Quick Value 12.6.21 ($BABA)

Alibaba -- 12.5x FCF with some very valuable equity investments too...

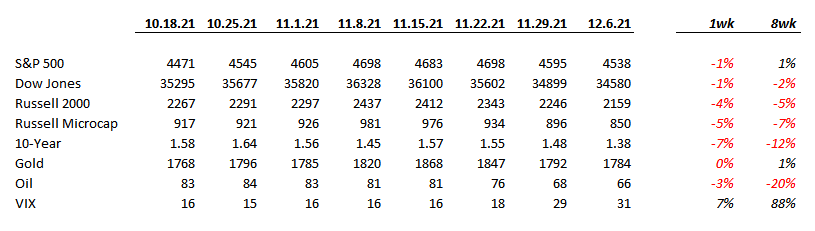

Market Performance

Market Stats

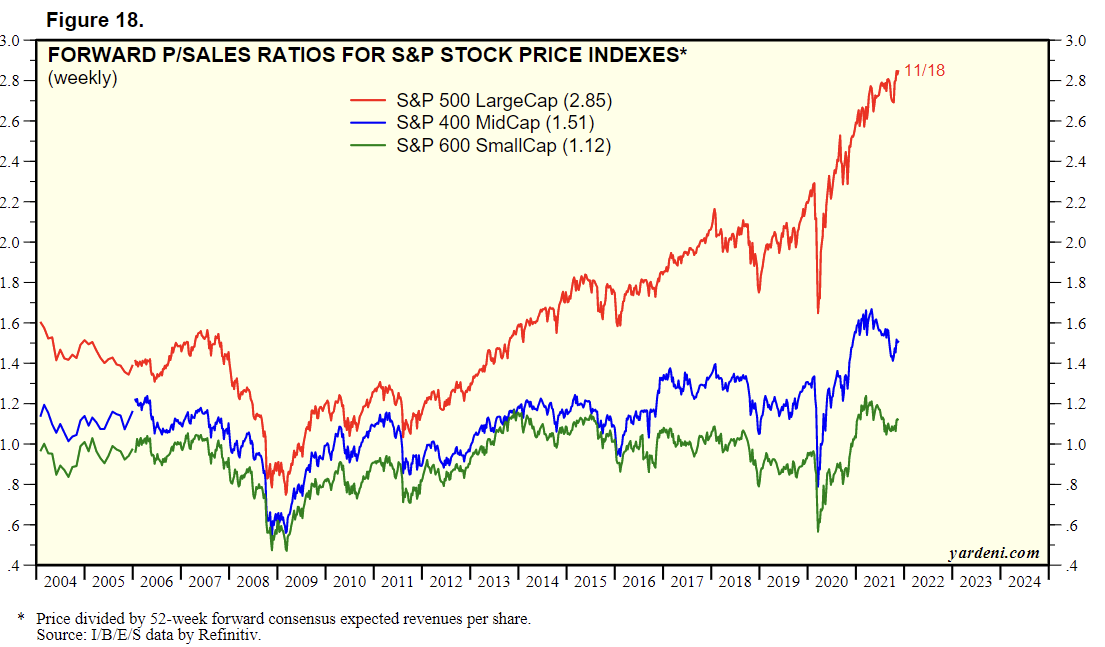

Price to sales ratios hitting highs and it’s interesting that small and mid cap stocks may not be feeling as much exuberance as the large caps (though if a company has midcap fundamentals at a huge sales multiple, it’ll naturally become a large cap stock)

Profit margins have spiked to highs as well…

Quick Value

Alibaba Group ($BABA)

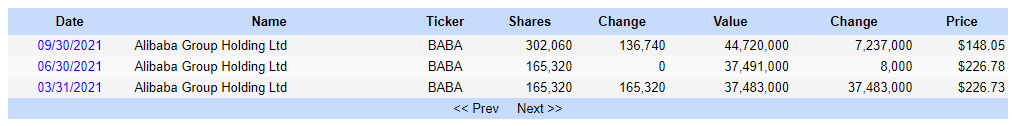

The widely followed Chinese e-commerce company first came onto my radar when it was publicized that Daily Journal Corp ($DJCO), which is chaired by Charlie Munger, bought a few hundred thousand shares this year.

I don’t know if Munger has outlined his thoughts on the stock since then but with BABA shares down from $300+ to $112, it felt like a good time to take a quick look…

A quick review shows that BABA has several wholly-owned e-commerce operations such as Tmall, Taobao, Alibaba.com, etc. offering B2C and B2B marketplaces. Beyond that, there’s a cloud computing business, digital media and entertainment, and lastly some unconsolidated investment holdings — mainly a 33% interest in digital payments company, Ant Group.

There’s quite a bit to unpack here so this will be some running notes for myself:

E-commerce businesses continue to see great top-line growth but profits are declining — caught a comment that they are investing 100bn RMB by 2025 in growth initiatives ($16bn USD)

Cloud computing segment looks and feels similar to Amazon’s AWS business earlier in its life — growing fast, was losing money and became wildly profitable — Alibaba’s cloud business just turned profitable…

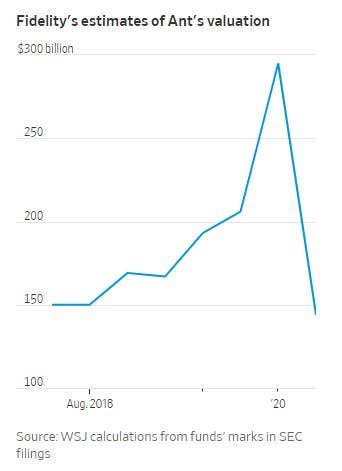

Potentially significant value locked up in Ant Group — Alibaba owns a 33% interest and the valuation was as high as $300bn before the IPO was blocked…

Huge political risks both internal (China) and external (US) — looks like China wants to curb their power and most recently scuttled the Ant IPO; annual report is littered with discussion of political risks and “blacklists” from US policy…

Capital allocation shifting to buybacks — $5bn spent in the latest Q…

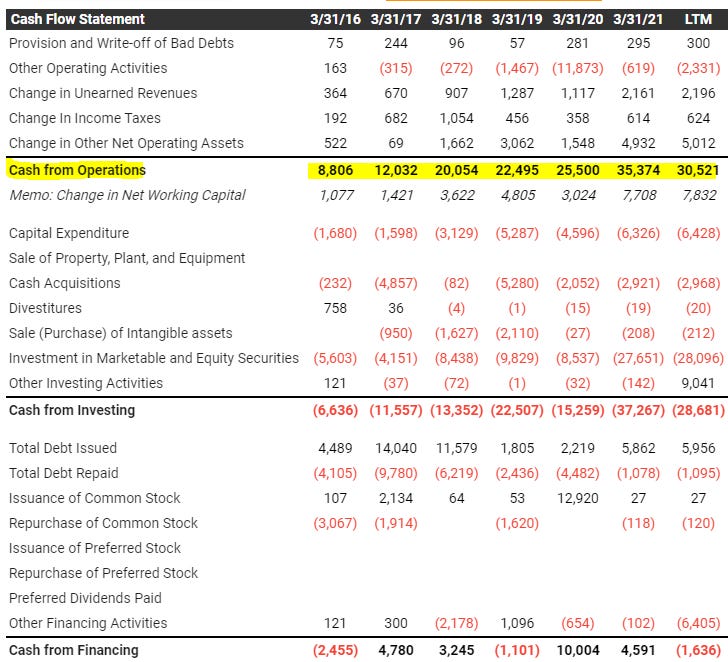

At $112/share, BABA is close to a $300bn market cap. Net cash looks something like $45bn as of 9/30/21. Free cash flow was close to $29bn in FY2021 and $24bn over the last 12 months. Roughly 12.5x P/FCF at today’s price.

The valuation is even cheaper if they’re able to extract $50-100bn for their ownership in Ant Group + another series of equity investments…

The share price action and major risks could simply boil down to the political risks… Look what happened to China Mobile (no longer traded in the US)… if China is trying to clamp down on their control and the US is doing the same, it could make life difficult for BABA investors… this looks like a difficult thing to handicap…

What happened to China Mobile shareholders when they delisted? Do they receive cash? or foreign shares? What would happen to BABA shareholders if they are forced to delist?