Quick Value 12.5.22 ($FIS)

FIS - another payment processor trading at 11x 2022 earnings; cheap or at risk?

This is a free version of the Quick Value newsletter. Hit subscribe to stay on the list and consider joining the paid version for next week’s newsletter!

Market Performance

Market Stats

Business confidence has fallen hard from the post-pandemic recovery period… it looks to be rebounding somewhat but still close to pandemic lows (which is wild)..

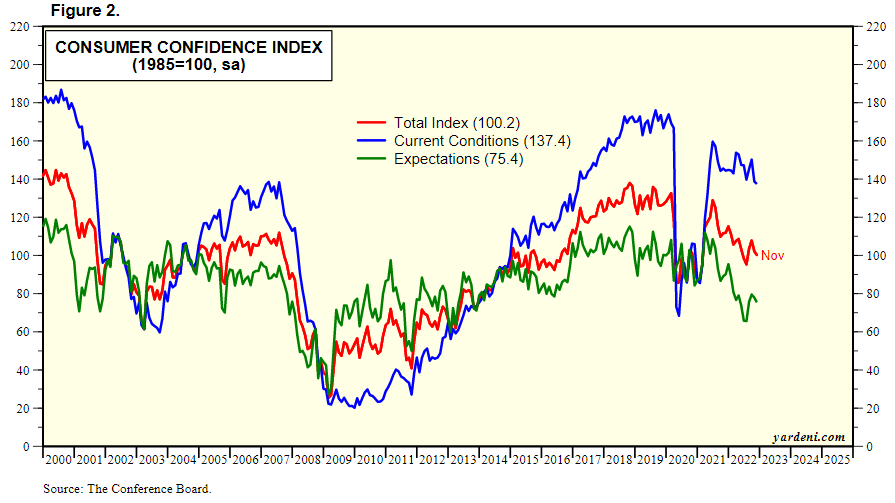

Consumer confidence paints a slightly different, more optimistic picture… the index seems to be drifting lower but still mostly in-line with the post-pandemic recovery period…

Quick Value

Fidelity National Information Services ($FIS)

Last week I took a cursory look at GPN, and this week I wanted to get a sense for what was happening at competitor FIS.

What they do…

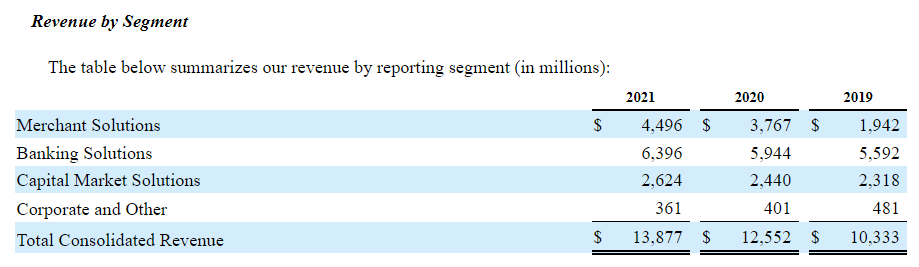

FIS is another merchant acquirer / payment processor with a few additional lines of business. They operate 3 lines of business:

Merchant (32% of FY21 sales) — Payment processing at point of sale and online; customers are small/med/large businesses selling goods and services

Banking (46%) — Software and other services to process bank transactions; customers are banks/financial institutions

Capital Markets (19%) — Software for processing securities transactions; customers are asset managers, funds, brokerages, etc.

There are 594m shares outstanding x $74 = $44bn market cap. Net debt brings the enterprise value to $61bn. The business mix is a bit different from GPN.

Why it’s interesting…

1) Biggest industry underperformer — Over the past 5 years, FIS has massively underperformed its peers (and the overall market). Over that 5 year stretch it doesn’t look like a “falling knife” situation, though you could argue otherwise from the peak in 2021… I usually like these setups so long as the company is working on some kind of pivot to improve the situation.

2) Diverse business — The retail/POS/ecom payment processing division (Merchant Solutions) seems to be the most controversial and susceptible to new competition. The other businesses (Banking & Capital Markets) seem way more defensible and make up ~2/3 of FY21 EBITDA.

3) Cash flow — Similar to GPN, this is a high margin and cash generative business. Historically, management allocated most cash to acquisitions in large spurts followed by debt paydown. The dividend has grown significantly since 2015. And meaningful buybacks are only recently becoming part of the picture.

The capital allocation plan is to grow the dividend until hitting a 35% payout ratio and then use any excess cash flow for share repurchases. Large M&A sounds like it isn’t being considered.

4) Why the stock is down — After a review of FIS, I feel like I’m better clued in to the industry’s declines. Some of this may be specific to FIS but the industry trends are there too… here are some quick thoughts on it:

Growth is slowing — from mid-single-digit revenue growth down to ~3% in Q3 and implied flat-to-negative in Q4; that’s a concerning trend

Q3 results had a big guide down in sales and earnings

Competitors taking share — Stripe, Square, Adyen, etc. there are an increasing number of payment processing competitors

At $74/share and a 2022 guide for ~$6.60 in EPS, the stock is trading at 11x earnings vs. the market at 18.5x. Over the past 5yrs, FIS has averaged a market multiple so a big devaluation here recently. If margins and revenue growth are at risk, it could be a trap; if not, then it could be a good value here… depends on how management will respond… plus they have a new CEO stepping in on January 1st 2023…