Quick Value 1.11.21 ($ATR)

Packaging superstar -- AptarGroup Inc $ATR

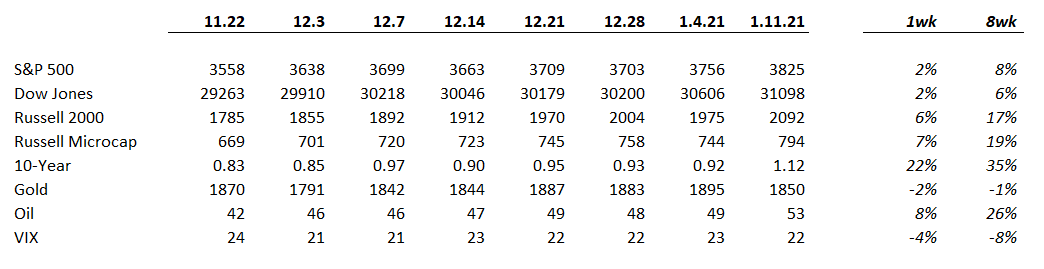

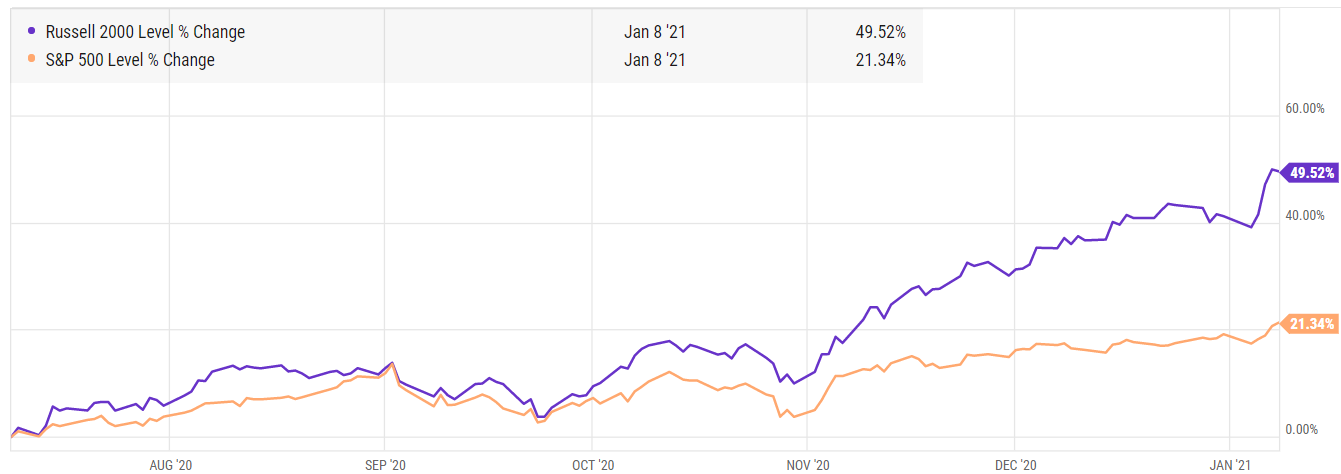

Market Performance

Yet another big week in the markets with fresh all-time-highs all around.

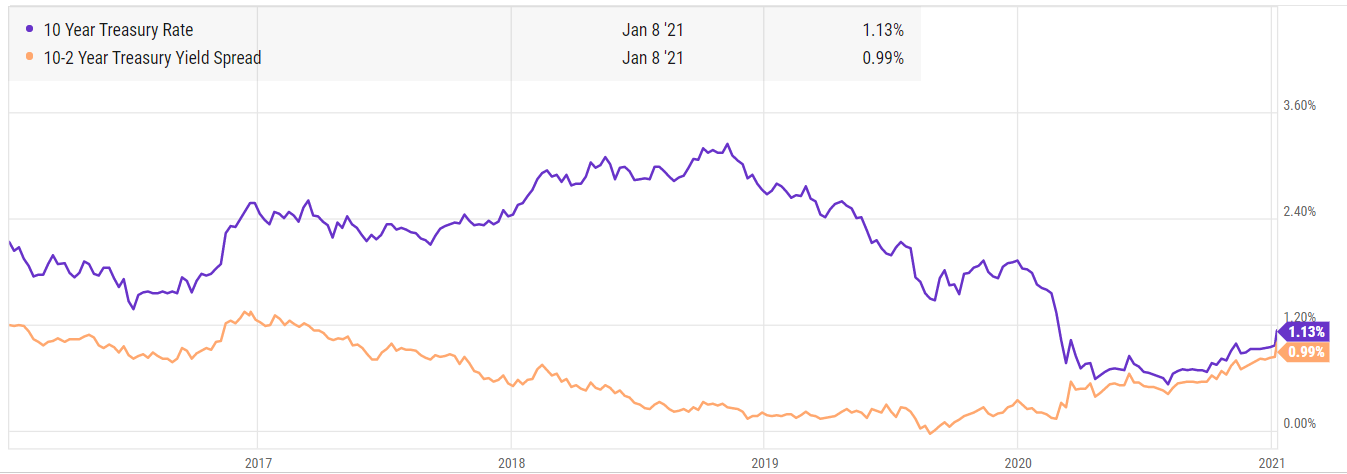

There were notable jumps in both the 10-year yield and oil prices over the past week.

Rates are more than 2x off lows earlier this year but still 0.5-1.0% below where they were for most of 2019…

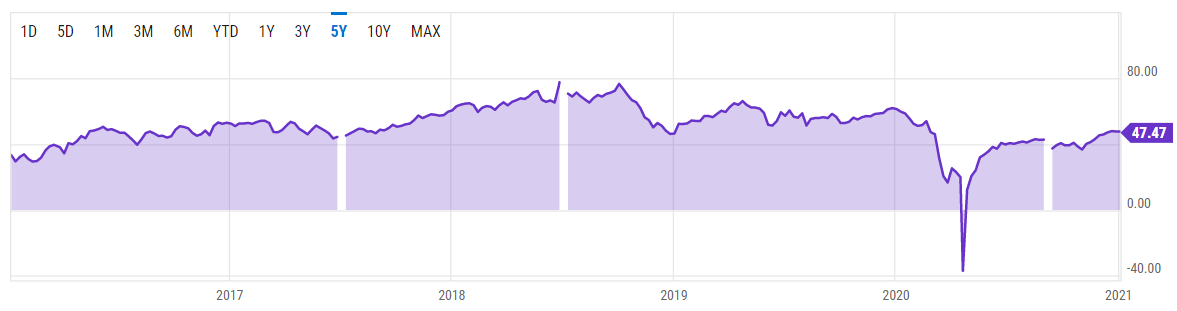

Crude oil prices have nearly fully recovered from the year 2020…

Market Stats

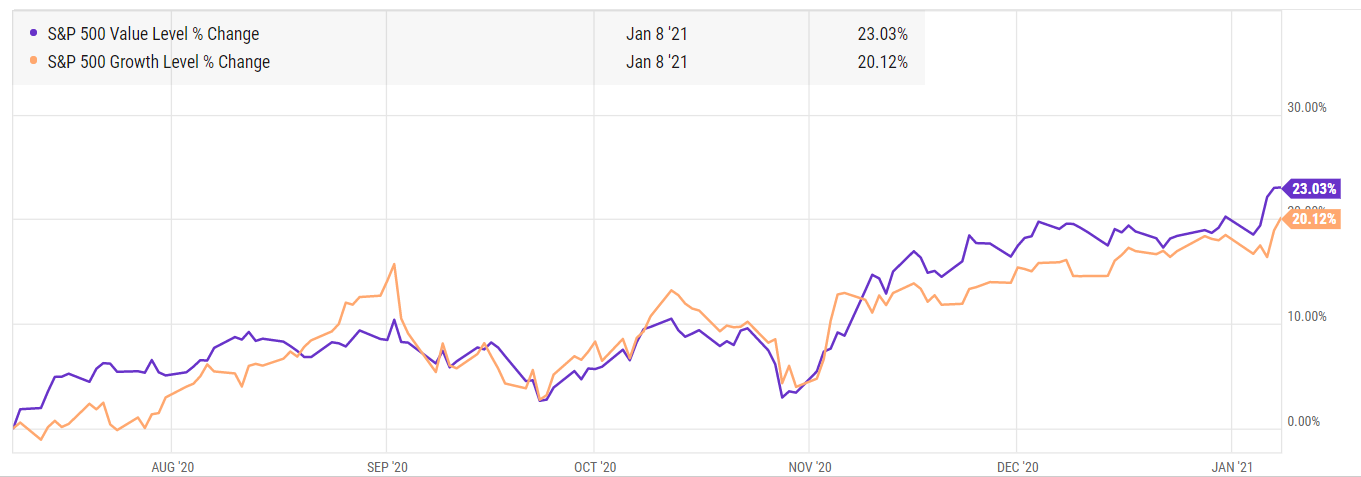

Time to stop complaining about value vs. growth… Over the past 6 months, value stocks have outpaced growth stocks in

And small stocks (Russell 2000) are up nearly 50% over the 6-month period!

Quick Value

AptarGroup Inc ($ATR)

Trying something new this week and piggybacking off last week’s post on Amcor… As a reminder, Amcor is coming off a big acquisition (Bemis in June 2019), trades at ~16-18x earnings and is shooting for 10-15% earnings growth via buybacks, acquisitions, and organic growth.

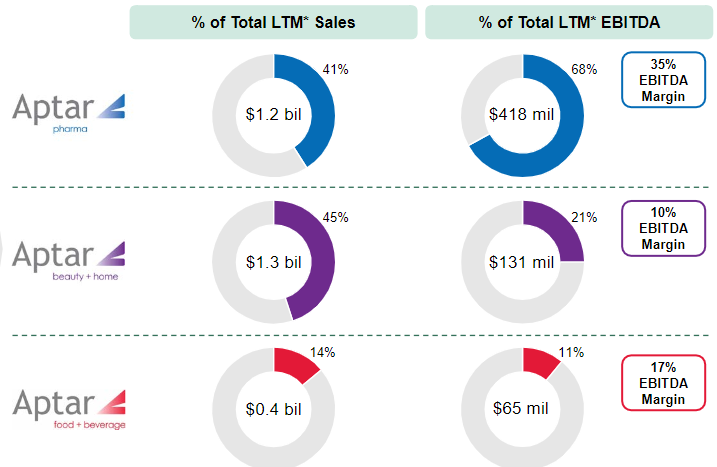

AptarGroup is a competitor in the packaging industry with more exposure to pharmaceuticals, injectables, drug dispensing (but still a player in food & bev, consumer goods, etc.).

The key difference with Amcor lies in the pharma division which has insanely good margins with it… This segment has also been a growth machine with sales climbing from ~$800m in 2018 to $1.2bn over the past 12 months — a 17% annual growth rate.

Capital allocation…

Since 2017, Aptar generated ~$1.5bn in operating cash flow… They spent:

$783m on capex (~40% of cash uses)

$800m on acquisitions (42% of cash use)

$320m on dividends (17% of cash use)

$0 (net) on share repurchases (after accounting for stock issuance)

$215m net borrowed (source of cash)

Overview…

At $140/share, Aptar is a $9bn market cap and a $10bn enterprise value with 2021 estimated EBITDA of $650m (15.4x multiple) and EPS of $4.10 (34x earnings).

Definitely a higher multiple than Amcor but the crown jewel here (pharma segment) might be worth the premium with 35-40% EBITDA margins and double-digit revenue growth. This post isn’t designed to cover why this crown jewel might be so valuable but it’s a great starting point for anyone digging into this industry and uncovers the surface-level differences from Amcor.

Next week we’ll take a look at another player in the packaging space…