Quick Value 11.29.21 ($IAC)

$IAC - Internet-driven holding company

Market Performance

We’re finally starting to feel some pain in the markets!

Market Stats

Total market cap of stocks >20x sales has reached $4.5tn (with a “T”); visually looks like absurd valuations for expensive companies — courtesy of Kailash Concepts via Twitter

Personal savings levels have dropped back to pre-pandemic amounts — about $1.3tn per month and 7% of personal income — will be interesting to see how or if this impacts future consumer spending habits

Quick Value

IAC/InterActiveCorp ($IAC)

IAC recently announced they’d acquire Meredith Corp ($MDP) — one of my larger holdings from the Premium Newsletter — I’ve had it on my agenda to dig in and finally sat down to do so.

In the simplest sense — IAC is a holding company with several controlled operating businesses and some minority investments. They’ve spun off some well known companies in the past. Consider it an internet-version of Berkshire Hathaway if you want — controlled operating businesses generate cash for centralized capital deployment into various investments or acquisitions.

It’s actually a pretty complicated web of businesses but to try and keep it simple, there are a few main pieces:

Dotdash — digital content business set to combine with Meredith

Search — Ask.com and some other search websites

Care.com — web platform for connecting with caregivers (was formerly a public company before IAC bought it)

Everything else — Controlling ownership stake in publicly traded Angi ($ANGI), a large minority stake in publicly traded $MGM, 27% interest in non-traded Turo

Here’s a look at each segment’s financial performance over the last 3 years

Personally, I don’t really care for some of the higher growth / more expensive business units but a few of them are publicly traded so it’d be possible to hedge them out. Obviously I’m most interested in Dotdash given they acquired a previous holding of mine.

Angi trades at >2x sales and >50x EBITDA based on 2023 estimates — not my cup of tea. IAC owns ~424.6m shares of ANGI at $9.60 that’s $4.1bn in value. IAC also owns 59m shares of MGM at $41.85 = $2.5bn.

IAC itself is about an $11bn market cap at $126/share. Backing out Angi and MGM alone gets down to $4.4bn for the remaining assets. On top of that they have $3bn in net cash (when excluding Angi cash & debt). That’d be roughly a $1.4bn enterprise value for $1.7bn in trailing revenue for the remaining businesses + some other assets on top of that. Way more interesting…

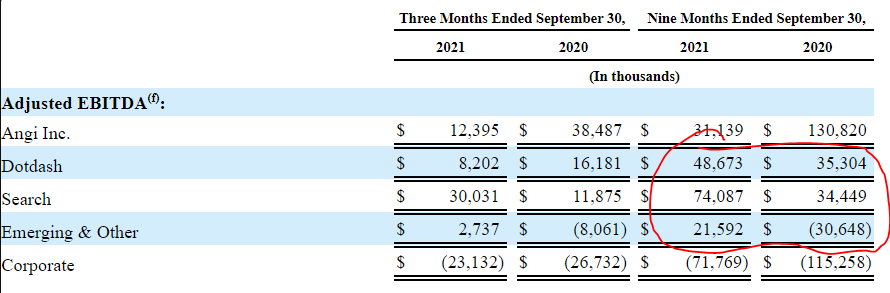

Most of the remaining segments were hit pretty hard by COVID and 2021 results are shaping up a lot better than 2020 too. We have trailing EBITDA for the ex-Angi businesses at $184m and corporate costs at $104m — I’ve not dug in to know what those corporate costs should really be.

Back to Dotdash/Meredith — The purchase price will amount to $2.7bn so the enterprise value of $1.4bn I mentioned above is really closer to $4.1bn after this deal closes. They are targeting $450m in 2023 digital EBITDA, I’m guessing there would be some print-related EBITDA in there too. Maybe that’s worth $5bn or more down the road (10x EBITDA+).

The remaining pieces of the business are somewhat interesting but maybe harder to peg a value to.

Turo is the peer-to-peer car sharing platform which IAC owns 27% and invested $250m in 2019.

Care.com was bought in 2020 for $500m and it’s hard to imagine that’d be worth any less under IAC’s ownership.

Search has a web and desktop component to it and the latter is likely worth very little. But the overall segment chipped in $90m in trailing EBITDA and has rebounded from pandemic performance.

Overall a pretty interesting setup…