Quick Value 12.19.22 ($MBC)

Housing spin off at 6.6x EBITDA

As a regular reminder about this newsletter… “Quick Value” looks at a new stock every week (usually a random selection from my ever increasing watchlist); it’s meant to be a jumping off point for further analysis (i.e. idea generation). This is just a surface level look at what’s going on.

Posts rotate between free and paid subscribers. Free subscribers are getting 2x per month. This week is a free post. I highly recommend checking out the paid subscription. Lots of interesting coverage recently and coming soon…

Market Performance

Market Stats

Housing starts and existing home sales are slowing

Housing affordability is hitting new lows (no surprise given interest rates)

Quick Value

MasterBrand ($MBC)

MasterBrand (MBC) was very recently spun off from housing-related conglomerate Fortune Brands (was FBHS, new ticker is FBIN). I was late in reviewing this Form 10 filing so today’s post will comb through that document along with their investor day presentation.

What they do…

Simply stated, MBC is a US-based cabinet manufacturer with a handful of brands. Sales are mostly through dealers, retailers like Home Depot / Lowes, and directly to homebuilders. Management estimates industry sales are split 1/3 toward new construction and 2/3 toward repairs and remodels (R&R).

As you could imagine, these various brands cater to different markets with varying price points and inventory levels.

Here’s a look at the “Cabinets” segment revenue and operating income as part of pre-spin Fortune Brands dating back to 2012. (Note: I don’t know if this is fully representative of the post-spin cabinet co.)

Why it’s interesting…

1) Growth and high margins — Sales are up a ton since 2019 from the hyperactive housing markets and loose money. Management has set long-term financial targets at 4-6% revenue growth and 16-18% EBITDA margins (from 13% today).

These are cyclical businesses but should grow with the overall housing market long-term and the consolidated nature of the industry means top players such as MBC should continue to generate good margins.

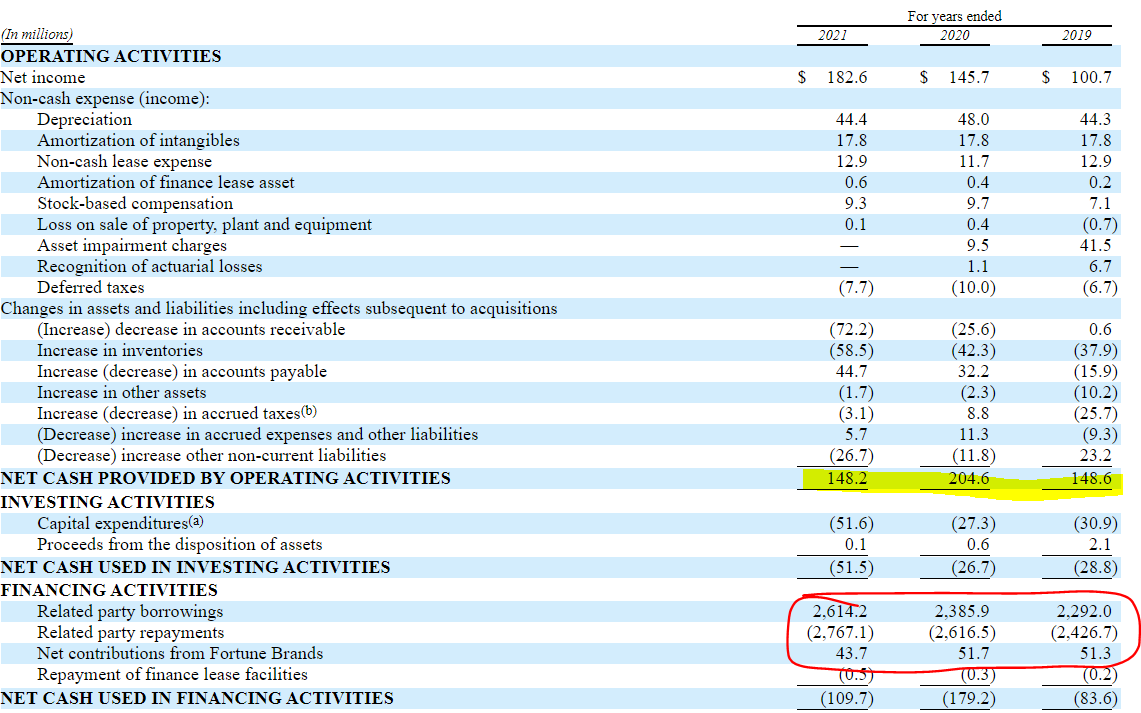

2) Cash flow — Whenever looking at pre-spin documents, I like to see the raw cash flow statement and the interactions between SpinCo/RemainCo. In this case, MBC generated a healthy level of FCF and sent virtually all of that money back to Fortune Brands each year.

Working capital has been a huge drag in every period from 2019-3Q22. This should reverse in 2023 based on initial comments from management.

The cash flow statement above doesn’t reflect additional corporate costs and interest expense from the spin. Taking those into consideration and excluding the working capital outflows, operating cash flow would have been ~$152m in 2021 and ~$100m in FCF.

3) Valuation — MBC has a market cap of ~$1.2bn and $930m or so in net debt for a $2.1bn enterprise value. EBITDA guidance for 2022 is $415m (5.1x multiple) but management anticipates a slowdown in 2023. Sales expected to be down close to 10%, margins will be lower, capex should be level, and cash flow should jump.

A 10% drop from 2022 sales and 25% drop in margins would mean 2023 looks a lot like 2021 — $2.9bn sales and $320m EBITDA. And if working capital was similar to what AMWD experienced in 2007-2010 then it wouldn’t be a stretch to see $200m or more in 2023 FCF. That would clean up the balance sheet quite a bit and setup the company for 2024.

I wasn’t able to find a ton of information on past deal multiples but for reference: AMWD bought RSI for nearly 2x sales back in 2017-2018 and MAS sold their cabinets business to PE for 1x sales in 2019. A 1x sales multiple would value MBC at $15/share using 2023 guidance.

It would be hard to own a stock like this without an opinion on where housing markets are headed… it seems worth a follow and maybe would be interesting to track some cyclicals/housing stocks that might experience big cash windfalls next year from working capital reversals…