Quick Value 12.28.20 ($PRSP)

Perspecta Inc ($PRSP) -- underperforming IT services spin-off...

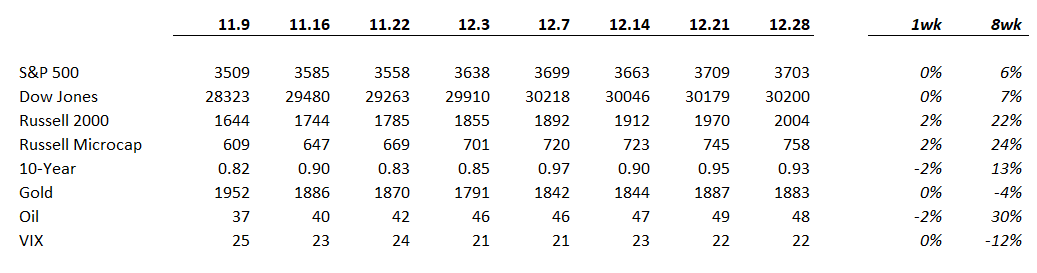

Market Performance

Market Stats

Wages continue to grow! Significantly off the lows of March / April and still higher relative to any point in 2019. Consumers still looking just fine and potentially set to get another bonus with more stimulus…

An interview with Neel Kashkari in the recent Barron’s issue highlighted this “unexpected” consequence of increased savings…

You’ve said you weren’t concerned about rising government debt caused by the pandemic. Why not?

The U.S. government has extraordinary debt capacity. We have the capacity to support our fellow Americans, individuals and small and midsize businesses, until we get this pandemic behind us. That’s different than saying, “Hey, I’m going to have unlimited government spending forever.” No. 1, this is a wartime investment we’re making. No. 2, something curious happened when the pandemic hit: The savings rate took off.

Let’s say there are two sectors of the economy: the one where you and I work, and the restaurant sector, which shut down. We used to support the workers in the restaurant sector by going to restaurants, so in a way, they were our employees. Now, we aren’t going to restaurants. Their incomes have gone to zero, and our savings have gone up. When you and I save more money, we put it in the bank, and it ends up going to the bond market. So, through our domestic savings, we have the capacity to support these workers. The fact that our national savings rate went up in this crisis shows that there’s this pool of excess savings in our economy available to support workers who’ve been laid off.

Quick Value

Perspecta ($PRSP)

This is an old spinoff from DXC Technology a few years back. An IT service provider in the Government sector.

The stock hasn’t done much since the spin took place in 2018 so don’t worry, you haven’t missed much.

Fundamentals haven’t been too bad…

Operating cash flow has been consistently at or above $600m with fairly minimal capex needs. Not bad for a < $4bn market cap company. They’ve made a few small acquisitions and repaid some of the debt they were left with from the spinoff.

Part of the problem is a key contract set to expire on 12/31/20.

With the contract loss out of the way and still great free cash flow conversation (100% or better), it looks like Perspecta might be paving the way to earnings growth in the future.

At 14x earnings (post-NGEN contract), it’s cheaper than other peers like Booz Allen or Leidos. Northrop recently struck a deal to sell their IT services unit for $3.4bn (~1.5x sales) so there’s certainly some interest in the industry…