Quick Value 1.20.20

Macquarie Infrastructure Corp ($MIC)

Market Performance

[Index | Last week ==> This week | % change]

S&P 500 | 3265 ==> 3330 | +2%

Dow Jones | 28824 ==> 29348 | +1.8%

Russell 2000 | 1658 ==> 1700 | +2.5%

Russell Microcap | 615 ==> 630 | +2.4%

10-Year | 1.82% ==> 1.82% | unch

Gold | 1560 ==> 1560 | unch

Oil | 59 ==> 59 | unch

VIX | 13 ==> 12 | -7.7%

Market Stats

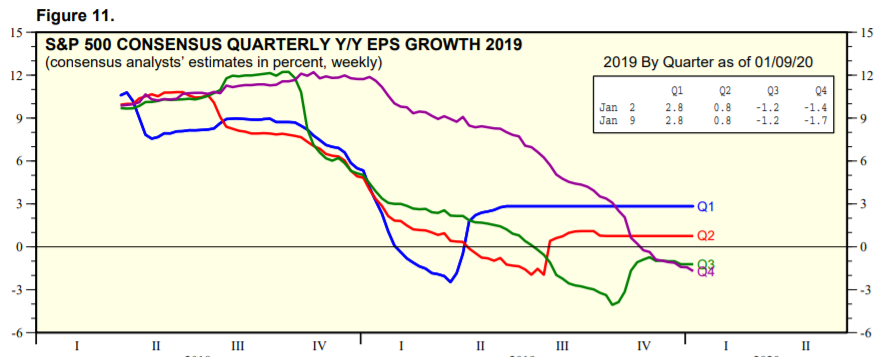

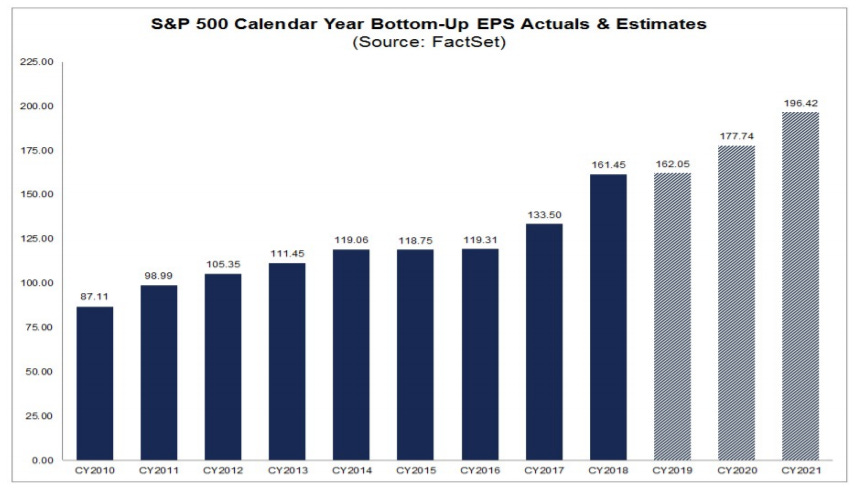

Market fundamentals… Q4 2019 earnings are expected to decline and the estimates for 2020 market earnings (as of right now) indicate a +10% earnings growth year. And another 10% earnings growth in 2021.

I’d love to know where this growth is going to come from…

S&P 500 earnings grew 6% per year from 2011 to 2019 (est.) — $99/sh to $162/sh. This time period included QE and tax cuts… Just my opinion on the skepticism behind 2020 and 2021 earnings growth estimates at 10% each year…

Quick Value

Macquarie Infrastructure Corp ($MIC)

I like a good dividend stock. I understand the logic behind stock buybacks over dividends from a tax perspective but I feel that most boards and management teams are flat out wrong when it comes to buying back their stock. Instead, I’d prefer to see more variable payout ratios based on cash generation.

For a good read on dividend investing, check out The Single Best Investment by Lowell Miller.

Macquarie is a $45 stock / $4bn market cap that has gone nowhere since late 2012 (surprise!).

In 2018, the dividend was cut from $5.76 per share to $4 per share (8.8% yield today) and the stock responded by falling from the mid-60’s to ~$40 per share. The dividend cut was a good move to get debt in a reasonable spot.

First, the bad:

Cash flow has been dropping — peaked at ~$560m in 2016 / ~$460m today

Debt is still pretty high at $2.7bn (5.9x debt to cash flow)

MIC is externally managed by Macquarie and the terms aren’t super favorable — worth reviewing

Then, the good:

MIC owns some pretty good businesses — petroleum storage, aviation fuel and services, processing and distribution of gas in Hawaii.

Company is considering selling off some/all assets

Committed to reducing debt

Dividend looks reasonably well covered (for now)

This is one of those stocks that could potentially go nowhere for another few years but provide a decent overall return. With some optionality if the company were to sell itself…