Quick Value 12.14.20 ($GRA)

WR Grace ($GRA) -- Rejects $60 buyout offer as too low...

Market Performance

Market Stats

Jobless claims last week were quite a bit higher than anticipated… We’re at the point where improvements in the labor market are starting to slow.

Initial jobless claims have leveled out and recently started turning higher while continuing jobless claims recently turned higher.

Quick Value

WR Grace ($GRA)

Shares are up a bunch since the early COVID lows but this has still underperformed the overall market for several years…

Back in November, 15% shareholder 40 North Management made an offer to buy Grace for $60 per share which was immediately rejected by the Board:

Given the Company’s strong prospects and its ongoing review of the alternative opportunities available, Grace’s Board of Directors unanimously believes that 40 North’s $60 per share proposal significantly undervalues the Company and is not a basis for further discussion.

Sure, the offer was a huge premium to the depressed prices from earlier this year but this has been a $60-70 stock for years. Maybe Grace is onto something here…

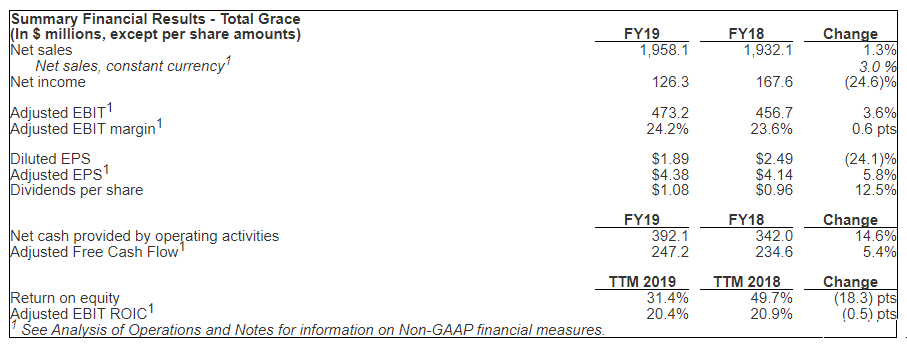

Even after the run-up from the offer announcement, at $55 per share it’s a $3.6bn market cap with ~$250m in adjusted free cash flow for a 14.4x multiple on 2019 results.

Over the past 4.5 years, Grace generated $1.3bn in free cash flow (on the $3.6bn market cap that’s 36%). They spend most of it ($1.1bn) on acquisitions and the next big chunk ($1.1bn) on buybacks and dividends. A pretty balanced capital allocation framework.

Grace is a specialty chemical company with strong ties to serving the petrochemical industry (an industry that is rapidly adding capacity by the way). EBITDA margins are >20% and they hold #1 or #2 positions in most product lines served.

Here’s a quick overview:

It’s a high margin business but fundamentals have been stuck in a rut for a while now. Maybe going private is the best path for Grace to turn things around. Looks like a potentially interesting setup for some fundamental improvement with the chance for a takeout…