Quick Value 12.20.21 ($CEG)

Constellation Energy Group ($CEG) -- Upcoming merchant power spin from Exelon Corp

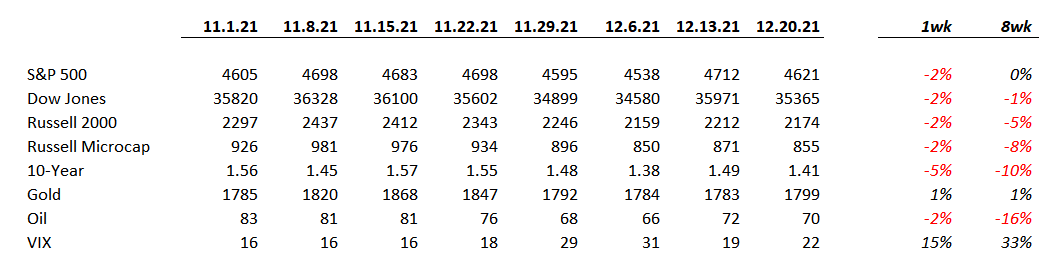

Market Performance

Market Stats

Retail sales grew 0.3% from Oct to Nov but jumped 18% from last year… Headlines will say that spending slowed but make no mistake, consumer spend is quite strong…

E-commerce growth is slowing which may not be all that surprising given the lapping of COVID sales figures… it could be 2nd Q of 2022 until we see a clear picture of “normal” e-commerce trends

Housing starts and permits continue to creep higher… Permits in particular are flattening-inflecting after an earlier spike…

Quick Value

Constellation Energy Group ($CEG)

Maybe this one is a bit of a cheat since shares aren’t yet publicly traded. Exelon Corp ($EXC) announced back in Feb 2021 that they’d split their regulated utility business from the competitive generation business.

Constellation Energy (the SpinCo) will be the competitive generation business. I’ve followed competitors NRG and Vistra closely so this has been on my to-do list for a while now. With the Form 10 filed, it felt like a good reason to dig in…

CEG supplies electricity and natural gas to residential and business customers throughout the US. They operate in competitive markets where customers have a choice as to who they buy from (this has led to volatile earnings and low valuations for these businesses). Like their competitors, CEG owns and operates their own portfolio of power plants.

Where CEG differs from NRG/Vistra is the progress they’ve made on getting away from fossil fuels — roughly 65% of 2020 power supply came from nuclear/renewable sources.

With the heavy nuclear mix, SpinCo is playing to the clean energy crowd. And frankly it makes the future cash flows of the company a bit less risky to navigate the timing / uncertainty of retiring coal and gas plants…

Constellation will become the 2nd largest competitive generation business following the spin-off. And the largest player with business customers and #3 behind NRG/Vistra in residential customers. Also important to note that Constellation generates more power than is consumed by their business/residential customers in a year, meaning they sell the excess power into the open market, this is typically seen as more volatile than the consumer side of the business, as it’s dependent on market prices for power / commodities.

As of 3Q21, the SpinCo filings indicate $7.2bn in debt and $3.4bn in cash pro-forma. It also looks like SpinCo will be taking the full balance of asset retirement obligations totaling nearly $15bn (for the nuclear facilities). There’s another $15bn in decommissioning assets to fund these obligations (similar to the way pension assets/obligations work).

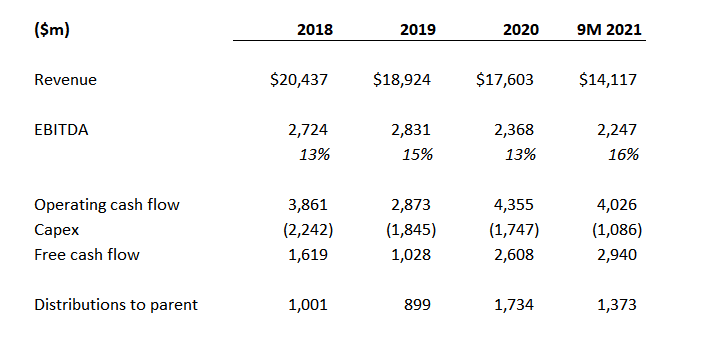

Free cash flow looks like $2.5bn+ per year and EBITDA likely north of $3bn per year (figures below don’t add-back asset impairment charges over the years). Since 2018, CEG sent $5bn in distributions back to parent Exelon, that’s about $1.25bn per year.

The final capital structure hasn’t been set and capital allocation priorities are yet to be announced. Management plans to hold an Analyst Day outlining the company’s plans in more detail closer to the time of the spin.

Competitors are trading at cheap valuations and yet Constellation looks like it will have the cleanest balance sheet in the industry with the most progress on clean/renewable generation sources… Could make for an interesting opportunity if shares trade in-line with the industry at the time of the spin…