Quick Value 1.24.22 ($CHTR)

Charter Communications ($CHTR)

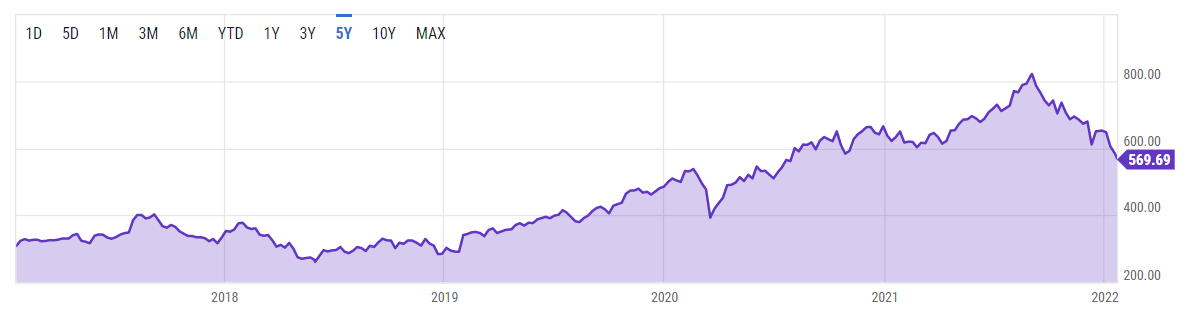

Market Performance

Market Stats

Here were some interesting charts I came across the past week…

Retail sales continue to grow at a 10%+ annual rate dating back to January 2021…

San Francisco Fed attempted to breakout the inflation increase between COVID and non-COVID impacts… Indicating that maybe inflation isn’t as concerning as headlines state…

Quick Value

Charter Communications ($CHTR)

There are a lot of Charter fans out there that know quite a bit more than me… I came across some chatter on Twitter about the stock being down >20% and thought I’d take a quick look. So it felt appropriate to use it as this week’s Quick Value…

This is a cable / internet / phone company with some 32m residential and business customers. It’s pretty well known that cable and phone subscriptions are in decline (or at least not growing) but broadband / data usage is up.

Charter came public in 2010 following a bankruptcy process. In the 2010-2015 period they were investing just about every dollar of cash flow into capex to grow the company but both revenue and operating cash flow weren’t growing all that much. In 2015-2016 they made a $92bn move to buy Time Warner Cable and Brighthouse. Again in 2017-2019 they were investing most of cash flow without seeing much growth.

Starting in 2017, they began dedicating a lot of cash for repurchasing stock. Cumulative stock repurchases total $46.6bn since yearend 2016 vs. the current $102bn market cap. What’s fascinating is that despite the share price run-up, market cap is virtually unchanged at ~$102bn from mid-2017 despite 2x growth in per share cash flow…

They say that stock prices follow earnings and that has generally been the case with Charter (until lately). On top of that, it looks like capex is leveling off which should allow them more room for repurchases…

One caveat here is the debt situation… Net debt was close to $13bn back in 2011 after emerging from bankruptcy. Today, it’s closer to $90bn, though earnings have grown too. When Charter acquired TWC + Brighthouse in 2015-2016, leverage jumped from 4.1x to 4.8x and today it remains close to 4.5x trailing EBITDA… Management doesn’t intend to take leverage below 4-4.5x; so whether justified or not, it may be a stock susceptible to leverage-induced selloffs…