Quick Value 10.31.22 ($COF)

Capital One - 6.2x forward earnings

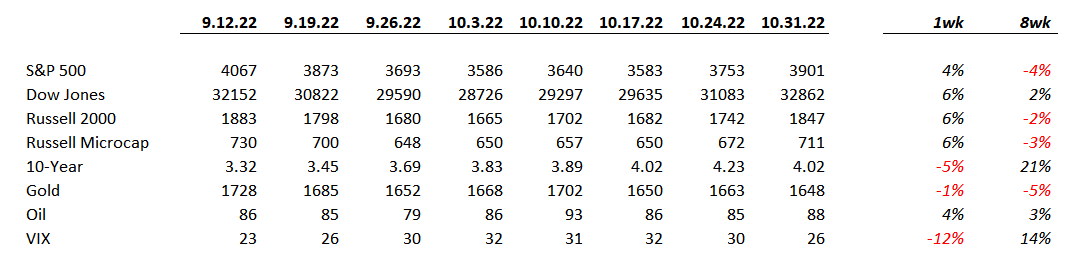

Market Performance

Another big week for markets puts us right back where we were *checks notes* a month ago…

Market Stats

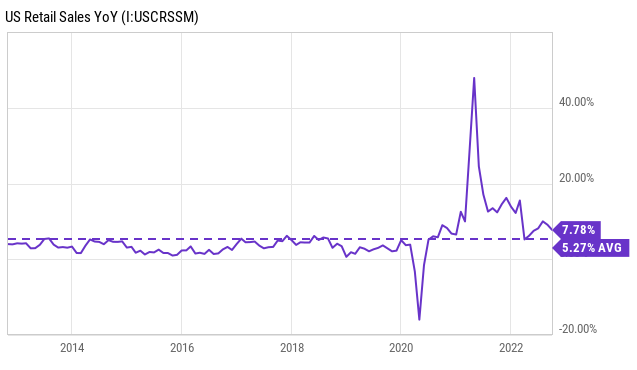

Retail sales are still growing YoY at above average rates… consumers continue to spend, spend, spend…

Personal savings rates are starting to dwindle to 2005-2009 levels…

Quick Value

Capital One Financial ($COF)

I’ve always wanted to look closer at Capital One and have never taken more than a cursory view. I’m a user of their business banking/card products and think they have an excellent brand in that space (probably the first name that comes to mind when it comes to small business financial products).

Shares are down from $180 to around $107 but still well above pandemic lows in 2020.

What they do…

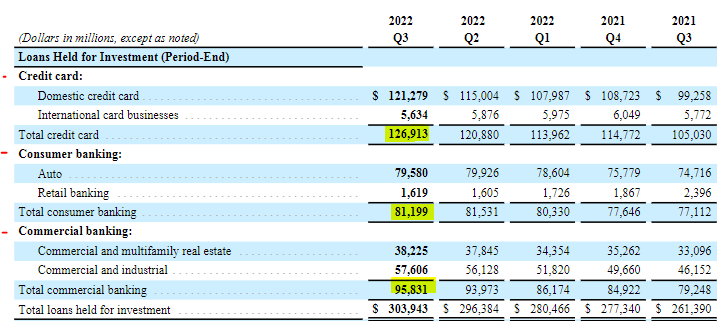

My first thought of Capital One is a credit card issuer to small businesses. They also issue credit cards to consumers via their branded cards and private label cards. This business is ~42% of the total loan book at 3Q22. There’s also a large auto lending piece (~26% of loans) and traditional business financing to real estate and businesses (~32% of loans).

A good chunk of loans across the credit cards / consumer banking portfolio are at credit scores of 660 and lower. Deposits are mostly interest bearing and gathered via the consumer banking division on checking/savings accounts and CDs.

Why it’s interesting…

I’m focusing mainly on the qualitative factors here but I do think there are some qualitative considerations with the business from a quality brand standpoint.

1) Capital allocation — Capital One has been returning tons of cash to shareholders over the past decade. Share count is down 34% from 12/31/12 to 383m. Also, COF gave back the vast majority of supernormal earnings from the pandemic (although at higher share prices).

2) Growth in book value / consistent earnings — Book value per share has grown at an excellent rate the past decade and price-to-book hasn’t budged much around the 0.8x mark.

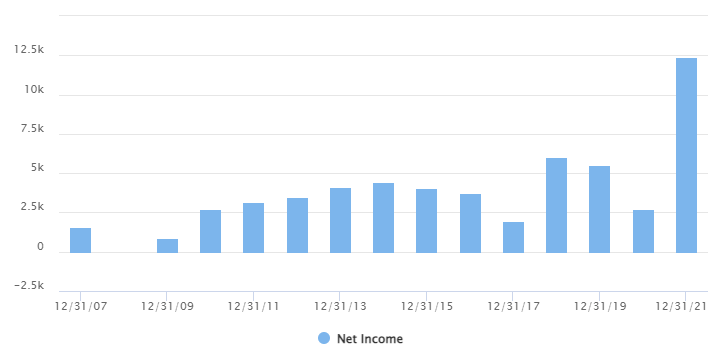

Outside of the 2008 year, Capital One has been consistently profitable (this is GAAP net income):

Through 9 months of 2022, they’ve reported $5.9bn in GAAP net income compared to $9.7bn during the same period last year — mainly from increasing loan loss provisions which swung $5.7bn YoY.

3) Conservative balance sheet — My approach to calling a conservative balance sheet in the financial services industry might be a tad simplistic… I like to see a good ratio of equity to assets (>10% ideally). There are probably better metrics like CET1, etc.

Capital One consistently maintains a solid equity cushion to support their asset base, especially knowing that loss ratios are going to be somewhat higher than a traditional bank.

Analyst estimates call for $17/share in earnings for 2023 and $17.50/share in 2024. If that played out, those 2 years would account for close to a third of the current market value of the stock… The catch being that Capital One is heavily tied to the wellbeing of consumers and small businesses…