Quick Value 12.7.20 ($KHC)

Kraft Heinz ($KHC)

Market Performance

It’s never felt so easy to make money in the markets, right?

Plenty of stocks are up a ton over the past year — remember the S&P 500 Growth index is +30% or so on the year — and plenty of others are flat or down a little, but at the same time they may have double or even tripled off their bottoms in March/April. This makes for a very precarious investing situation!

Do we plow ahead expecting the returns to continue?

Will the laggards from COVID rally to catch up with the rest of the market?

Will the leaders underperform the “average” stock from here?

Or is another leg down on the horizon?

Market Stats

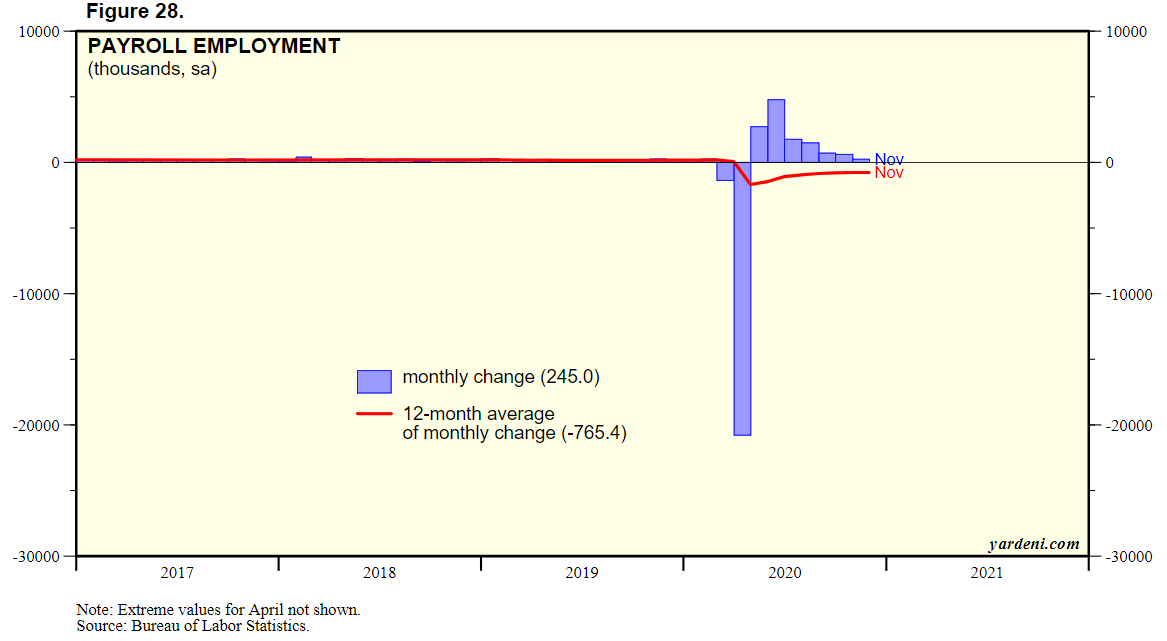

Employment levels are still on the rise but definitely slower than they had been after the max exodus in the labor markets earlier this year… 245k jobs added in November brings unemployment rate to 6.7% — well off “recession” levels from earlier this year.

A good portion of the folks that became unemployed earlier this year also left the work force entirely and this has been much slower to climb back.

Wage growth continues to accelerate as well…

Quick Value

Kraft Heinz ($KHC)

Remember back in 2015 when these guys merged?

They levered up a good deal to complete that merger and things went well for a while. The combination of debt service and underinvestment in the business led to a major drop in performance over the past few years. Sales fell, EBITDA fell from ~$7.6bn to $6bn, earnings fell from $3.50 to $2.85, etc.

Since early 2019, it looks as though the bar has been fully reset with shares more or less treading water since then in the low $30 range.

COVID has helped to produce some extra cash this year but the company is also focusing on slimming down, reinvigorating growth, and paring debt. They have a goal of 4x leverage by end of 2020.

Things look to be turning the corner a bit. Operating cash flow has been trending higher thanks to some working capital benefit and capital expenditures have been trending lower — creating a dual-prong benefit of improving free cash flow and debt reduction. The dividend still weighs heavy at ~$2bn per year on a $40bn market cap and maybe $3.5-4bn in FCF depending on how sustainable some of the 2020 performance will be.

They recently held an investor day laying out the plan to turn things around. I believe most of these targets are off a 2019 base of $25bn sales, $6bn EBITDA, $2.85 in EPS.

At $34 per share, $KHC trades at 12x 2019 earnings with a 4.5% dividend yield. If they hit 4-6% EPS growth and you get your dividend, then maybe you’re seeing 8-10% returns over the next few years with no change in multiple.

But other packaged foods brands trade in the 16x+ range. If they grow EPS at 5% for 5 years and then you get a 16x multiple, then this could be closer to 14% annual returns…