Quick Value 11.23.20 (BBVA)

Banco Bilbao Vizcaya Argentaria SA (BBVA) - the other side of the PNC acquisition...

Market Performance

Market Stats

Ecommerce sales as a percentage of retail sales has been on the rise for years and no surprise that COVID has accelerated that shift — jumping from 11% share in 3Q19 to 14% share in 3Q20.

Housing market remains strong… Existing home sales are still surging to levels not seen in 10 years (sure, some of this is a result of lower activity during lockdowns earlier this year).

Retail sales in the month of October were up 5.7% from last year with the same laggards as usual — gas stations, clothing, restaurants, and malls/department stores.

Quick Value

Banco Bilbao Vizcaya Argentaria SA (BBVA)

After PNC announced their plan to acquire the US operations of BBVA for $11.6bn — shares of BBVA jumped from $3 to $4 per share. PNC also saw a (smaller) jump in share price.

BBVA is still well below prices from earlier in 2020 and perhaps it’s the better bet than PNC?

For starters, PNC is paying 1.34x tangible book value for the US operations. BBVA still trades at about 0.6x tangible book value (even after the jump in share price).

First, the bad…

Book value has been flat at ~$6.80 per share since 2015 despite positive earnings which isn’t exciting

The remaining business will derive nearly all revenue/earnings from loans in emerging markets — Mexico, Spain, Turkey, South America

Emerging market exposure means currency risks

Then, the interesting…

They’re getting 1.34x tangible book and 19.7x 2019 earnings for the US division

Gross sale proceeds of $11.6bn are ~41% of the current market cap

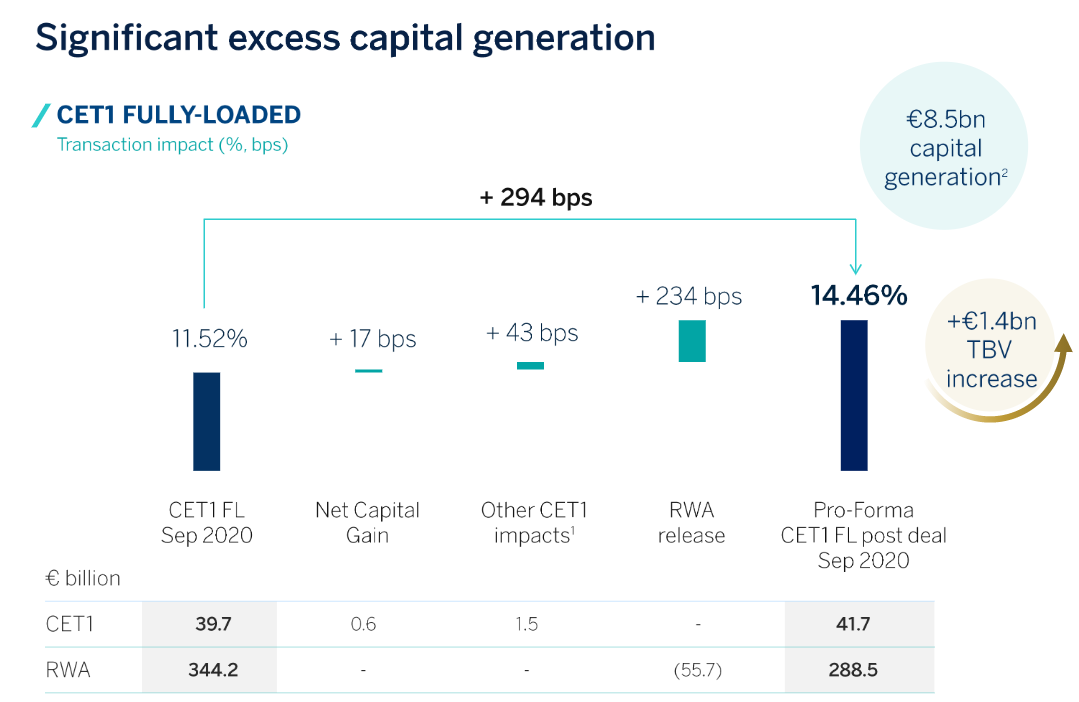

Overcapitalization — post-sale, the equity cushion will jump significantly giving BBVA some excess cash

What will they do with all that cash? There have been talks about an acquisition and share buybacks are certainly on the table.

A closer look at the bank itself…

Total assets by each region:

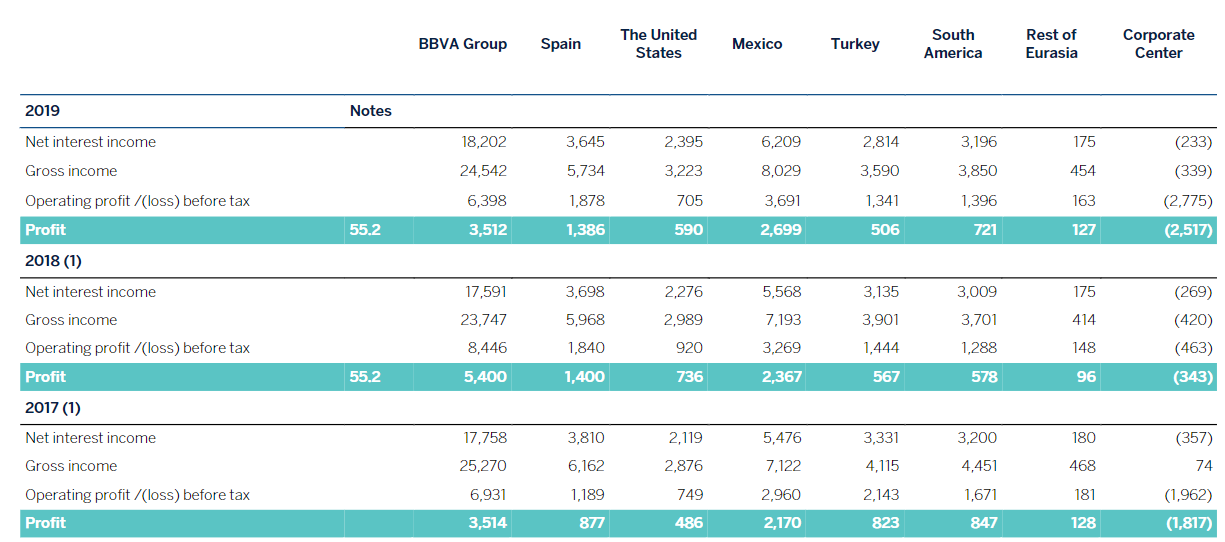

Profitability by region:

Back to the post-deal setup…

So BBVA will have plenty of capital and a mostly emerging markets business portfolio once the PNC deal closes.

Management is talking about doing buybacks which would be pretty beneficial at 0.6x tangible book. There are also rumors about a deal with Banco de Sabadell which has a 2.3bn Euro market cap. Looks like BBVA will have about EUR 8bn or more to deploy (and a EUR 24bn market cap). Shares trade at about the same multiple as rival Santander (SAN) despite having the excess cash available…