Quick Value 12.13.21 ($AXL)

American Axle ($AXL) - 4.4x EBITDA / 2.8x leverage making axles for GM!

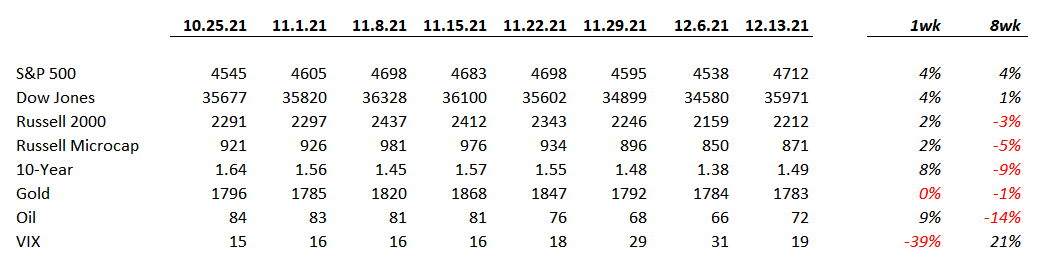

Market Performance

Market Stats

Jobless claims hit their lowest level since the 1960’s… (link to tweet)

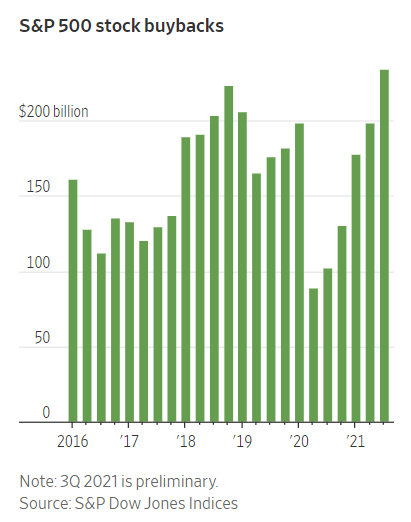

Buybacks are back to record levels per a recent WSJ article… Not surprising given the level of stimulus and liquidity in the market. Also not surprising that buybacks plummet at valuation lows and peak at valuation highs…

Quick Value

American Axle & Manufacturing ($AXL)

AXL is an automotive supplier (mostly to GM) making drivelines and some other components. The automotive sector is interesting given the challenges they have (and continue) to face ranging from plant shutdowns, chip shortages, and the shift to electrification…

From the latest 10-K… Here’s how they describe their business:

Narrative Description of Business

Company Overview

We are a global Tier 1 supplier to the automotive industry. We design, engineer and manufacture driveline and metal forming products that are making the next generation of vehicles smarter, lighter, safer and more efficient. We employ approximately 20,000 associates, operating at nearly 80 facilities in 17 countries, to support our customers on global and regional platforms with a focus on operational excellence, quality and technology leadership.

Major Customers

We are a primary supplier of driveline components to General Motors Company (GM) for its full-size rear-wheel drive (RWD) light trucks, sport utility vehicles (SUV), and crossover vehicles manufactured in North America, supplying a significant portion of GM's rear axle and four-wheel drive and all-wheel drive (4WD/AWD) axle requirements for these vehicle platforms. We also supply GM with various products from our Metal Forming segment. Sales to GM were approximately 39% of our consolidated net sales in 2020, 37% in 2019, and 41% in 2018.

We also supply driveline system products to FCA US LLC (FCA, now part of Stellantis N.V. effective January 2021) for programs including the heavy-duty Ram full-size pickup trucks and its derivatives, the AWD Chrysler Pacifica and the AWD Jeep Cherokee. In addition, we sell various products to FCA from our Metal Forming segment. Sales to FCA were approximately 19% of our consolidated net sales in 2020, 17% in 2019 and 13% in 2018.

We are also a supplier to Ford Motor Company (Ford) for driveline system products on certain vehicle programs including the Ford Edge, Ford Escape, Lincoln Nautilus, and we sell various products to Ford from our Metal Forming segment. Sales to Ford were approximately 12% of our consolidated net sales in 2020, 9% in of 2019 and 8% in 2018.

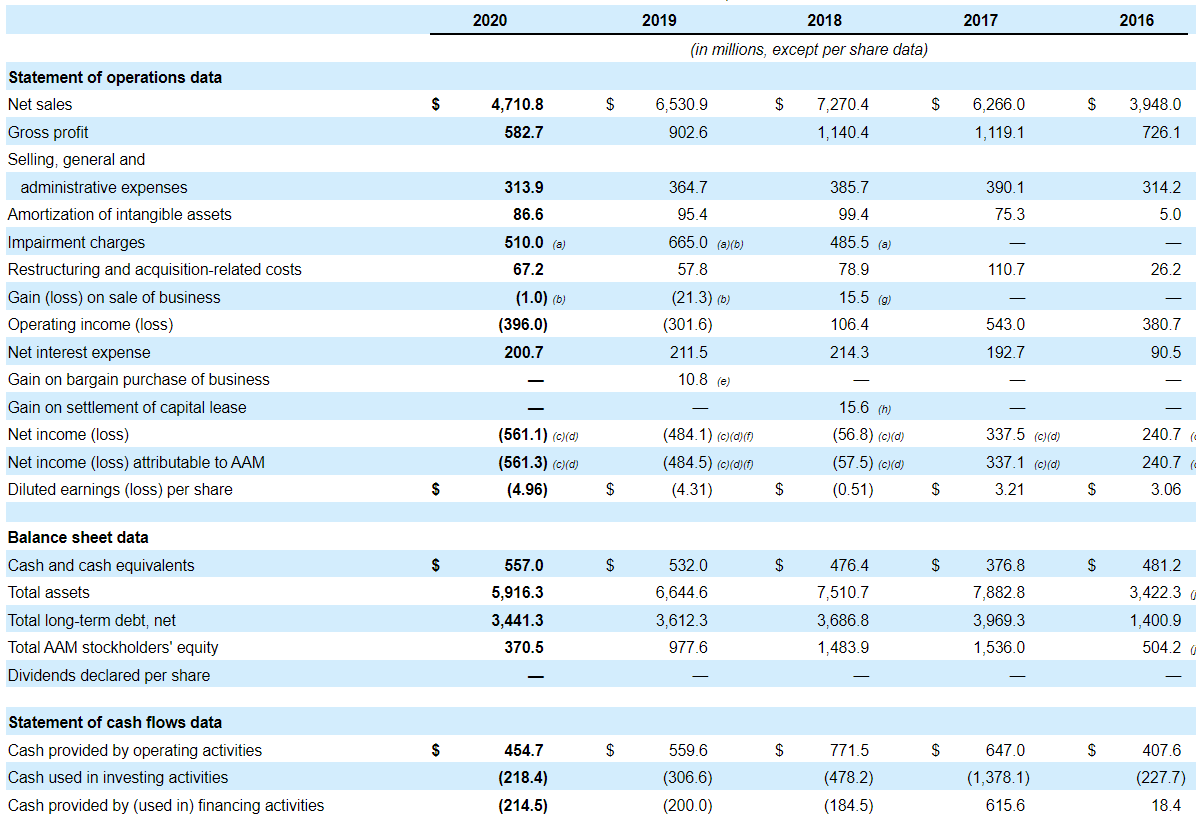

Here’s the financial highlights from 2016-2020… A few quick comments:

AXL spent $3.2bn on an acquisition in 2017

Revenue was choppy from 2017-2019, then fell in 2020 from the pandemic and 2021 guidance calls for a 10% rebound to $5.2bn

2020 was heavily impacted by COVID / automotive plant shutdowns / chip shortages

Customer concentration is high with GM, Fiat, Ford making up ~70% of total revenue

Uses for cash other than debt repayment have been limited

More than anything, shortages and plant shutdowns are having a huge impact on revenue and margins… taking an $83m bite out of Q3 2021 EBITDA alone! Despite the continued challenges, full year EBITDA is set to rebound from $720m in 2020 to $840m in 2021.

Debt continues to be a focus for AXL with gross debt down to $3.1bn as of Q3. Down from $3.6bn at the beginning of 2020… Management is targeting 2x net leverage vs. 2.8x today.

I haven’t yet discussed the shift to electric vehicles and the impact on valuations. AXL is very much a non-EV company today. Their main programs run at least through the end of the decade which gives them cash flow visibility through that period. Like competitors, they’ll have to make some changes to improve that EV mix over time.

Beyond the key question of how AXL fits into an electric vehicle future, investors are focused on what’s happening in the auto production schedule and CFO Chris May mentioned in a recent investor presentation that uncertainty could stretch into 2023…

“our view is this issue will be with us for an extended period of time. Hopefully, it continues to get sequentially better, but we continue to see this issue dragging deep into 2022, possibly early 2023.”

AXL has about 115m shares outstanding ($1.1bn market cap) and net debt of $2.6bn for an enterprise value of $3.7bn. Guidance is calling for $840m in 2021 EBITDA — a 4.4x EBITDA multiple. And free cash flow is typically around 50% of EBITDA.

That would mean another 2 years or so to reach management’s goal of 2x leverage (i.e. $1.7bn in net debt), assuming no growth in EBITDA. Bear in mind, 2018 and 2019 (pre-pandemic) EBITDA was $1.18bn and $970m respectively. That would change the picture pretty significantly in deploying capital sooner…