Quick Value 10.9.23 ($BC)

Brunswick - Potential quality business at <8x earnings

Taking a pause on the spin-offs this week with a look at a plain vanilla cheap stock. I can’t remember how Brunswick (BC) got on my watchlist but I’ve been meaning to take a look. My notes are below…

Thanks to all the new paying and free subscribers signing up recently. Your support keeps the research going. There are plenty of cheap and quirky companies out there to be highlighted so be sure to drop a note if you think I should add a name to the list…

Sign up below for access to all posts (side note: I’m nearing my 400th article later this year so maybe a “deep dive” is in store, taking suggestions!).

Market Performance

Quick Value

Brunswick Corp ($BC)

What they do…

Brunswick operates 4 segments (the 4th was recently added from an acquisition):

Propulsion — Makes boat engines for recreational, commercial, and racing uses. Engines are mainly sold under the Mercury brand name which is a market leader.

Parts & Accessories — The P&A segment makes and sells aftermarket parts to retailers and distributors. There are a wide variety of parts in this segment: electronics, sensors, monitoring, fish finders, sonar, radar, fuel systems, batteries, electrical, etc.

Boat — Of course Brunswick makes and sells actual boats too. These include several well known brands like Bayliner and Sea Ray. They also own Freedom Boat Club which is a boat rental club charging initiation and membership fees.

Navico — This was a 2021 acquisition that was previously recorded within parts & accessories because that’s what they make. Starting in 2023 they’ve begun to break it out as a separate segment. [Note: the table below includes Navico within P&A for TTM figures.]

As an additional reference, here’s a neat chart from their 10-K outlining sales by various product lines:

The industry produces just shy of 200k new boats each year and total boats registered has been steady at ~10.5m for more than a decade [does this mean the installed base has not increased?]. Brunswick anticipates 2023 boat sales falling to 2014 levels.

Brunswick has changed quite a bit over the past few years. In 2019, they completely exited non-marine product lines including billiards, bowling, and fitness. Since then they’ve been a pure-play marine parts and crafts company. In 2019 and 2021 they made 2 large acquisitions for ~$1bn apiece. These 3 moves (1 sale and 2 buys) have completely reshaped the business as a primarily boat engines and parts supplier.

Let’s take a look at this refreshed company…

Why it’s interesting…

1) For starters, it screens cheap!

They’ve guided to ~$9.50/share in 2023 earnings on a $74 share price (7.8x P/E) which is well below long-run average multiples for this company (13x). As an additional reference point, they earned $10/share in 2022, $8.28/share in 2021, and $5.07/share in 2020.

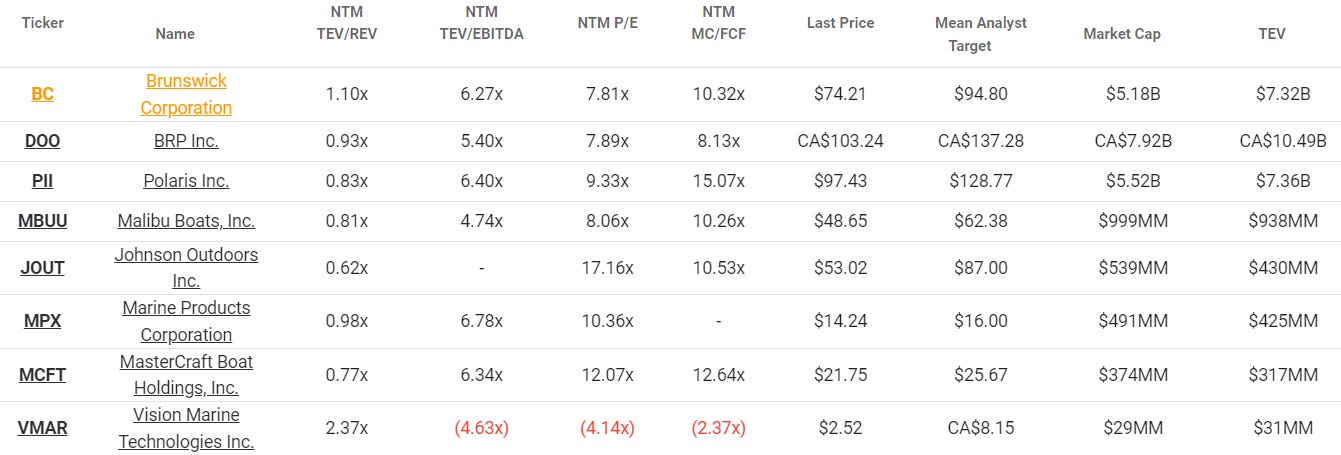

On the other hand, the entire leisure products industry is pretty cheap — right around 9x earnings and 6x EBITDA on NTM estimates:

So on current numbers, the stock is cheap relative to its own history and slightly inexpensive when compared to the broader industry. Figuring out normalized earnings over the next 1-2 years would be key.

2) High quality business?

The Propulsion and Parts & Accessories segments seem very high quality. Propulsion in particular generates tremendous earnings ($300-500m) on an asset base of only ~$1.5-1.6bn. P&A looks like a classic specialty distributor with mid teens margins.

These are purely qualitative comments but the products being sold have high market shares, a deep dealer network, good mid-teens margins, and high returns on capital. While they’re still attached to a cyclical end market, that along with the industry concentration probably works to keep any newcomers out of the industry entirely.

3) Smart capital allocation decisions

How has Brunswick been spending their cash lately?

Buybacks and 2 major acquisitions (Power Products in 2019 and Navico in 2021) have been the primary outlet for capital during the past 5 years.

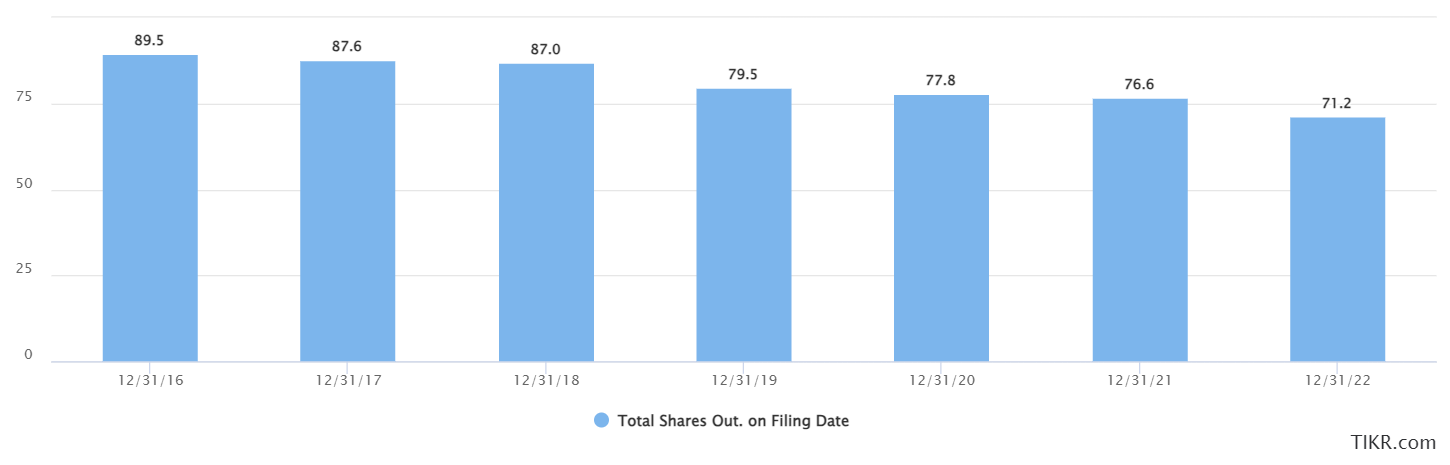

Share count fell from ~90mto 70m since 2016 — a 4.1% annual reduction. In total they spent $1.5bn on buybacks from 2016-2022 (roughly 75% of cumulative FCF during that timeframe).

Not seen in the cash flow chart above is a ~$482m divestiture in 2019 which helped fund a large buyback and acquisition. Acquisition spend has totaled $2.5bn from 2016-2022 or 125% of cumulative FCF. This means Brunswick increased leverage to fund those uses.

One final comment on M&A — I probably don’t fully comprehend how much the business mix has shifted recently but since 2019 alone: they’ve sold a ~$1bn+ revenue line, and acquired >$2bn in businesses that add to the propulsion / P&A segments. So we’re looking at a meaningful mix shift here.

Summing it up…

My biggest hurdle in owning this name is the 2-3 year stretch of massive revenue increase and whether that was all or mostly tied to a spike in activity thanks to COVID. However, they were smart to retire a big chunk of stock with those extra earnings so even if sales receded to pre-COVID levels they should be earning much more on a per-share basis.

As a quick math exercise on the downside scenario… if sales fell 25% to $5bn (still ~20% higher than 3-year average leading up to COVID) and held operating margins at long-run average ~12% less $110m interest expense and 25% taxes = $370m net income or $5.30/share in earnings. The current share price of $74 would mean ~13-14x P/E or right at the long-run average multiple. Perhaps the stock is pricing in sales levels giving back some ground to a larger degree than estimates predict?

The other factor that’s intriguing is the balance sheet… I’ve seen plenty of these highly cyclical consumer businesses run net cash balance sheets (for good reason) and that’s exactly what Brunswick historically did… but with the business mix shift, maybe they’re arguing it’s a less cyclical business today than a few years ago? Check out this chart of net debt since 2013 — can you spot the change in strategy?

Anyone following the stock have a good feel for why sales should continue to grow from this elevated base?

I may need to review some others in the industry to get a better feel for this name…

Hi, thanks for this Quick Review.

If that can help, you have this analysis on Brunswick on another substack. It's a bit old but may be usefull.

https://philippejkurzweil.substack.com/p/brunswick-corporation-a-compelling