Quick Value 1.17.22 ($JWN)

Nordstrom ($JWN) - 10x earnings for recovering luxury retailer

Market Performance

Market Stats

Here were some interesting charts I came across the past week…

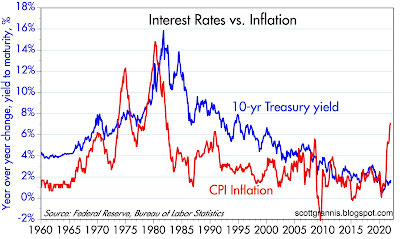

Interest rates and inflation rates diverging like never before… Here’s the commentary from Scott Grannis…

“compares the yield on 10-yr Treasuries to the year over year change in the Consumer Price Index. We've never seen such a huge difference between the two, and I for one never thought something like this would or could ever happen. Where are the bond market vigilantes when we need them? Those vigilantes are supposed to ensure that interest rates are nearly always as high or higher than the rate of inflation. That's certainly NOT the case today.”

Quick Value

Nordstrom ($JWN)

Nordstrom was recently called a Barron’s top 10 stock pick for the 2022 year. Their quick pitch was that the stock trades at close to 10x earnings and 0.5x sales with 40% of revenue coming from ecommerce.

Retailers Kohls and Macy’s have been under pressure to sell or spin off their ecommerce divisions. Privately held Saks Fifth Avenue already went down that path and separated it’s physical stores from ecommerce. Nordstrom, which is a harder activist target given family control, recently announced they were exploring a spin-off of their off-price segment Nordstrom Rack.

In addition to the ecommerce sites, Nordstrom operated 94 US retail stores and 242 Nordstrom Rack stores as of yearend 2020. The flagship Nordstrom brand is truly a luxury retailer with top 20 markets like NYC, Chicago, LA, and Dallas making up 75% of revenue.

Like other brick-and-mortar retailers, calendar 2020 was a really tough year! Sales fell 32% for the year. Also like other retailers, ecommerce was a bright spot during the pandemic, where sales grew 16%. Digital sales went from ~$5bn in 2019, to $5.7bn in 2020, and close to $6.1bn over the last 12 months (as of Oct 2021).

Though the business is rebounding, total sales are still below 2019 and 2018 levels.

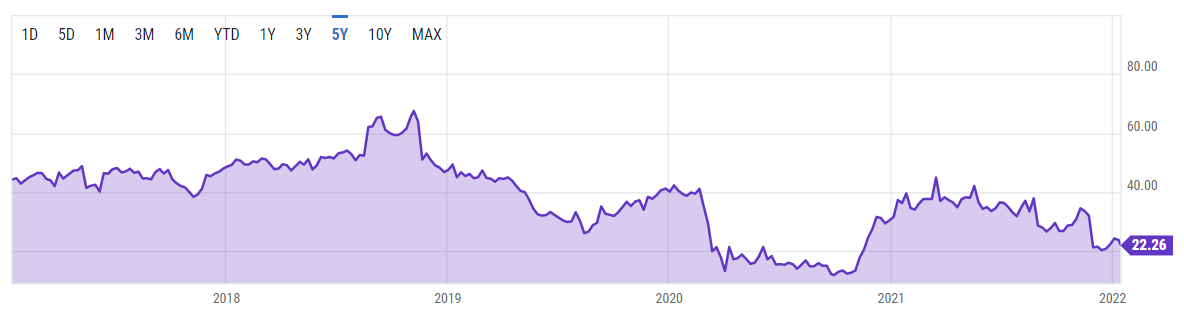

There are ~160m shares outstanding x $22/share = $3.5bn market cap. Tack on $2.8bn or so in net debt for a $6.3bn enterprise value.

Historically, Nordstrom had been spitting out cash flow of $1.2-1.6bn annually until the pandemic hit. Since February 2020, they’ve generated a cumulatively negative amount of cash! That should turn the corner as sales recover.

And prior to the pandemic they were spending an equal amount on repurchases / dividends which essentially went to zero. Those capital returns should come back into the picture starting next year.

Estimates call for $1.30/share in earnings for the current fiscal year and $2/share+ for next year. Back in 2018-2019, Nordstrom earned closer to $3.30/share. But supply chain, labor, and other inflationary costs may make it difficult to get back to those levels.

Looking out an entire year, Nordstrom is trading at close to 10x earnings while Kohls and Macys are well below 10x…

I’m not sure how much sense it makes to separate ecommerce from physical stores but there seems to be some upside if they’re capable of getting back to pre-pandemic performance levels.