Quick Value 10.4.21 ($Y)

Alleghany Corp ($Y) - Insurance holding company at 1x book value

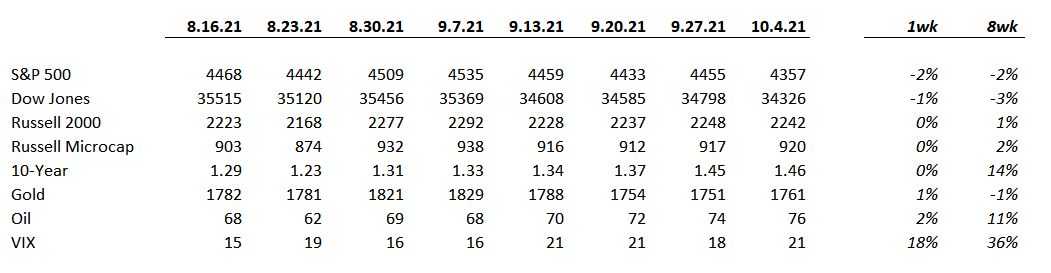

Market Performance

Market Stats

I came across a few interesting charts on the auto market that I wanted to share…

Auto inventories are at extreme lows… That word hardly does the picture justice…

Prices for used autos are also at extreme highs… Obviously prices are a function of low inventories but still a crazy chart!

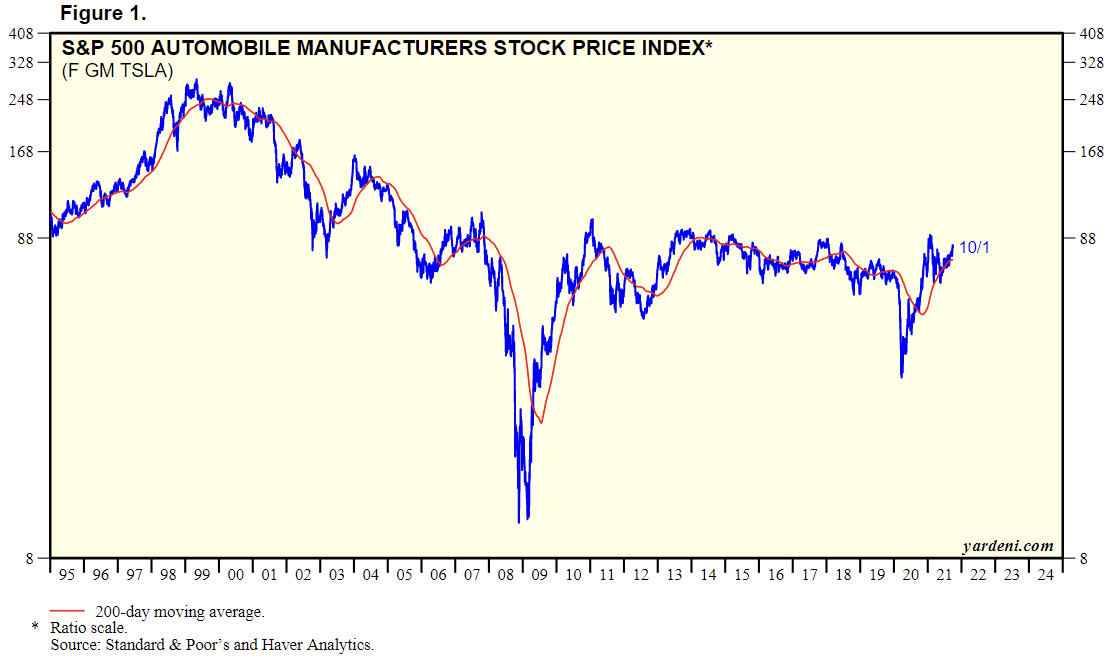

Shares of auto makers have rebounded off of 2020 lows but haven’t been spectacular performers the last 10 years… It’s a different story for others in the supply chain such as auto dealers, parts makers, and retailers

Quick Value

Alleghany ($Y)

Berkshire and Markel get more attention from the insurance-meets-operating business investor crowd but Alleghany is quietly building a similar business and trades at what looks like an attractive price.

Alleghany operates an insurance / reinsurance business and a portfolio of non-insurance operating businesses (known as Alleghany Capital).

On the surface, $Y has done a great job of growing per share book value over the last 10 years and its multiple of price-to-book is relatively unchanged.

Alleghany Capital started in earnest in 2012 when they acquired Bourn & Koch (now Precision Cutting Technologies). It’s now a large part of the overall business and will continue to see the majority of capital allocated here. Alleghany spent >$600m on noninsurance acquisitions since 2018.

These businesses make things like tools for the machining industry, custom truck trailers, toys and musical instruments, and steel fabrication services. The focus is on finding businesses that are “#1/#2 positions in niche markets or share gainers in large, fragmented markets.”

Noninsurance operating businesses now top $3bn in revenue and $200m+ in pre-tax earnings…

The insurance side of the business has been an underperformer the past few years with combined ratios over 100% (i.e. earning an underwriting loss) since 2017. Management has been adamant that the industry has not been earning adequate returns for the risks they are writing and pricing should normalize over time.

Underwriting profits on the insurance side were $33m in 2019 and a loss of $128m in 2020. For reference, back in 2015-2016, the business was generating $400m+ in underwriting profits on smaller amounts of net premiums. Through the first half of 2021, the insurance business produced $190m in profits; a substantial improvement.

A turn in insurance dynamics and continued growth in the noninsurance side of the business could make for an attractive long-term setup with Alleghany…