Quick Value 11.14.22 ($MAT)

Mattel - turnaround nearly done, stock trading at 7.9x EBITDA

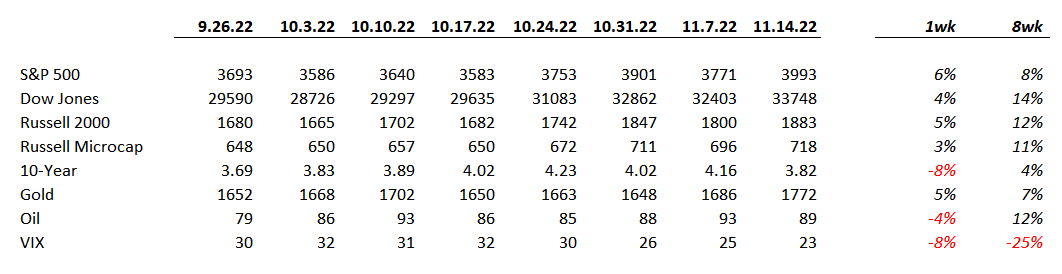

Market Performance

Market Stats

Inflation for October came in lighter than expected at a ~7.8% YoY rate… excluding food and energy it was a 6.3% YoY rate.

Quick Value

Mattel Inc ($MAT)

It’s interesting, Hasbro ($HAS) has mostly been known as the best toy company out there… long dominating the share price performance of Mattel (seen in the 10yr relative performance below).

…But Mattel has been working on a turnaround the past few years that has borne fruit and now shares are starting to outperform the slightly larger Hasbro ($8.8bn market cap vs. Mattel’s $6.1bn).

What they do…

Mattel is a global toy manufacturer with a large portfolio of owned and licensed brands like Barbie, American Doll, Polly Pocket, Hot Wheels, Fisher Price, Star Wars, Pixar, etc. They sell mostly direct to retailers — Walmart, Target, and Amazon were 46% of 2021 sales.

Barbie, Hot Wheels, and Fisher Price were the largest individual brands as of FY21.

Why it’s interesting…

1) Tail end of turnaround — A string of acquisitions, closing of Toys R Us, and a handful of CEO changes during the 2010’s put Mattel in turnaround-mode with high leverage. Current CEO Ynon Kreiz came into the picture in 2018 and slimmed down the business while focusing on organic improvement and repaying debt. Since 2018, Mattel has improved in nearly every fundamental metric from sales growth, to margins, to free cash flow…

With those efforts mostly in the past, they’re now turning to “growth mode” in 2022-2023.

2) Margin catch-up with Hasbro — With the turnaround taking shape, Mattel is closing the performance gap with peer Hasbro. EBITDA margins have essentially equalized and yet the stock continues to trade at a discount on EV/EBITDA.

3) Capital allocation — Perhaps the most impactful aspect of wrapping up a turnaround (other than the share price appreciation) is the ability to use your cash flow for other purposes beyond debt reduction! Mattel went several years without acquisitions, without share buybacks, without dividends.

Management hopes to improve FCF conversion from EBITDA to >50% from ~30% today. With $1bn+ annual EBITDA that would leave $500m for alternative capital deployment.

At $17/share, Mattel is a ~$6.1bn market cap and $8.7bn enterprise value business. EBITDA estimates for 2023 are >$1.1bn which puts the stock around 7.9x EBITDA.