Quick Value 1.30.23 ($CR)

Crane spin off upcoming

It feels like there have been a lot of spin offs lately and plenty more coming… This split should close in April 2023 so I wanted to get a look at prior to that. Subscribe below if you haven’t yet. The paid newsletter offers tons of actionable idea generation for value investments!

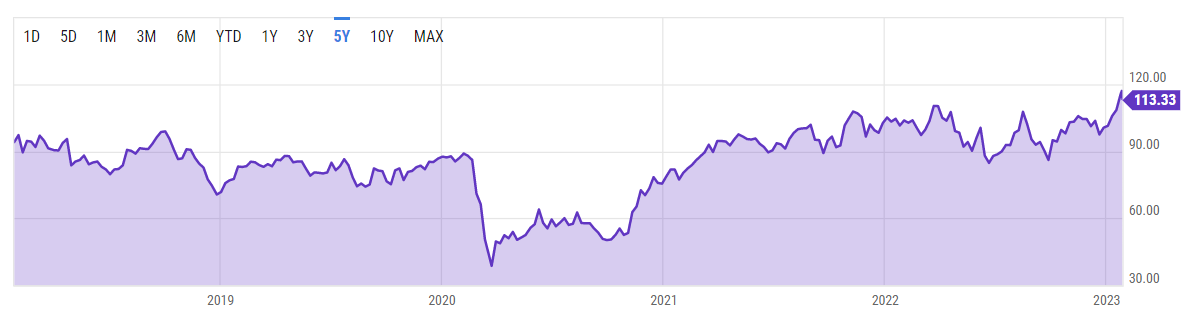

Market Performance

Market Stats

Personal income / spending data showed an increase in Wages (+3% annualized since May), spending for Goods decreasing, spending for Services increasing, and Savings increasing (both absolute $ and % of income)…

Quick Value

Crane ($CR)

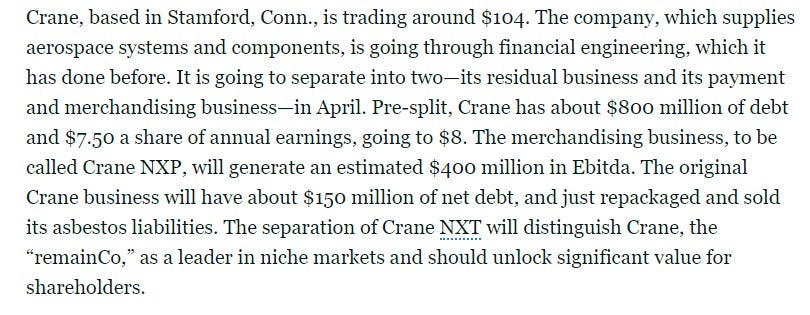

Gabelli beat me to the punch with his Barron’s roundtable mention of this stock but I still wanted to cover it since it popped up on my Form 10 screener and the spin-off is coming shortly (April 2023). Here’s what Gabelli had to say about it in Barron’s:

What they do…

Crane is a multi-industry conglomerate. You could call it an industrial since the main business lines include aerospace products, engineered products, and valves/pumps. They also have a “payments” business which sells cash dispensing systems and prints currency.

Aerospace and process flow segments will become Crane Company (SpinCo) while the Payment & Merchandising segment will stay as Crane NXT (RemainCo). It’s basically a split down the middle so if you own a share of Crane today you’ll have 2 roughly equal-sized positions post-spin.

Why it’s interesting…

The main focus here will be on the spin off… Before that, here are some quick numbers on pre-spin Crane:

There are ~57m shares outstanding which makes a $6.4bn market cap. Net debt is is less than $600m so $7bn EV. They earned $7.88 in 2022 adjusted EPS and expect >$8/share in 2023. On a $113 share price that’s right around 14x earnings.

Operating cash flow has been consistent at $300-500m (excluding a one-off asbestos liability “sale” in 2022) on sales of $3.3bn.

SpinCo (Crane Co)

This is what I would call the “industrial” side of Crane and both pieces should be leaning into a cyclical recovery from COVID. It’s a much smaller business compared to big dogs like Parker Hannifin, Illinois Tool Works, Ametek, Dover, etc. etc. In fact, it might be the smallest multi-segment industrial?

Despite being small, it’s a stable and very high margin business with solid organic growth. Both the aerospace and process flow segments have yet to recover to pre-pandemic 2019 sales levels. Growth outlooks are 7-9% annually for aerospace and 3-5% for process flow over the next few years.

Post spin, Crane Co will have 57.3m shares outstanding, 2023 EBITDA of $321m, and 2023 EPS of $3.40-3.70.

SpinCo is getting a pristine balance sheet with $100-150m in net debt (i.e. less than 0.5x leverage). What will be the capital allocation priority with such a balance sheet? Acquisitions of course. Management describes it as $1bn M&A capacity at time of spin and $2-2.5bn through 2025. To get a sense for how much capital that is, if SpinCo were to trade at 9x EBITDA ($2.9bn), the total M&A capital deployed through 2025 would be nearly 100% of the post-spin enterprise value…

RemainCo (Crane NXT)

This is the Payments & Merchandising Technology segment. The big “rub” on it is the potential secular decline in domestic/global use of cash as a form of payment (similar to Brinks $BCO). Currency in circulation is still growing and this is a very global business but it’s a valid argument against the longevity of these businesses.

Still, this is another high margin and very stable business with some cyclicality around recessions. Most (all?) of the acquisitions done at combined Crane since 2016 have been in the payments segment.

Post spin, Crane NXT will have 57.3m shares outstanding, 2023 EBITDA of $364m, and 2023 EPS of $3.65-3.95.

RemainCo will keep most of the pre-spin debt for a total net debt position of $650m or 1.5-2x EBITDA. Again, Crane NXT is also talking of an acquisition focus with $1bn of M&A capacity at spin and $2bn through 2025.

If we just add the 2 sets of guidance together we get $685m EBITDA and $7.05-7.65 in EPS — both are a step down from 2022 due to spin dis-synergies (i.e. standing up separate corporate functions and public company costs).

I find the overall emphasis on acquisitions to be interesting since Crane, as a combined company, only spent $1bn over the past 7 years and $2bn over the past 12 years; yet here they are talking about spending multiples of that over the next 2-3 years? Curious…

Valuation sits at or slightly above long-term averages of ~14x earnings / 9x EBITDA. These multiples are somewhat lower than bigger industrial peers mentioned above but that’s been the case for quite some time.

It’s possible the spin-off takes place and both pieces simply trade at the current 15x earnings multiple… that may or may not be interesting if there’s a play at closing the gap on peer valuations… OR what could be more interesting is the industrial SpinCo is bid up to a peer multiple (>20x earnings) leaving the payments RemainCo at a much cheaper ~10-11x earnings multiple…

Stay tuned…

Great work and very interesting!

Will management stay with remainCo or go with spinCo? Thats usually a sign of where the value is.

Regards,

Dani