Quick Value 11.30.20 ($TRN)

Trinity Industries ($TRN) - another way to play railroads?

Market Performance

Tracker shows another week of solid gains and new all-time highs… As a reference, I see Russell 2000 (small cap stocks) at 11%+ YTD returns and S&P 500 at 12%+

Interestingly, the growth vs value debate is still ongoing… S&P Growth index is +27% YTD and value index is down 3.5% YTD.

There are still plenty of beaten up companies and sectors out there for any bottom feeders and bargain hunters.

Market Stats

As always, there are reasons to be both optimistic and pessimistic on the future outlook. Here are a few as I see it…

Employment levels getting back to normal (positive)

The most recent unemployment rate of 6.9% is on par with November 2013 — well into the recovery from 2008-2009. Jobless claims are still higher than peak levels from 2008-2009 so the numbers might still be a bit messy.

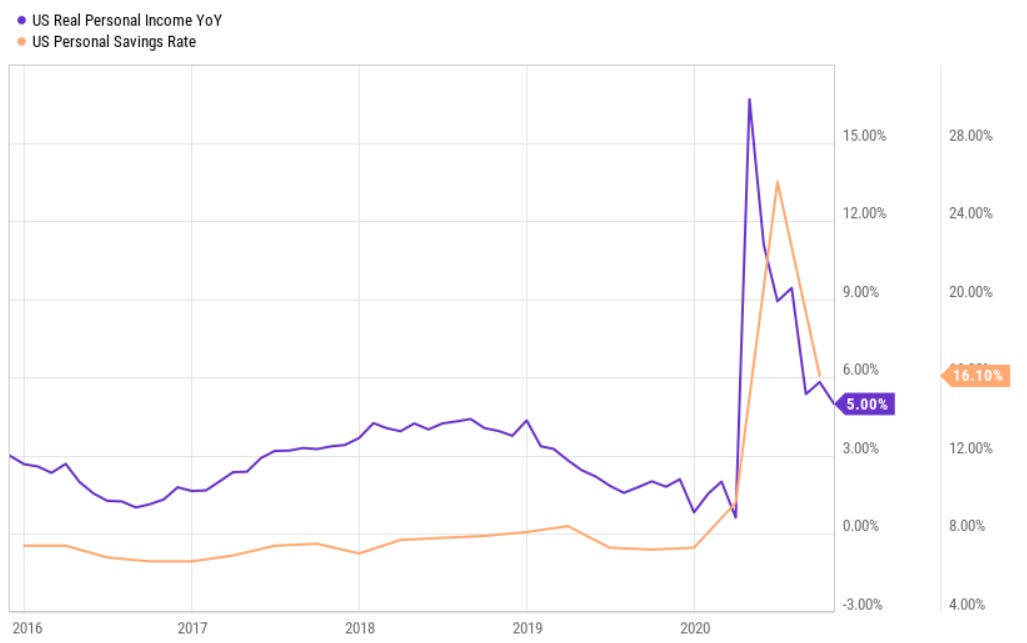

Consumer financials (positive)

Retail sales have been strong and personal income and savings levels are also strong thanks to stimulus funds. Most encouraging though, “bonus” unemployment payments have faded for months now so most of the personal earnings are coming from pure and simple wages and salaries. There are no longer and “gifts” in the data.

Business activity (positive)

Activity in both manufacturing and non-manufacturing has been in solidly positive territory

Government debt (negative)

We’ve taken on a major debt-funded stimulus program this year and whether you’re a MMT believer or not, most politicians will argue the need to repay these debts over time. We have roughly $27tn in national debt vs $21tn in annual GDP. A trend that has been in place for some time now as well — every dollar of debt added seems to be creating less additional GDP.

Tax outlook (negative)

I don’t know when or if this will come to fruition but the talk of raising corporate tax rates from 21% to 28% would likely have the same effect as back in 2017 when they were lowered. In essence, the same $1 of pre-tax earnings will be “worth” 9% less. Interestingly, one of the most battered industries in 2020, financials, would likely be one of the most harmed by tax changes given their mainly domestic earnings base.

Quick Value

Trinity Industries Inc (TRN)

Trinity is in the railcar leasing and services business. In the simplest sense, they make, sell, and lease railcars to railroads. As of 2019, they owned 128,000 railcars with an average lease term of 3 years. Back in 2018, Trinity spun off their industrial and construction products business (Arcosa). Since then, this stock hasn’t done much.

Most of the railroad stocks like CP, CSX, and UNP have all performed well lately while the railcar producers are lagging.

Trinity recently held an in-depth investor day presentation which could be a good time to dust off the file on this one.

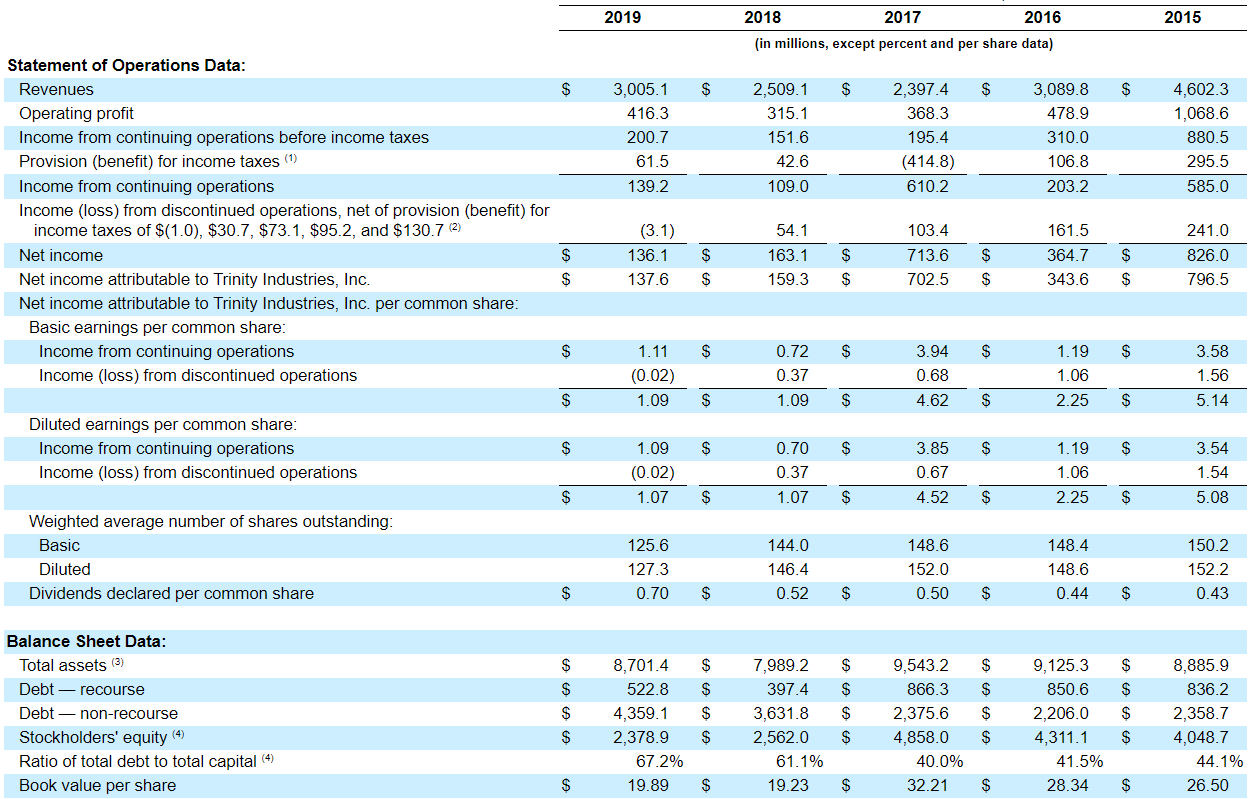

Some quick stats on the business — This is a $2.7bn market cap at $24 per share. There is a good amount of debt on the balance sheet at ~$5bn (though most of it resides in the leasing segment backed by railcars). Earnings were $1.26 per share in 2019 for a seemingly expensive 19x multiple and book value is $16 per share for a 1.5x multiple.

They highlight the cash generation of the business which is solid, but it has mainly gone back into reinvestment in new railcars.

The 3-year outlook calls for some lofty performance improvements. A pre-tax ROE of “mid-teens” could get to $2.10+ in pre-tax earnings on today’s $1.8bn in book value. If book value 3-years out is more like $2bn and they hit a 16% pre-tax ROE — that would be closer to $2.10 in after-tax earnings.

Beyond the financial metrics and outlook… The industry looks attractive. The railroaders and that method of freight transportation is not going anywhere, plus they have long-term plans to take intermodal share from trucking. Energy is clearly a risk with a big chunk of rail tied to coal and oil.

Railroads are also opting to own railcars less-and-less over time, shifting the burden to lessors. Lessor share of railcar ownership has increased from 35% to 53% over the past 3 decades. Trinity is already a major player in a somewhat fragmented market.

They like to compare themselves to the aircraft lessors claiming a somewhat more stable market in rail.

Not the cleanest setup with the recent spin of Arcosa, exposure to energy, and the remaining COVID impact on lease rates / production. But it looks like a decent business with a long runway tethered to a “quality” industry in the rail operators.