Quick Value 1.25.21 ($SLGN)

Silgan Holdings ($SLGN) -- Where do they fit in the packaging industry pecking order?

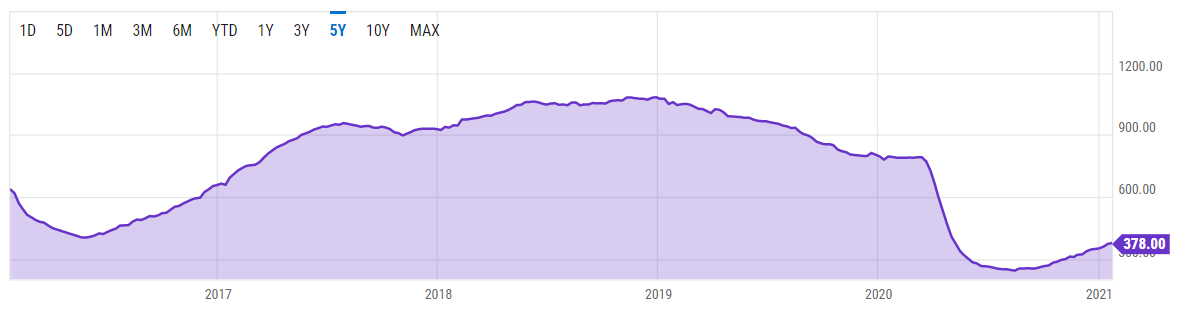

Market Performance

Market Stats

Remember when the price of oil went negative last year?

Energy prices have recovered over the past 12 months but most energy stocks are still down more than 25% over that same period.

Oil prices have fluctuated over the past 5 years but haven’t really gone below $40/barrel with the exception of early 2020.

US production levels are ~10-15% off recent peak levels but still well above historic trends.

Rig counts are still below 2016 lows (from the previous major oil selloff) but are starting to rebound as prices stabilize.

Quick Value

Silgan Holdings Inc ($SLGN)

Next up in the series of packaging makers is Silgan. We’ve already covered

Amcor $AMCR — middle-ground in valuation but solid earnings growth outlook of 10%+

AptarGroup $ATR — highest valuation in the group but potentially holds the highest quality division in its pharmaceutical products segment

Berry Global $BERY — cheapest stock in the group but most debt as well

So where does Silgan fit in??

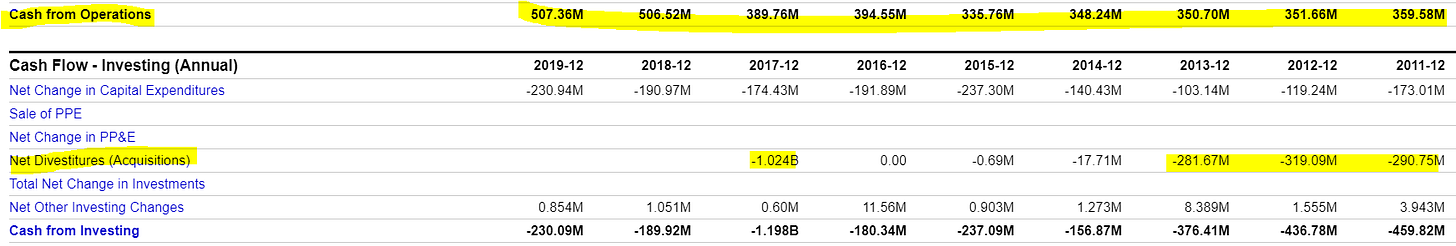

For starters, at $37/share this is a $4.1bn market cap and $7.4bn enterprise value. Sales and gross profit have grown over the years but less so on net income.

In mid-2020, Silgan closed on the acquisition of Albea Group’s dispensing business for $900m / 11x EBITDA. With that deal, Silgan likes to compare itself to Aptar’s industry-leading valuation — touting similar EBITDA margins and growth prospects.

Silgan generates the bulk of its cash flow during the fourth quarter each year so it’s probably fair to give them some credit for that. Call it a $7bn enterprise value and ~$2.9bn net debt.

That leaves the business with leverage at 3.7x and an EBITDA multiple at 8.8x based on 2021 EBITDA estimates. A pretty cheap stock on the surface and reasonable leverage given the cash flow.

The big question here is whether they can start to grow cash flow. Sales have grown but cash flow hasn’t despite investments in several large acquisitions over the years…

Competitor, Berry Global is working the same approach but with a tad higher debt at the moment. They’ve consistently increased annual cash flow over the past 10 years while Silgan seems stuck in neutral.

Could the Albea deal be a real game-changer in future performance?