Quick Value 1.10.22 ($VNT)

Vontier Corp ($VNT) - Recent industrial spin-off from Fortive at 11x earnings

Market Performance

Market Stats

Yield curve expanding again as 10-year treasury yields push higher

Unemployment rates at 3.9% are now within earshot of pre-pandemic levels (3.5%)

Job openings are still plentiful as the US labor force remains 2m+ below its pre-pandemic peak

Quick Value

Vontier Corp ($VNT)

Vontier was spun off from Fortive Corp in 2020 (which itself was a 2016 spin-off from Danaher). I’ll reference the October 2020 roadshow for the most part…

VNT is a collection of industrial businesses with 20% operating margins and good cash flow… They make the pumps you use at gas stations, point-of-sale software for c-stores, vehicle repair tools for mechanics, and software for tracking vehicle fleets.

These businesses don’t have a ton of overlap but as far as public industrials standards go, the margins are good at >20%. Fortive spun off VNT with roughly $1.8bn in debt in Q4 2020 and since then, VNT has already made a decent splash by acquiring DRB Systems, which makes software for the car wash industry, for close to $1bn.

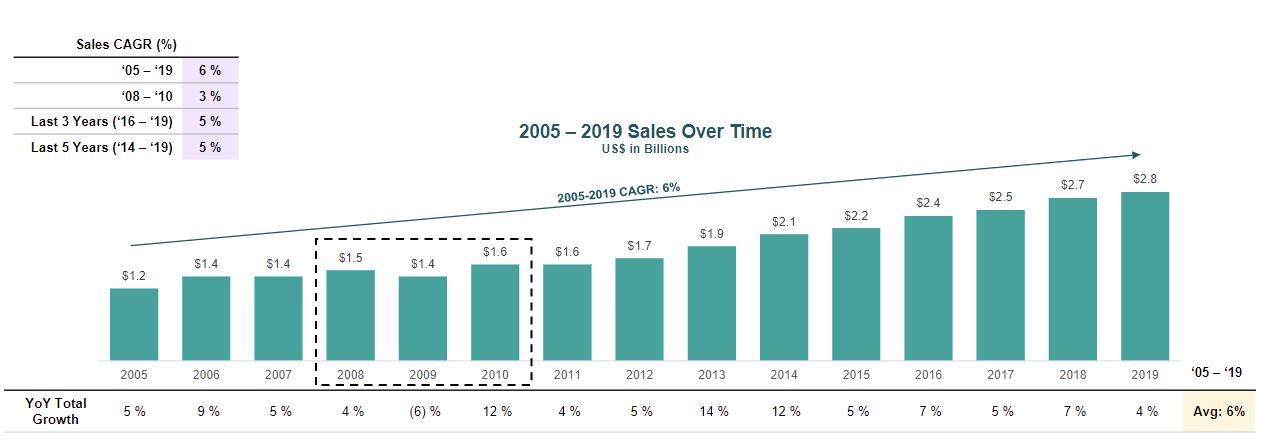

Despite the “mid-20%” recurring revenue stat, VNT has historically been a pretty resilient business. Even during the 2008-2010 period, there was hardly a blip in performance.

There are 170m shares outstanding x $31/share = $5.3bn market cap. They have $2.1bn in net debt for a $7.4bn enterprise value. Guidance calls for $2.84/share in 2021 earnings so right around 11x earnings.

With free cash flow conversion near the 100% mark, that would leave VNT just shy of $500m in annual free cash flow to spend on acquisitions or buybacks. Even after the latest DRB acquisition, net leverage is ~2.9x which leaves plenty of room for continued M&A.

Management is heavily focused on M&A. It sounds as though buybacks are not on the table even with shares trading around 10-11x earnings. This is a bit of a head scratcher since the latest acquisition, DRB, was done at 5.7x sales and 27x operating income.

There’s also the long-term risk from a transition to electric vehicles. Though perhaps VNT has or develops products catering to electric charging infrastructure?

Overall — it appears to be an inexpensive stock with a stable business. It’s unclear yet whether management can add value with their M&A approach but they’ve already fired their first bullet so we’ll get a taste soon enough…

Do you own VNT stock? Great summary, appreciate it.