Quick Value 1.27.20

Equity Commonwealth ($EQC)

Market Performance

[Index | Last week ==> This week | % change]

S&P 500 | 3330 ==> 3295 | -1%

Dow Jones | 29348 ==> 28990 | -1.2%

Russell 2000 | 1700 ==> 1662 | -2.2%

Russell Microcap | 630 ==> 616 | -2.2%

10-Year | 1.82% ==> 1.69% | -13bps

Gold | 1560 ==> 1572 | +0.7%

Oil | 59 ==> 54 | -8.5%

VIX | 12 ==> 15 | +25%

Market Stats

Small vs. large / value vs. growth… the battle will always rage on…

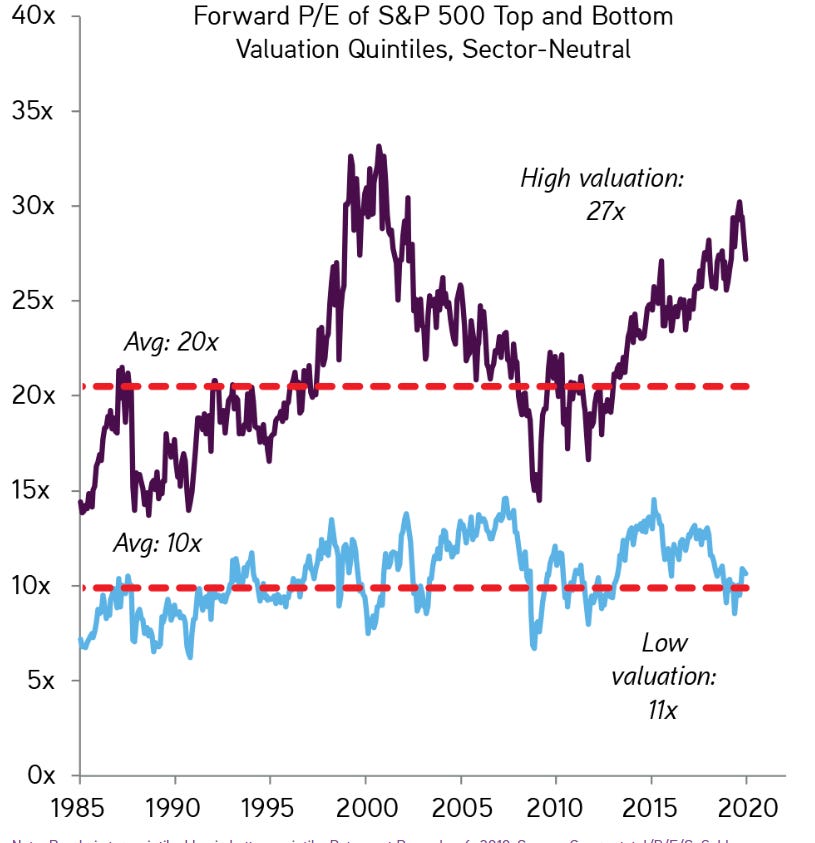

A few interesting charts that caught my eye recently. Looks like the most expensive stocks have gotten more expensive and the least expensive stocks have more-or-less bounced around at low values.

One thing I absolutely LOVE about the markets are the constant mixed signals you can get from all sorts of data points. There are charts / data to back up every side of an argument. Here are some examples from the KKR 2020 Global Macro article…

I’ve felt the recent tax reforms were a one-time hit of adrenaline. Tax cuts may provide some added cash (that many companies opted to share with employees) but likely won’t be the permanent solution to ongoing growth or continued margin improvement…

On the flip side, when comparing the market’s earnings yield to interest rates, things could look fairly inexpensive. This chart would indicate there could be plenty of upside in the market before valuations could be considered outrageous…

Quick Value

Equity Commonwealth ($EQC)

This is a very simple idea. EQC is a Real Estate Investment Trust (REIT) which owns and manages office buildings.

What’s unique about this company is that management decided real estate is/was expensive starting several years ago and has been selling off properties for 5 years now totaling $6.9bn in sales proceeds from 2014-2019.

At $33 a share this is a $4bn company sitting on $2.8bn in cash, virtually no debt and a handful of cash-generating office properties. It’s likely that a few additional properties will get sold in 2020 but “the market will dictate” how cash gets deployed down the road.

A large portion of EQC’s earnings come from interest on the large cash balance as this company moves throw a slow-motion liquidation. Hard to guess what they’ll eventually do… acquire more offices or non-office property but only during a downtown, merge with a highly-levered competitor, invest in other businesses / assets, or perhaps completely wind-down the business and distribute the remaining cash… Time will tell.

Looks like a pretty low-downside bet on an eventual cash use. Plenty of optionality in this stock…