Quick Value 12.27.22 ($RICK)

RCI Hospitality - truly amazing fundamental picture

A little late this week (after a brutal family stomach bug made the rounds) but we’re back on track now… Final Quick Value of the year ought to be available to everyone, especially being so tardy… enjoy!

Don’t forget to subscribe to the premium newsletter if you haven’t already, discounted pricing set to lapse here soon:

Market Performance

Market Stats

Consumer confidence has been rebounding lately and last week’s reading came in at 108 vs. analyst expectations of 101

Personal income & savings data came out lately and wages are still growing while savings are shrinking (lowest levels in decade+). Can’t forget all that stimulus which on a TTM basis makes the savings levels look a lot more reasonable…

Quick Value

RCI Hospitality Holdings ($RICK)

I can’t get away from all the talk about RICK and then saw this tweet from their CEO asking what an appropriate multiple for the stock should be… so why not make this the last Quick Value of the year…

What they do…

RICK is an operator of nightclubs and restaurants (a spin on the Hooters concept). As of 9/30/22, they operated 54 nightclubs and 12 restaurants (one franchised location and 11 company-owned).

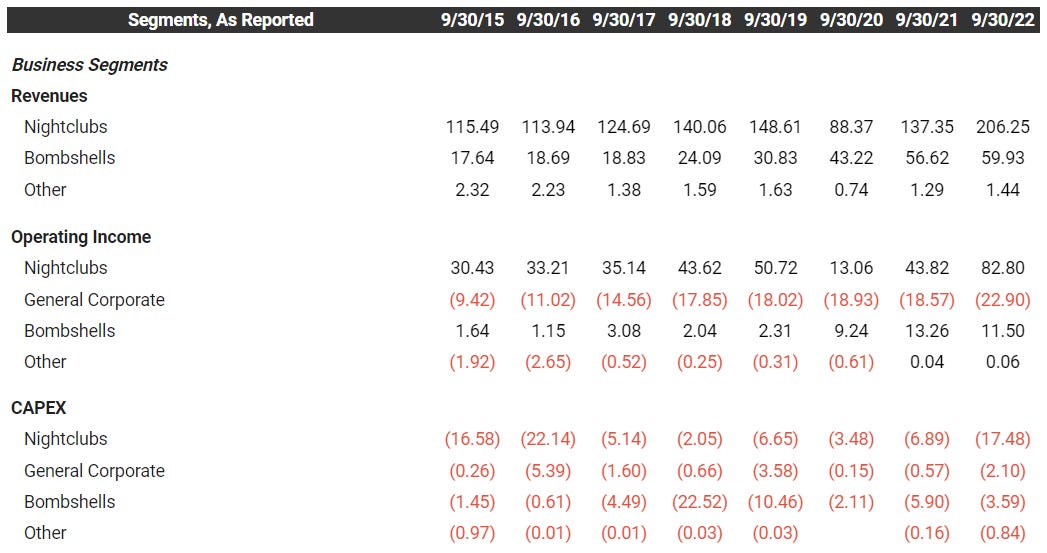

Both of these segments have seen good growth but the restaurant concept (known as Bombshells) has seen a tad higher revenue and EBIT growth over the past 8 years.

Why it’s interesting…

1) Solid fundamentals — On the surface, RICK checks a ton of boxes on what good fundamentals should look like…

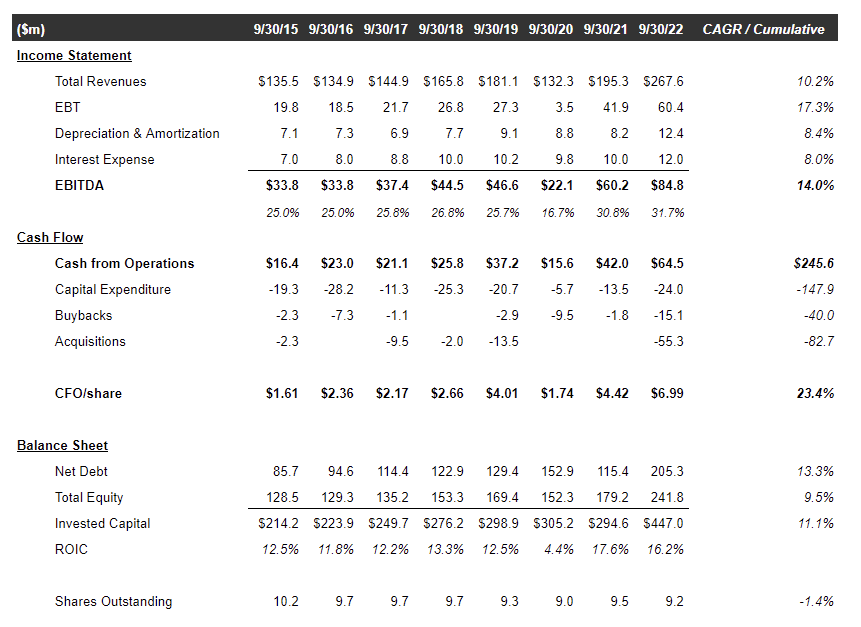

Double digit revenue growth and EBITDA growth since 2015

Margins expanding from 25% to ~32%

Cash flow growth at/above earnings growth

Share count declining

ROIC expanding

Leverage neutral (debt to equity and leverage ratio)

Equity and book value per share growing

Capital allocation a healthy mix of capex, buybacks, and M&A

I’m a sucker for free cash flow and RICK doesn’t have a lot of it. Mainly as they’ve been investing in new locations, remodels, etc. So far, all of that spend has panned out into more revenue. I’d focus on operating cash flow since capex is probably highly skewed toward “growth” investments; it’s unclear what a maintenance level capex number might be (though perhaps pandemic year 2020 might be a good proxy).

2) Growth — Aside from the organic growth at both nightclubs and bombshells, RICK seems to be making a splash with some larger acquisitions lately… starting with the $88m purchase of 11 clubs in FY22 and now another $66.5m acquisition announced in December 2022. The first acquisition added ~$14m in EBITDA and the latter another $11m.

Acquisition multiples look great with recent deals at 6x EBITDA or less vs. RICK at ~11x. And the combination of cash + seller financing + equity is making these super accretive right out of the gate.

I don’t have a great sense for the size of the “adult entertainment” industry or the strip club market; but a quick search online suggests maybe ~4k total US strip club locations… meaning RICK is still a small player in the space (i.e. plenty of runway for growth and acquisition).

3) Valuation — I see many of the comments in the tweet thread above mentioning 25-30x “multiples” (could be earnings, FCF, whatever) and that seems a bit rich even for a fast growing company like this.

Over the past 5 years, RICK has averaged a 9.3x EBITDA multiple and a 2.4x EV/sales multiple. The stock is a notch above those averages right now… but why shouldn’t it be with the added growth?

I don’t know that I have a good sense for what a “fair” multiple is — there aren’t many comps, let alone many with the same 8-year revenue/EBITDA growth profile. I do know that >10x EBITDA (and definitely 25-30x earnings/FCF) is getting into loftier expectations territory and while it looks like they have a good model and outlook, the treadmill starts running a bit faster once you pay those premium multiples…

This one’s going to the watchlist for now…