Quick Value 12.27.21 ($NVS)

Novartis ($NVS) - Asset sale, buyback, strategic review on the horizon...

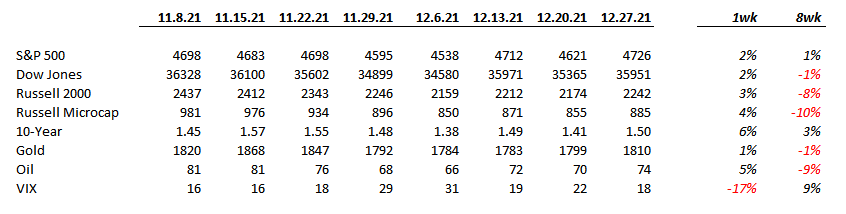

Market Performance

Market Stats

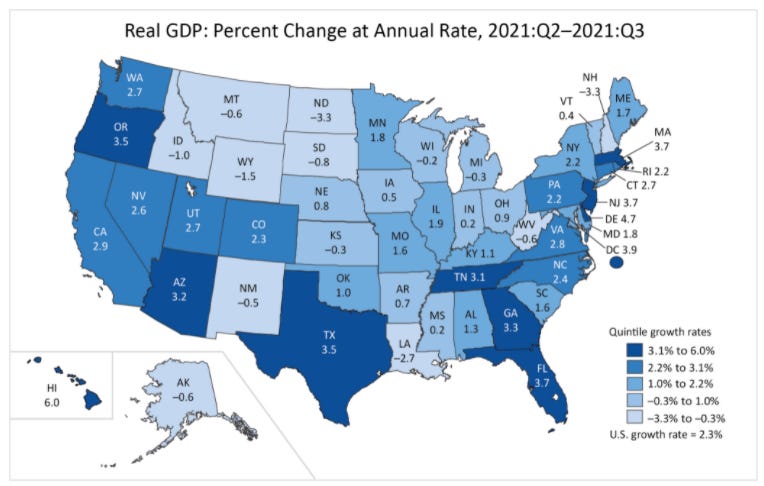

GDP grew an annualized 2.3% in 3Q21… and 37 states saw GDP growth during Q3.

Consumer confidence came in nearly 5pts better than expectations at 115.8 but remains well below pre-pandemic highs…

Quick Value

Novartis ($NVS)

Novartis is a global health care and pharmaceutical company with a $193bn market cap.

The stock caught my eye following a few significant announcements lately:

Sold $20bn worth of Roche shares at ~17x earnings

Initiated $15bn stock buyback (at ~13x earnings)

That’s a lot of activity for the 4th quarter!

What about the underlying business at Novartis?

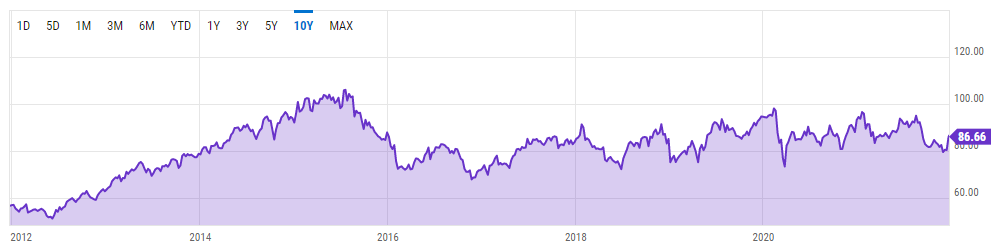

The cash flow statement speaks volumes to why the share price hasn’t done much of anything since 2014… From 2013-2020, NVS generated a cumulative $89bn in free cash flow — They spent $46bn on acquisitions, $25bn on stock buybacks, and $53bn on dividends.

Despite that, operating cash flow hasn’t really grown in those 8 years…

This isn’t totally fair since Novartis spun off the Alcon eye-care business to shareholders which is now a $40bn+ separate company. But as far as the core business is concerned, it seems like investors are waiting for things to turn the corner.

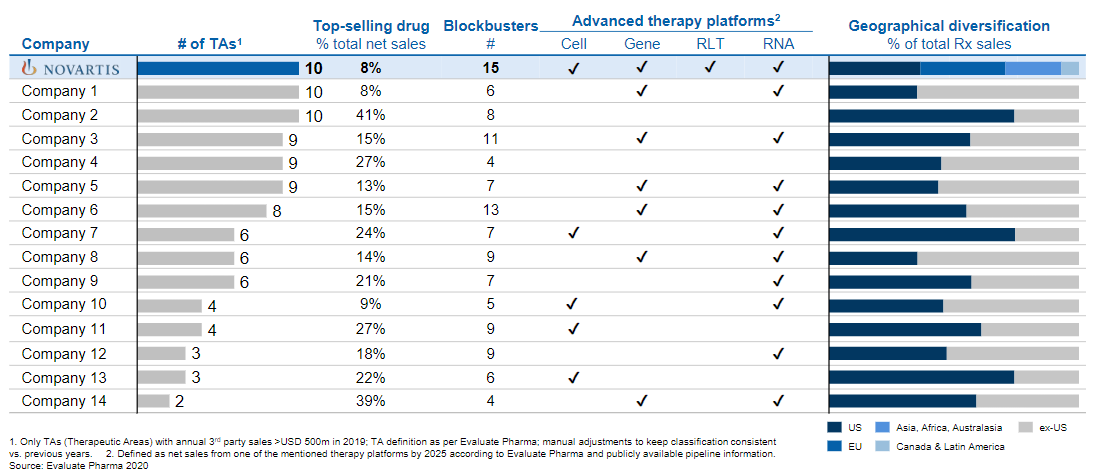

One challenge with pharma companies is the constant need to replenish the pipeline with new “blockbuster” drugs that can produce large and long-tail sales. The flip side to that is replacing those blockbusters when patents expire… This chart is a bit old (from Jan 2020) but highlights the low dependency on a single drug and the large number of therapeutic areas that Novartis serves:

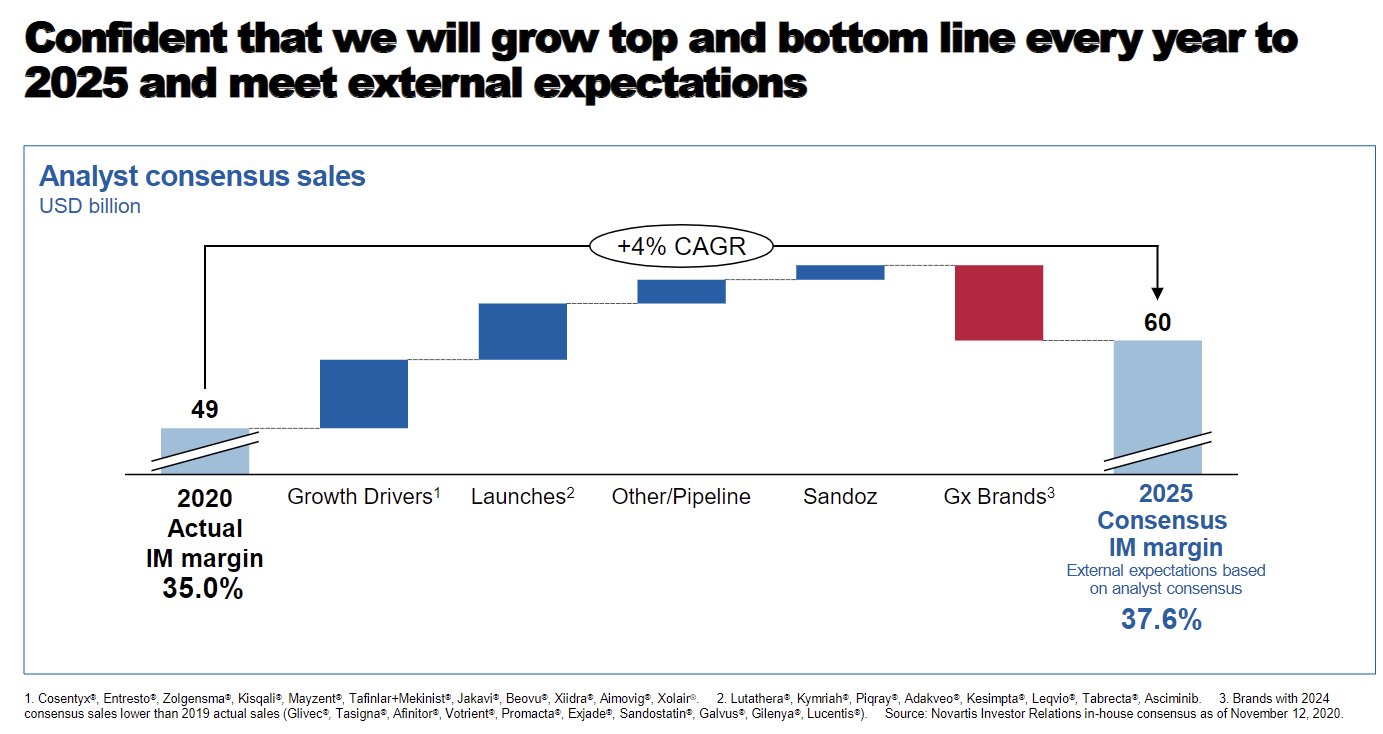

None of Novartis’ top 3 drugs (~24% of pharma sales) have patents expiring in the next 5-6 years… Management is confident the business should produce 4% top-line growth and that could be a bit higher if they dump the slower growing Sandoz generics business.

Looks like an interesting setup with a large buyback on the horizon, a potential sale/spin of slower growing generics business, and a reasonable growth outlook for the next 5-6 years…