Quick Value 12.21.20 ($NOC)

Northrop Grumman Corp ($NOC)

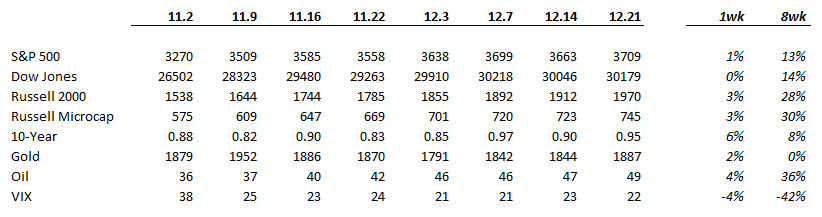

Market Performance

Market Stats

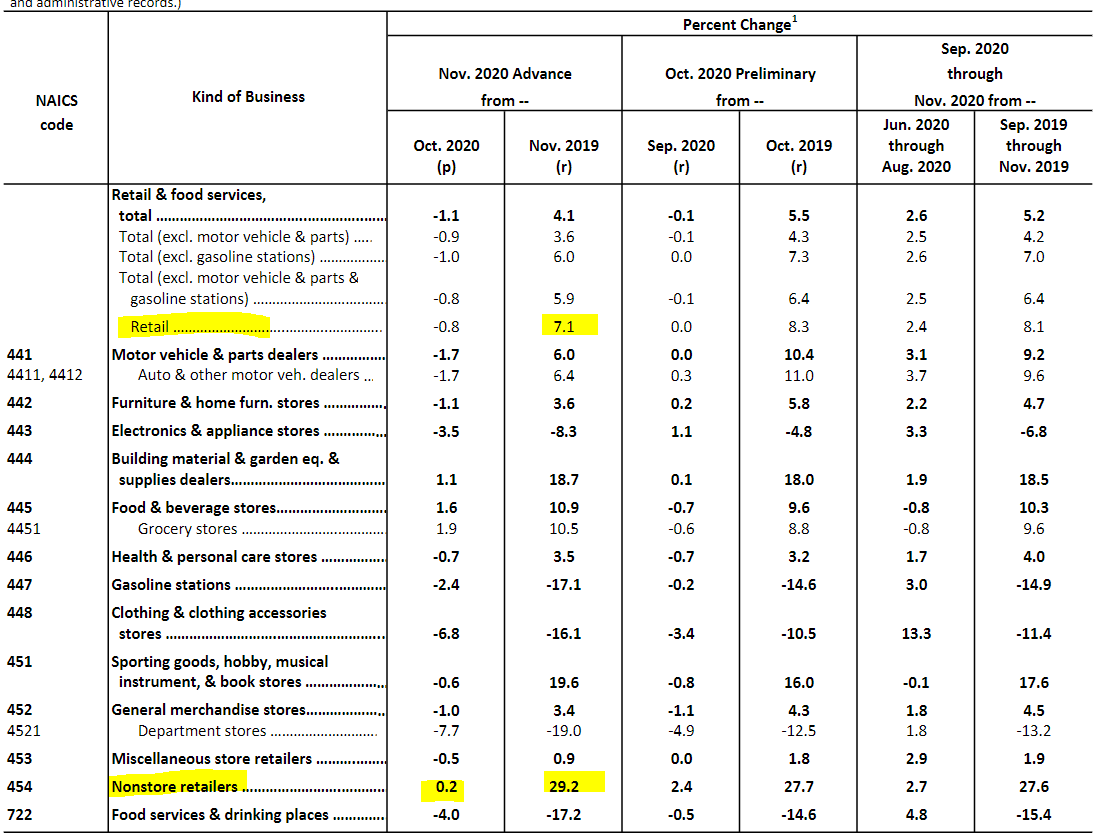

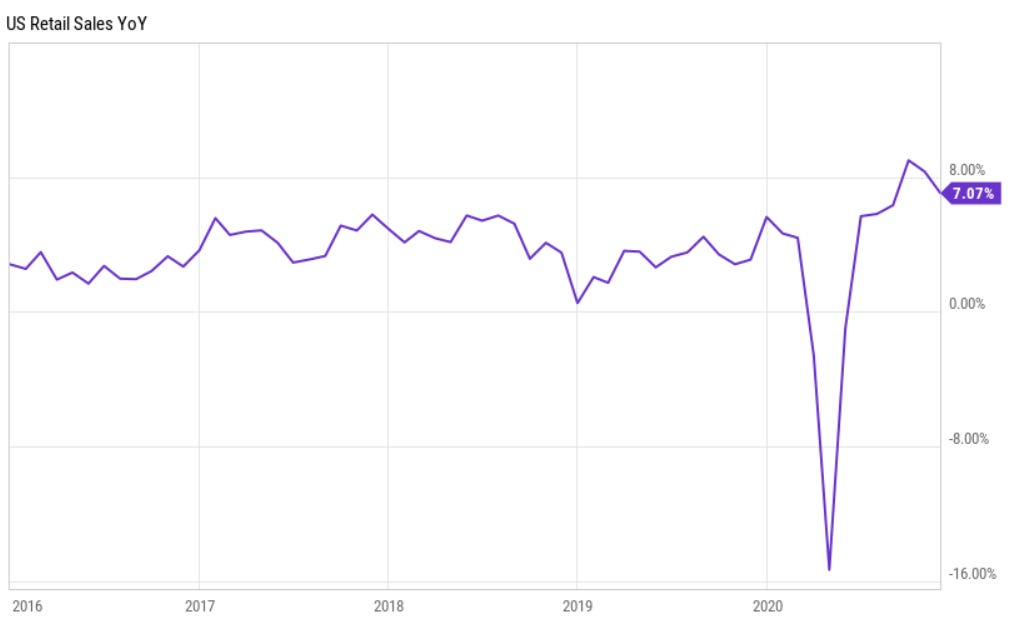

Retail sales grew 7% in November from last year.

Year-over-year growth in retail sales is still much higher than past years — indicating continued strength in consumer spending.

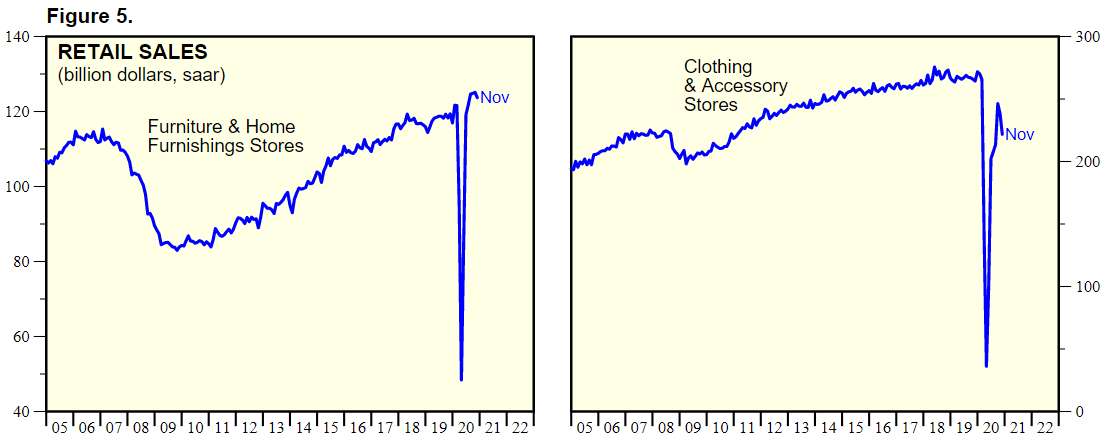

Certain sectors in retail spending are performing better than others. Some are accelerating (building materials) and others are seeing accelerating downward trends like electronics and department stores.

Quick Value

Northrop Grumman ($NOC)

This stock has underperformed the S&P 500 over the past 5 years which makes it an interesting candidate to dig further.

Northrop is an aerospace, defense, and space company that has grown by acquisition over the years and exited a few businesses along the way. They spun off the shipbuilding division (Huntington Ingalls) in 2011 and acquired a leading space systems company (Orbital ATK) in 2018. Now they’re looking to sell their IT services division in a $3.4bn sale.

They make and sell military products like missiles, ammunition, fighter jets, satellites, radar equipment, and all sorts of other military components and electronics.

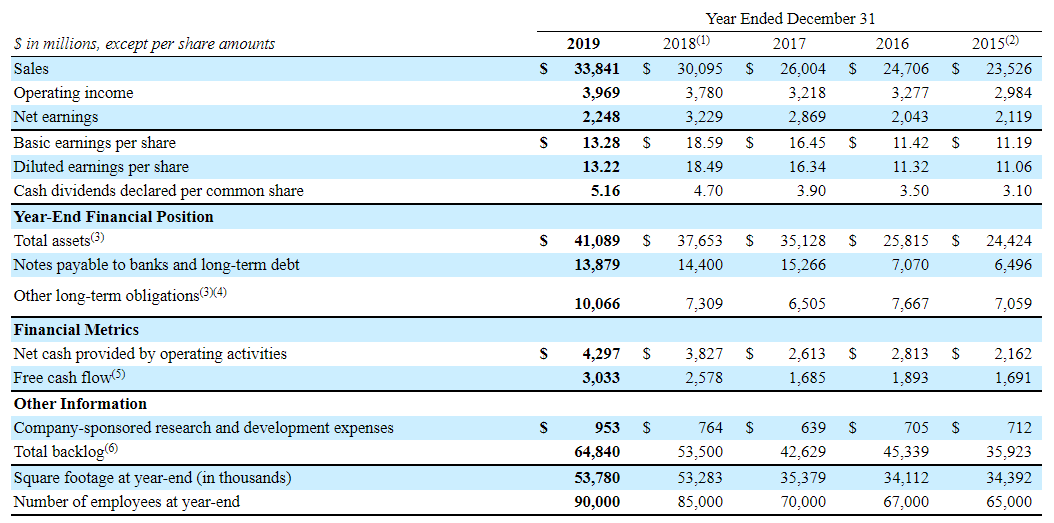

Despite the market underperformance, Northrop has delivered solid fundamentals.

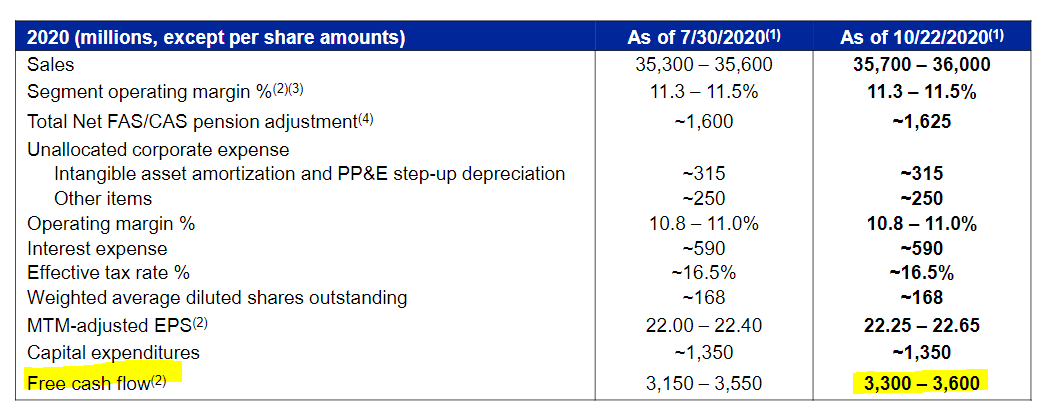

Guidance calls for revenue and earnings growth plus another year of good cash generation.

There are 167m shares outstanding x $300 share price = $50bn market cap. Net debt is $10bn and they should net $3bn or so in proceeds from the sale of the IT division for a $57bn enterprise value. At today’s price, it’s about 14x FCF and 13x earnings — pretty reasonable considering the growth they’ve seen.

After the sale of IT services, leverage should be ~1.5x or less, giving them plenty of room to spend more than 100% of FCF on buybacks or acquisitions over the next few years.

The setup looks pretty favorable compared to other large defense players Lockheed ($LMT) and General Dynamics ($GD) which trade at 16x FCF with similar levels of debt to EBITDA ($GD slightly higher than 2x).

How have they been allocating capital?

Since 2017, Northrop produced $13.5bn in operating cash. Capex was $4.3bn so $9.2bn in cumulative free cash flow on a $50bn market cap. They spent $7.7bn to acquire Orbital ATK in 2018 which was the only acquisition during the ~3.5 year period. Dividends and buybacks were $6bn. The difference came from net borrowings.

They’ll have an extra slug of cash too. Management called out reducing debt and resuming buybacks as 2 focal points for 2021.