Quick Value 11.9.20 (CFX)

Colfax Corp (CFX)

Market Performance

Bask in an entire year’s worth of performance in one week!

Market Stats

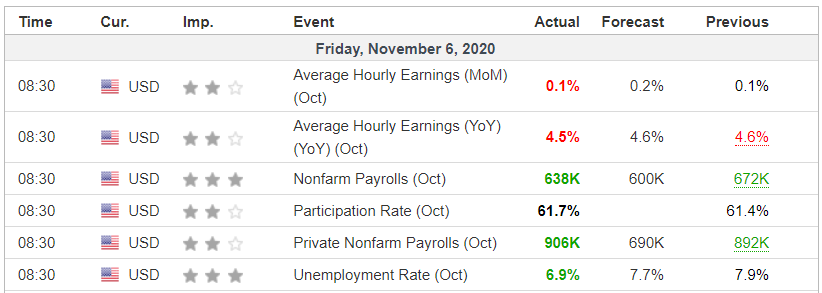

Jobs data showed another month of solid gains in employment. We’re now at a 6.9% unemployment rate which is the equivalent of mid-2013 in post-GFC terms…

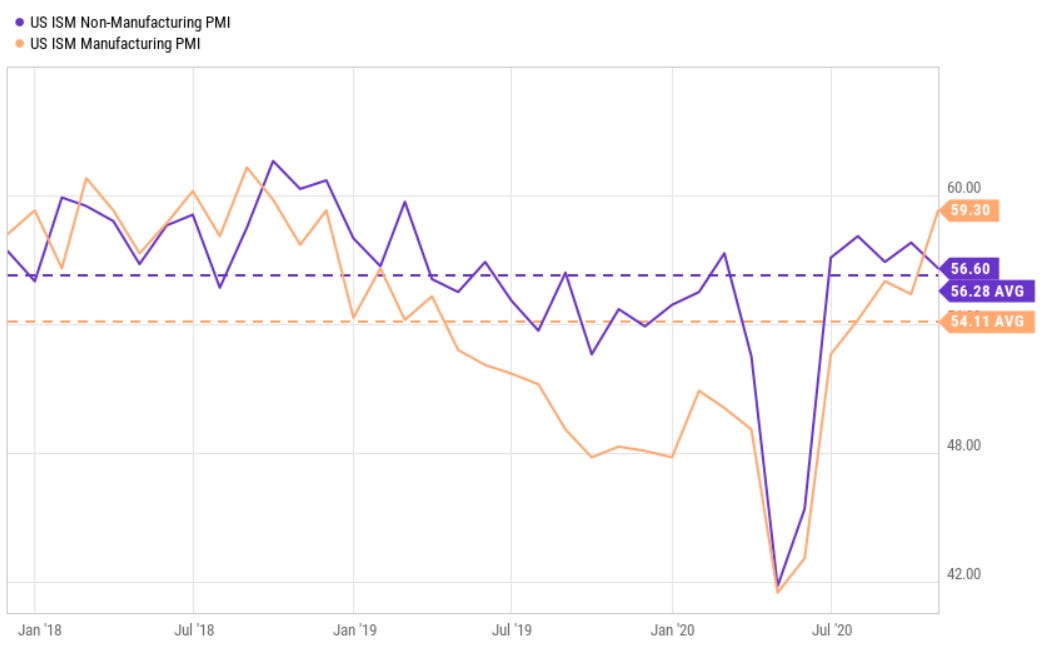

Industrial and services activity still looks promising with manufacturing and non-manufacturing PMI still above 3-year average levels… Manufacturing activity in particular seemed to accelerate a bit from September to October.

Quick Value

Colfax Corp (CFX)

This is the industrial business controlled by famed Danaher operators Steven and Mitchell Rales. The stock got very popular in 2013-2014 after some large acquisitions but has since fallen off the compounder bandwagon…

In 2012, Colfax bought Charter International for $2.4bn which got them into the fluid handling business. They later sold that business in 2017 and 2019 for ~$2.1bn. Then, in 2019, they acquired DJO Global for $3.2bn which completed the portfolio shift.

The 2 remaining business are likely less cyclical than before.

Fab Tech makes welding products — competes with Lincoln Electric and Illinois Tool Works

Med Tech makes orthopedic products — competes with Stryker and DePuy

Starting to resemble a prior day Danaher isn’t it?

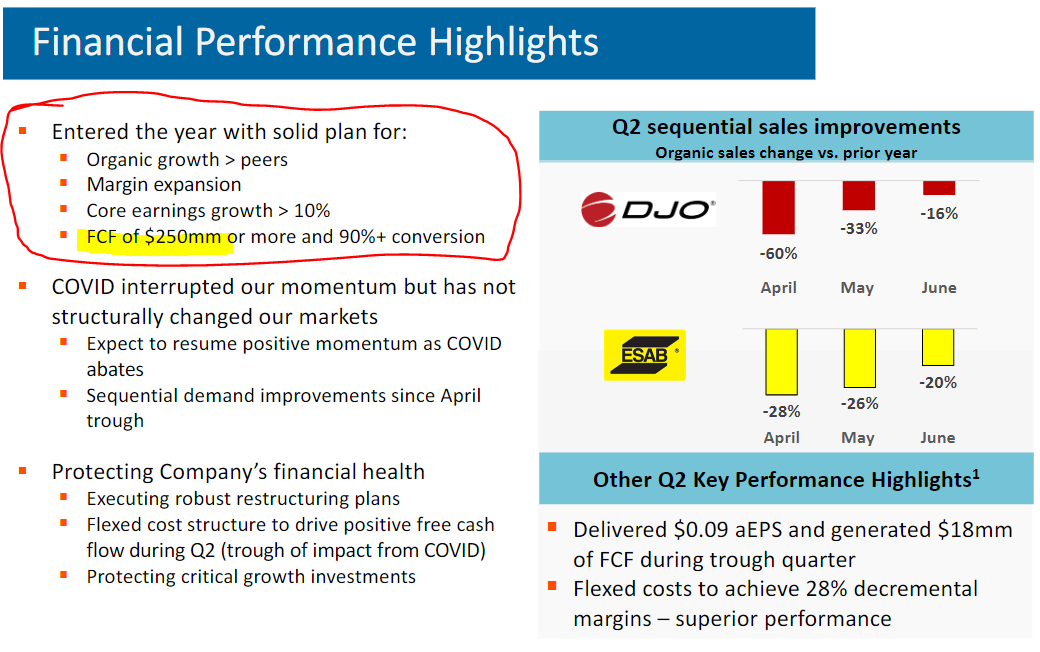

Like many other businesses, they started the year with reasonable goals including solid organic growth, improving margins, and $250m in FCF. This quickly turned to large revenue declines as elective surgeries were delayed and industrial activity slowed.

Colfax is a $3.6bn market cap at $30 per share with 120m shares outstanding. After the DJO acquisitions, they have $2.4bn in net debt. That’s a $6bn enterprise value.

Estimates call for $466m in 2020 EBITDA and $565m in 2021. Good for a 10-13x EBITDA multiple. If they can accomplish the $250m in FCF originally anticipated in 2020 that would be a 14.4x FCF multiple.

Colfax endured a rocky period from 2012-2017 following the Charter acquisition with revenue declines and no earnings improvement.

It appears they should have a better group of businesses today with good growth prospects but now they’re reeling from the COVID impact with Q3 revenue and earnings still declining from last year.

Time will tell if the new collection of businesses will prove out!