Quick Value 11.22.21 ($DB)

Banking turnaround at 0.4x book value

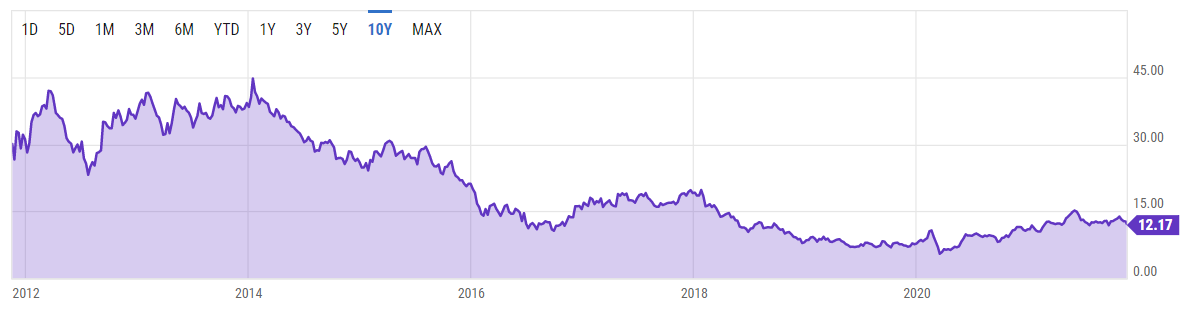

Market Performance

Tough week last week, especially for smaller stocks. Important to remember that the S&P 500 is still up 25% YTD and Russell Microcap index is up 25% YTD.

Market Stats

Small stocks flat since February 2021 despite being up some 20-25% YTD (depending on whether you’re looking at the tiniest companies or just plain small companies)

Housing loan-to-value ratios are hitting lows; though this is likely in part from a major rise in home prices (denominator rising more than the numerator) — h/t private Twitter account

Housing prices and comparison to rental rates are reaching all-time-highs — h/t private Twitter account

Quick Value

Deutsche Bank ($DB)

DB came onto my radar from a Third Ave Funds quarterly letter. I had assumed the bank was still struggling and never really watched it. They’ve struggled with all sorts of internal challenges for years (just skim their Wikipedia page to get up to speed quickly). The problems really started in 2015 — losses mounted from 2015-2017:

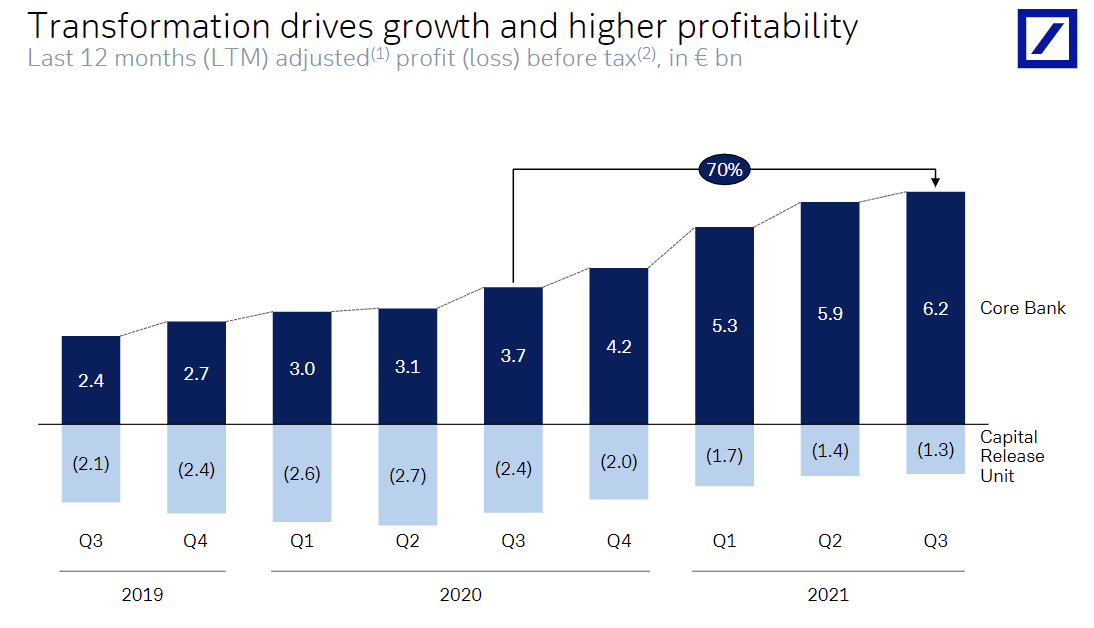

Current CEO Christian Sewing came in 2018 and laid out the turnaround plan — cost cutting and focus only on core business lines. So far, it’s been effective — here’s a look at core bank profits vs. the “runoff” business:

The “Core Bank” — corporate banking to medium-sized businesses, investment banking, private banking to retail customers, and investment management — has seen a large rebound in profitability, in part thanks to a robust trading and capital markets environment the past year and a half. At the same time, losses from the “Capital Release Unit” have fallen rapidly… i.e. the turnaround appears to be working.

These large banks (especially overseas ones) have a lot of in-the-weeds details to analyze so I’m going to drop in Q3 results and log a few notable items on DB:

Revenue grew 3.7% in FY2020 and is up another 5% through 9 months in 2021

Balance sheet looks pretty good with 13% capital ratio

Book value is starting to grow — EUR 27.32 per share from EUR 26.03 at FY2020

Other KPIs are trending up — AUM growing in the investment business (inflows too, not just market returns), loans, and deposits both growing

Capital returns coming back — management is projecting 5bn (EUR) in capital returns starting FY2022

Major restructuring charges look like they’re nearing an end — 7.9bn spent cumulatively to-date vs. an expected 8.8bn in aggregate —

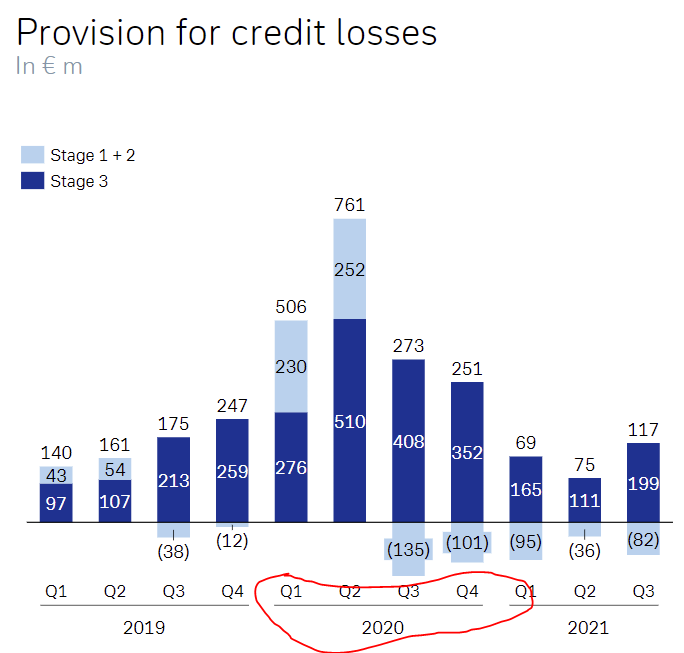

Provisions for credit losses are starting to normalize from the big spike in 2020 (COVID)

Shares are trading around $12 (USD) / 10.80 (EUR) for a EUR 23bn market cap. (Most of the figures above are in Euros so it’s probably easier to refer to the business this way.)

Book value at 3Q21 was 57bn for a 0.4x multiple. Compared to ~0.5x at competitor Barclays ($BCS). Trailing earnings at Q3 are 0.88/share for a 12x earnings multiple… Both of these are cheap in their own right. Especially if you add 5bn in capital returns into the mix… That’d be >20% of the current market cap.