Quick Value 11.1.21

The Quick Value archives are up-to-date, check out any past notes here. Be sure to subscribe to the free and/or premium newsletters if you haven’t already:

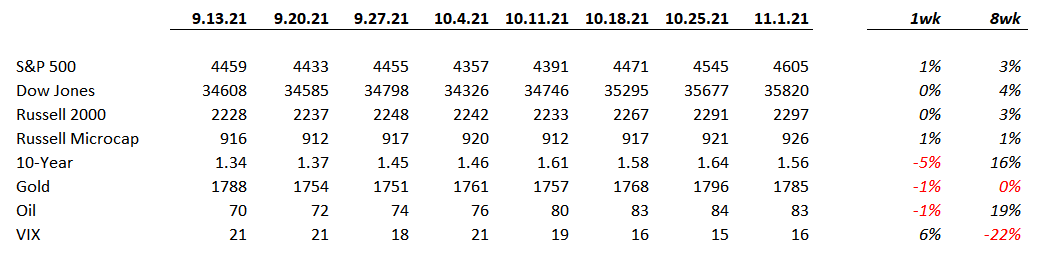

Market Performance

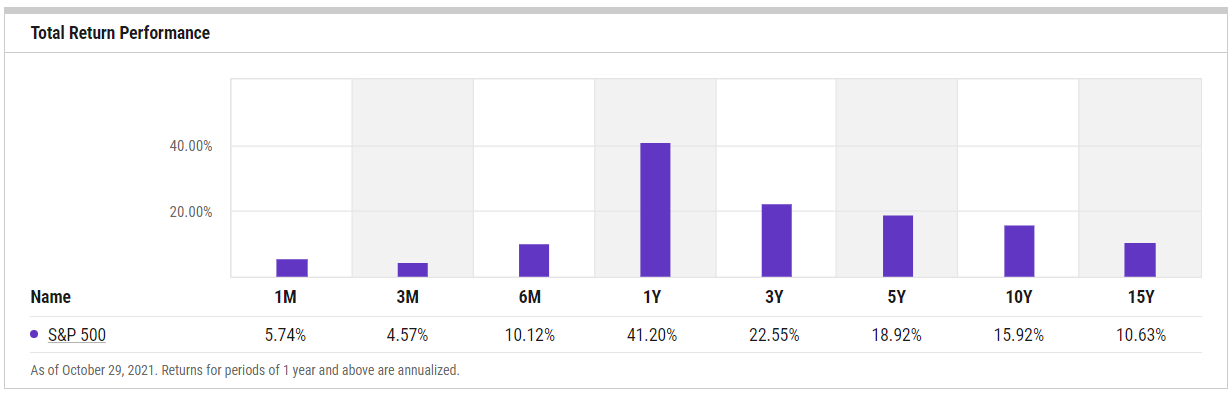

Quick check-in on various performance timeframes for the S&P 500:

Market Stats

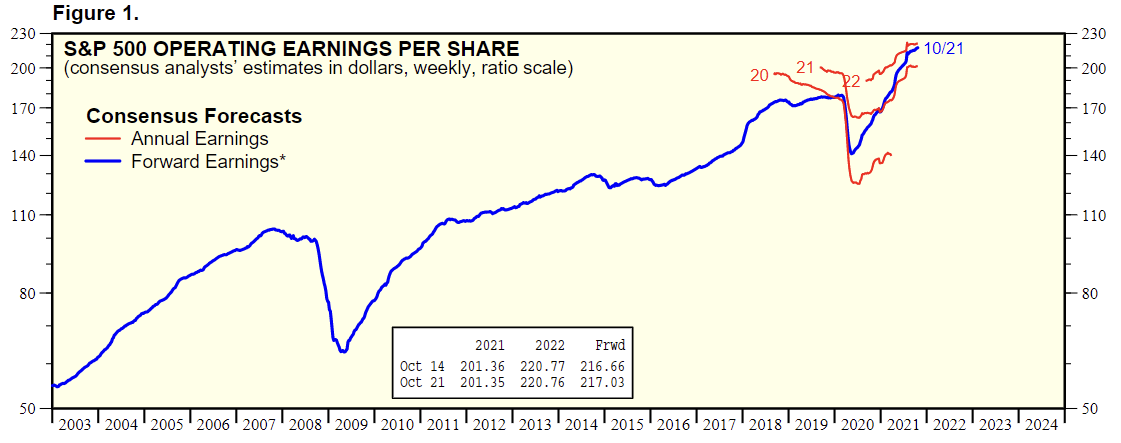

S&P 500 earnings estimated at 201 for 2021 and 220+ for 2022… that equates to 20.9x 2022 earnings

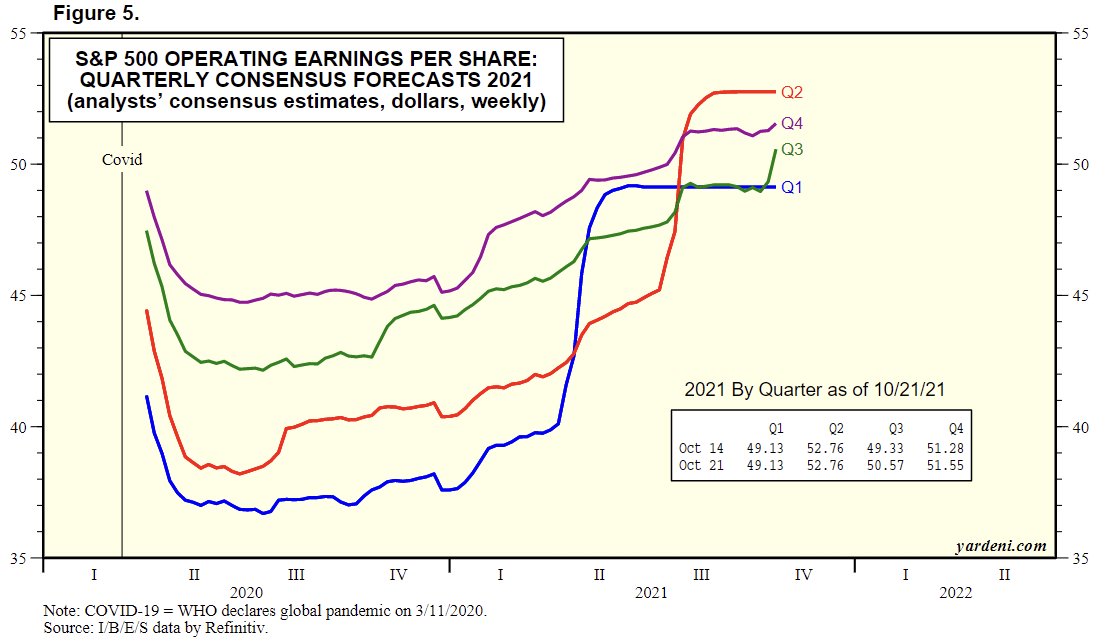

Building on S&P 500 earnings estimates… if you believe supply chain, chip shortages, labor challenges, inflation/raw material prices, freight capacity, etc. will weigh on upcoming earnings; then, it’s important to note that Q3/Q4 estimates haven’t really been adjusted downward (in fact they are ticking higher)

Quick Value

Takeda Pharmaceutical ($TAK)

My shortlist of stocks to review is growing and as much as I’d like to hoard the best opportunities to my private self, it makes sense to start reviewing some of the more intriguing ideas here to get them through the funnel.

Also, long-time readers have probably noticed I’ve covered a lot of pharma companies. This is an industry that interests me a lot for the coming decade with major blockbusters coming off patent, rise of biosimilars, and the incredible long-running underperformance of the entire industry.

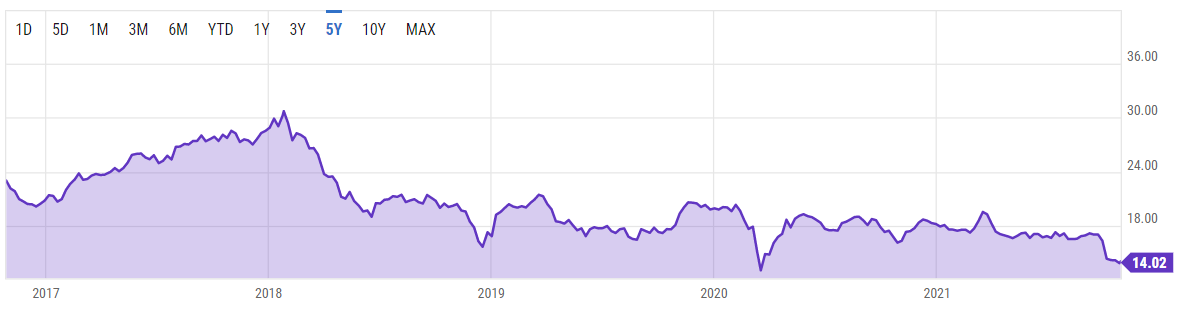

As a quick background — Takeda is a Japanese pharmaceutical company that has underperformed for a very long time. In 2019, Takeda acquired Shire Group for ~$62bn which dramatically changed the makeup of the company. (Quick side note: Shire itself completed a ~$32bn merger with Baxter spinoff, Baxalta, a few years earlier in 2016 — so today’s Takeda form is a byproduct of several very large acquisitions over the past few years.)

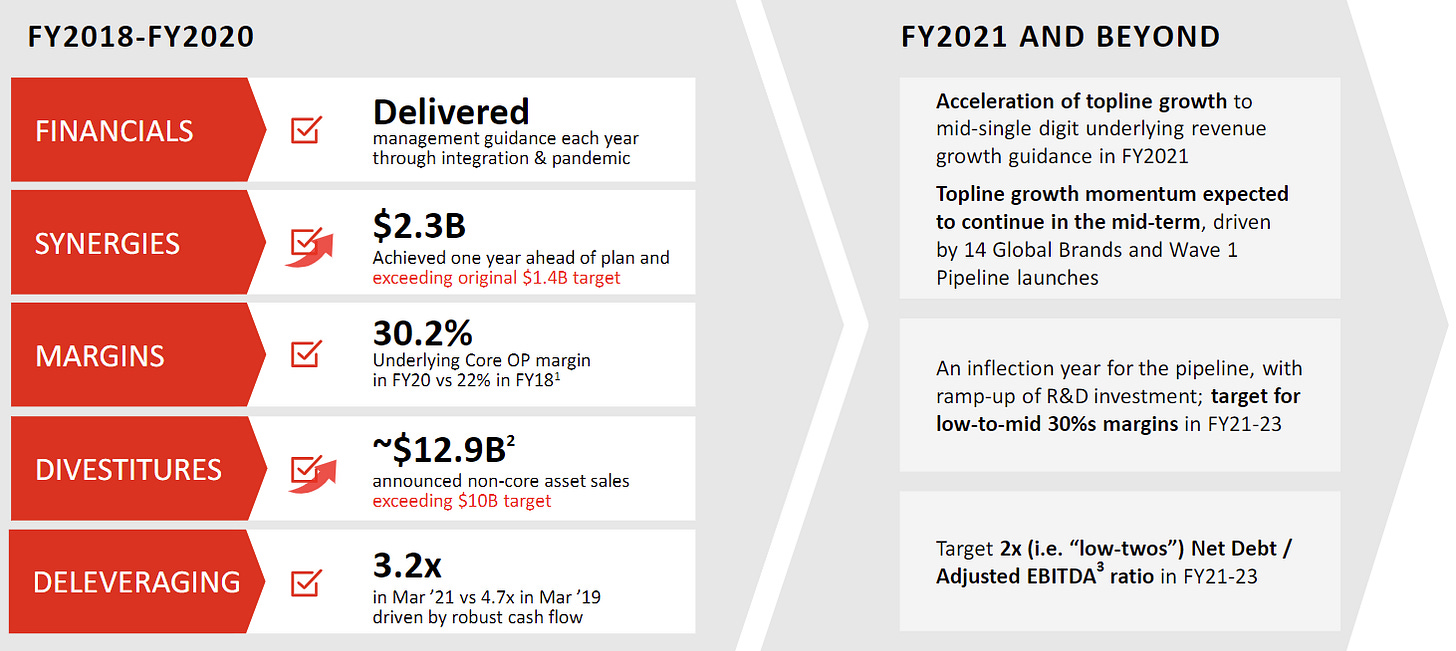

Obviously the Shire deal left Takeda with a bunch of debt (more than $50bn)… They’ve been spending the past 2 years selling off some non-core assets ($12.9bn) to pay down debt faster.

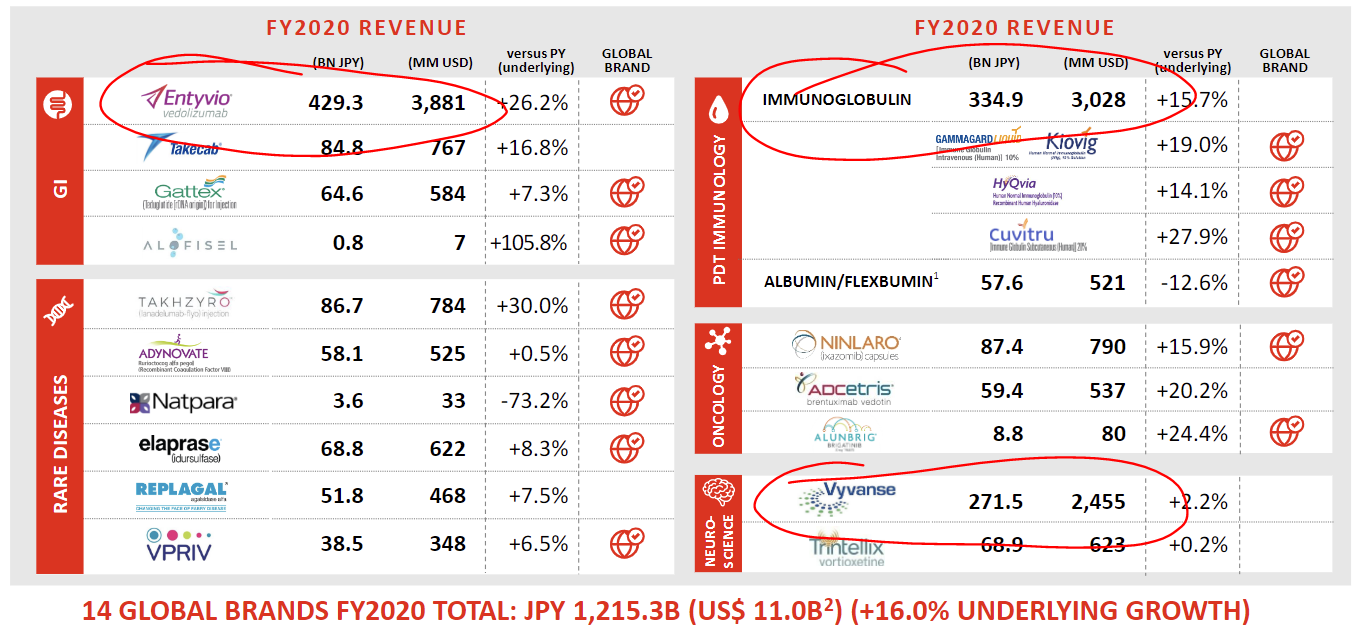

When I look at a new pharma company, I’m always concerned with what the blockbusters are, what % of revenue they make up, and when the patent cliffs are coming…

I found this slide helpful to unpack the key drugs in their portfolio… With about $29bn (USD) FY2020 revenue, there were 3 drugs that made up $9.3bn / 32%.

Of these drugs, Vyvanse has the earliest patent expiration in Feb 2023 for US markets. Entyvio is next in 2026. And Immunoglobulin is actually an aggregate of several products with no major patent risks. Essentially, Takeda is looking at ~$6.3bn or 22% of sales coming off patent in the 2023-2026 time period — seems like a very manageable position.

To recap the latest quarter — revenue grew 4.4%, EPS was down 2.8% and operating cash flow up 2%. They’ve guided to mid-single-digit revenue and EPS growth for FY21. It puts the stock at ~8.1x earnings. Leverage is down to 3.1x debt/EBITDA.

There’s a lot more going on than can be covered in a Quick Value post but the setup looks interesting… No overly concerning patent expirations, a 5.6% dividend yield (which consumes most cash flow outside debt repayment), leverage heading down to a reasonable 2x leverage target, a decent drug pipeline, and a newly announced share buyback program…