Quick Value 11.8.21 ($BHC)

Bausch Health - 2 IPOs and a spinoff for this highly levered pharma company

Market Performance

Markets have been a tear the past few weeks… Earnings rolling in better than expected so far.

Market Stats

Purchasing Managers Index (PMI) for both manufacturing and services remain in expansion territory and services have been accelerating all year… (a level above 50 indicates expansion)

October saw 531k jobs added vs. 450k estimated… the labor force is now at 161.5m vs. pre-pandemic peak of 164.6m (98%)… looking back at the 2008-2009 recession the labor force peaked at about 154.9m, got down to 153.1m, and took until June 2012 to get back to its prior peak… participation rates never recovered (and may not in today’s environment either).

Quick Value

Bausch Health Companies Inc ($BHC)

I apologize if you’re sick of hearing about health care and pharmaceutical companies; I gravitate to industries that look cheap…

Bausch was once known as Valent Pharmaceuticals and had a stock price north of $260/share. They bought drug companies, raised prices, and cut R&D spend until the leverage caught up to them. Debt levels got up to $31bn! Prior executives were booted, there were SEC and FBI investigations… things were bad. CEO Joe Papa came in 2016 and has been leading the turnaround / deleveraging since then.

Today, Bausch has 4 segments:

Bausch + Lomb — Eye-health (similar to Alcon) with

Salix — Gastro business

Ortho Dermatologics — Dermatology business

Diversified Products — Generics, neurology, and some dentistry products

The debt is still quite high with almost $22bn in net debt:

Operating cash flow is right around $1.5bn annually and capex at $300m per year. With $22bn in debt that’s close to 18x debt to FCF — and people consider AT&T highly levered at close to 6-7x…

What makes Bausch interesting (at least to me) is that they are on a mission to break the company up, separate the best pieces of the business, and get debt under control. That includes 2 IPOs and a spin-off coming in the next few months.

“we expect to launch the proposed Solta IPO in December 2021 or January 2022. And then we expect to launch the Bausch & Lomb IPO approximately 30 days after the Solta IPO, subject again to market conditions and other necessary approvals. After that, the Bausch & Lomb spinoff for the remaining shares to existing Bausch shareholders can occur”

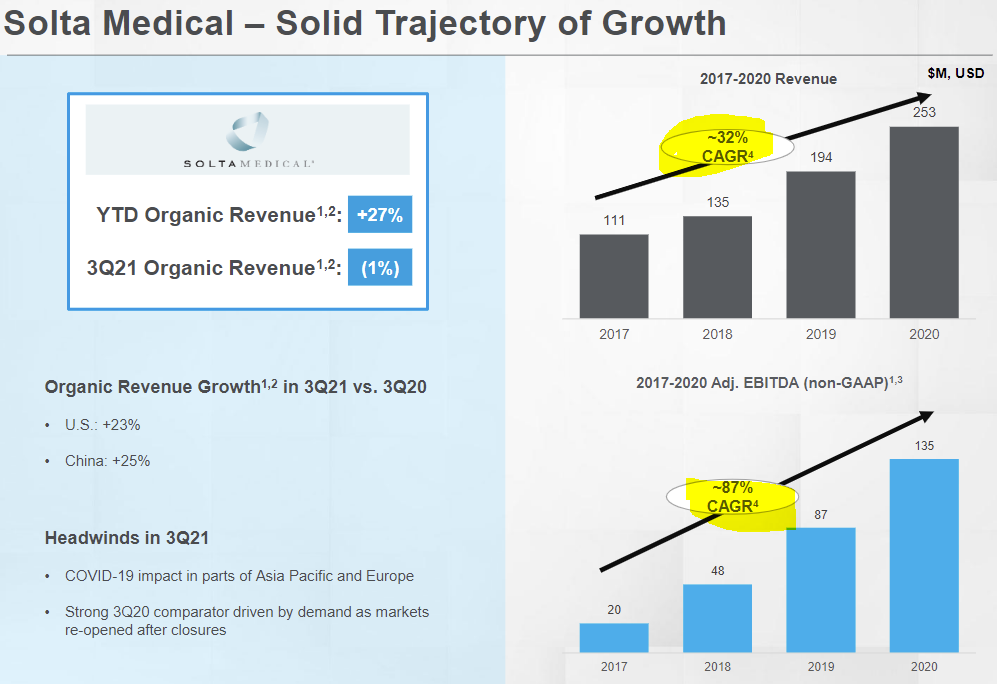

First is the Solta Medical aesthetics business (dermatology / liposuction) which is growing rapidly and very high margin.

Next is the Bausch + Lomb eye-care business… This is a $4.5bn+ revenue and $1.3bn EBITA segment.

For some back of the napkin math —

$BHC has 360m outstanding shares x $28/share = $10bn market cap. Net debt adds $22bn for an enterprise value of $32bn. Leverage is ~6.3x at $3.5bn EBITDA and EV/EBITDA is 9.1x.

Fast growing companies (30%+) in the drug, biotech, medical device space typically trade at 5-10x revenue which would put Solta at $1.3-2.5bn in value.

Bausch + Lomb peer Alcon ($ALC) is trading >5x sales which would mark B+L at a ~$22bn+ market value. The key question is how much will BHC IPO and how much will they spinoff to shareholders?

RemainCo (Salix and generics) is scheduled to have leverage of 6.5x EBITDA which looks like $2bn or so.

That last bullet implies the total divestiture proceeds should be $9bn or so which seems light if they were to IPO close to 50% of the B+L segment…

There’s a lot of change going on but plenty of catalysts! At the end of the day, BHC shareholders will get some portion of the B+L eye-care business and all of a highly levered RemainCo. It looks to me that RemainCo may have significantly lower leverage than management is indicating depending on the IPO valuations…