Market Performance

Small stocks continue their tear with Russell 2000 and Microcap indices up again last week.

Market Stats

Sharing some snippets from the Van Hoisington yearend 2020 letter…

Declining productivity of debt

No inflation worries

Bullish on treasuries

Quick Value

Berry Global ($BERY)

Continuing down the packaging line with Berry Global this week. Full disclosure — I own shares of Berry.

Berry Global (formerly known as Berry Plastics) makes a variety of plastic packaging items in consumer goods, food & beverage, and healthcare…

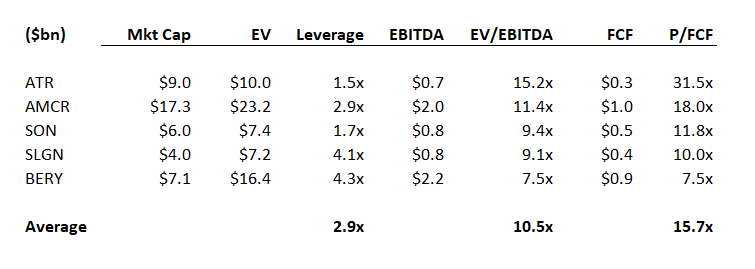

Here’s how Berry stacks up financially against others in the industry…

The quick synopsis is that Berry has operated akin to a levered private equity holding — using levered acquisitions to fuel growth. They’ve grown the overall business but mainly via acquisition.

And the recent ~$6bn acquisition of RPC Group in July 2019 has been no different… Adding plenty to free cash flow but also to debt.

Following the last major acquisition, Berry took a pause to pay down some debt and the stock responded well. They levered up again for the RPC deal and shares have wavered… Management anticipates hitting the 3.8-3.9x leverage target in 2021; the question is whether they intend to stay there or have another go at a major deal…