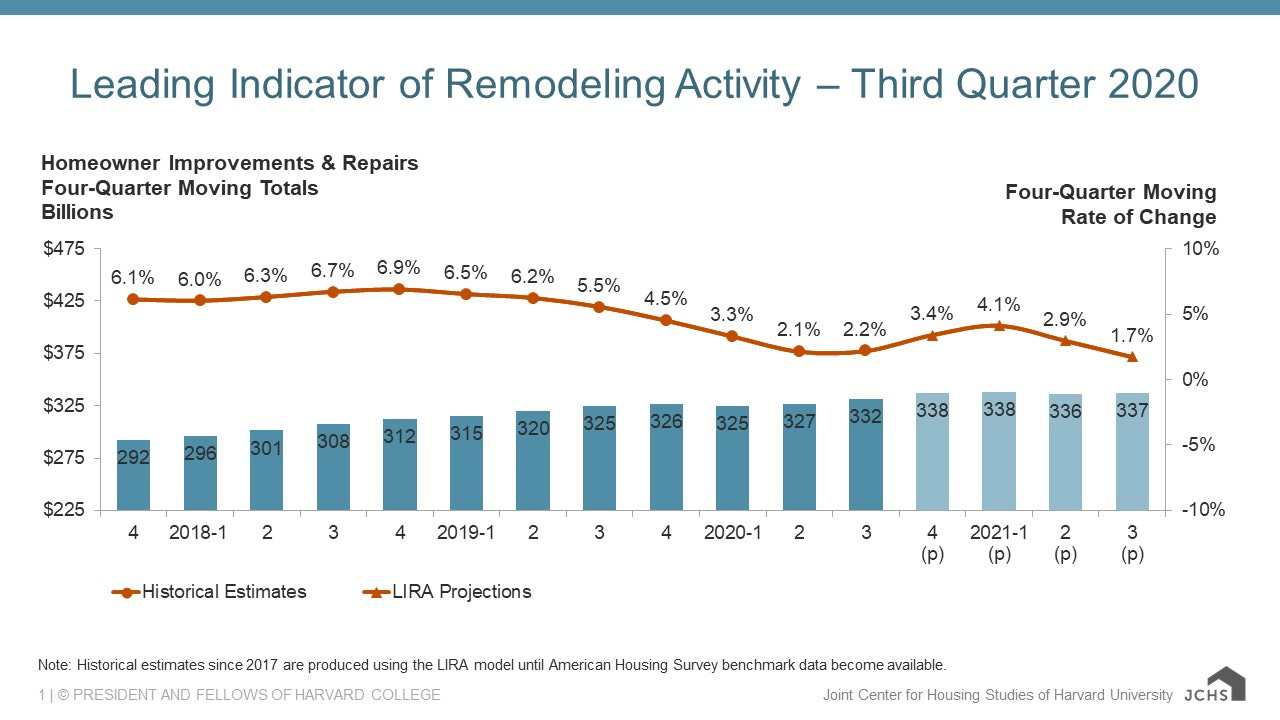

Remodeling activity is also picking back up…

The big question is whether this is a sustainable thing or a one-off spike thanks to COVID? A large refinance wave only lasts so long. A remodeling wave could last as long as work-from-home is largely in effect. And how much of the existing home sales is driven by families looking at low rates and swapping into a better home with minimal change in their monthly mortgage?

Quick Value

SS&C Technologies (SSNC)

SSNC is the largest hedge fund / private equity fund administrator and mutual fund transfer agent. They provide software for accounting / recordkeeping, performance, risk management, regulatory reporting, etc. The name stands for “Securities Software & Consultants.”

Think of it as the major player in back-office software for running a financial services / investment management operation. They compete with businesses like Northern Trust and BNY Mellon.

Selected Financial Data…

Looks like revenue and earnings have grown considerably over the 5-year period and they’ve issued some shares and added some debt along the way. This can only mean…

Acquisitions…

They’ve built this business through many acquisitions over the past decade… Most are smaller in size but a few in the larger “transformational” category.

Most of these acquisitions are done with a goal of adding recurring / contractual revenue and occasionally expanding into an adjacent market with a new product / service. (i.e. DST deal added healthcare vertical.)

The customer mix looks like this:

Financials…

SSNC has 260m shares outstanding x $65 stock price = $16.9bn market cap

Net debt is $6.6bn for an enterprise value of $23.5bn

2019 EBITDA was $1.8bn — this would be 13x EV/EBITDA and 3.7x leverage

The “catch” is that they turn a fair amount of EBITDA into free cash flow… that $1.8bn in 2019 became ~$1.2bn in FCF! Most businesses (especially levered ones) can’t turn an EBITDA dollar into 60-70c of FCF. As a FCF multiple this would be 14x.

Trailing EPS (as of 2Q20) was $4.08 and looks like it’s still growing — grew 14% in 2Q20 and YTD in 2020 — that’s ~16x earnings for a business with good cash flow, deleveraging, and potential growth prospects in a very sticky industry…

Risks…

At first glance, most of this business looks exposed to AUM in traditional investment management (RIAs and mutual funds) and alternatives (PE, hedge funds, etc.). I don’t have a take on the odds for rising/declining AUM in these spaces but consolidation may help/hurt SSNC — potential to add more customers as clients make acquisitions but pricing pressure may result.

They also have some exposure to the healthcare industry which may have better trends.