This is a free Quick Value post; as a reminder, Quick Value is all about idea generation… finding stock candidates worthy of a closer look. Subscribe below for access to all posts, including yesterday’s write-up on an interesting balance sheet transformation I’m invested in…

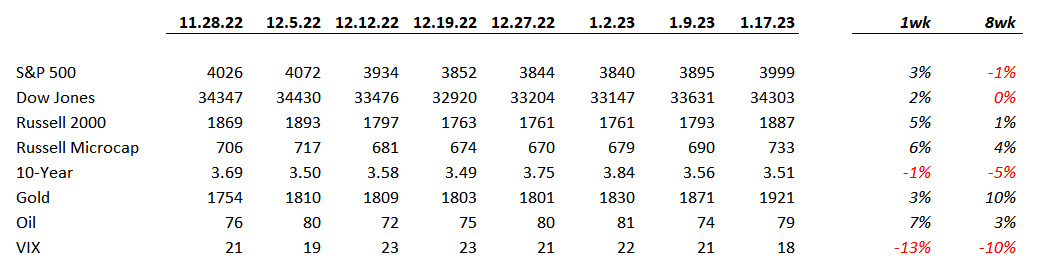

Market Performance

Market Stats

Inflation is slowing but still growing at a high clip… services still expanding while goods & slowing heavily (h/t zerohedge)

Quick Value

GE HealthCare Technologies ($GEHC)

GE completed the first of 3 spin-offs in December 2022. I’m typically good about getting in front of these to see if there’s a pre-spin investment opportunity but haven’t reviewed this one yet…

What they do…

GEHC sells healthcare equipment, services, and digital products under 4 segments:

These are mostly large and expensive pieces of equipment (X-ray machines, MRI machines, ultrasound devices, anesthesia machines, patient monitoring devices, etc.) but also plenty of consumables (mainly in the PDx segment) and services. Margins and growth profiles vary widely between each segment.

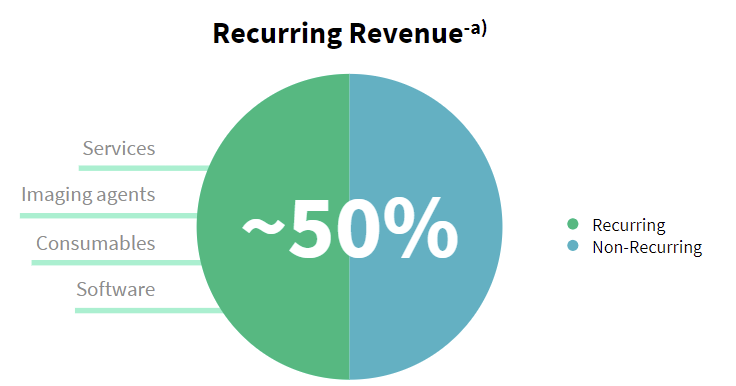

Overall, the business has a 50/50 split between recurring and non-recurring revenue sources based on FY21 sales:

If you want to learn more you can check out the 116-slide investor day presentation (or opt for the 22-slide JPM HC Conference version).

Why it’s interesting…

1) Long-term fundamentals

This looks like a “quality” business in the sense that margins are good, earnings are relatively stable, and the industry probably has high entry barriers. Though the business was heavily impacted by COVID and doesn’t appear to have fully recovered yet.

These are expensive products and services being purchased by large health systems; it strikes me as a mature and defensible business with incredibly high barriers to entry (though I say this with zero factual evidence). Industry players are all large and mature businesses like Siemens, Philips,

2) Growth — GEHC is growing at a 3% annual rate from 2019-2022E and another 5-7% is expected in 2023. Current EBIT margins are right around 15% and management hopes to bring those up to 20% over the “medium term.” That should create a decent revenue/earnings growth profile over the next few years.

3) Capital allocation — An 85% FCF conversion ratio means GEHC will be generating plenty of cash. Since 2019 (3.75yrs), GEHC generated $7.1bn in operating cash flow / $6.1bn in FCF — of that, they spent $1.6bn on acquisitions and sent $4.4bn back to GE parent.

So past capital allocation was: send dividends to GE. This makes sense because of the struggles and cash flow issues GE was facing from its other businesses. It’s also a big factor as to why GEHC might be able to reorient growth/earnings with proper investment and capital allocation going forward…

4) Valuation — GEHC has ~455m shares outstanding x $65/share = $29.6bn market cap. They were saddled with $10bn in debt and $1.8bn in cash for an enterprise value of $37.8bn.

Ballparking EBITDA for 2023… if they grow 2022E revenue of $18.3bn by 6% = $19.4bn 2023 sales x 15.25% EBIT margins for $2.96bn 2023 EBIT. Looks like D&A is ~$600m based on Form 10 filing for EBITDA just shy of $3.6bn. That puts the stock at 10.5x EBITDA with 2.3x leverage.

Siemens Healthineers trades at >16x EBITDA as do some other large medtech/healthcare companies. I don’t know if that’s the right multiple but it’s definitely less expensive than other large healthcare equipment cos…