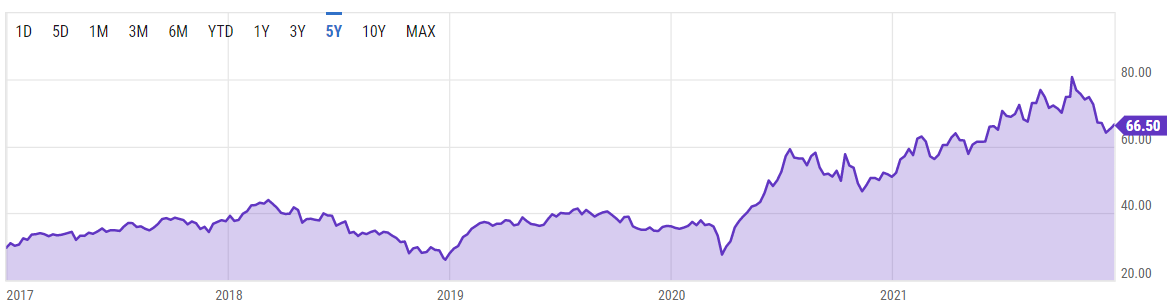

Quick Value 1.3.22 ($EBAY)

eBay selling off non-core assets and buying back plenty of stock

Market Performance

Market Stats

Buy Now Pay Later may really be subprime lending in disguise… (h/t private twitter account)

Barron’s top stock picks for 2022… for some extra New Year ideas to research!

Quick Value

eBay Inc ($EBAY)

eBay, the eponymous online marketplace, has made several moves over the last year

Sold StubHub business for $4.05bn

Sold Classifieds business for $9.2bn in cash and stock of buyer, Adevinta

Pending sale of 80% of eBay Korea for $3bn

Pending sale of ~$2.5bn worth of Adevinta shares

There are 626m shares outstanding and a $66.50 share price = $42bn market cap. Net debt as of Q3 was $3.9bn but they also hold $9bn+ in shares of Adevinta, buyer of the Classifieds business, and the pending $3bn from eBay Korea. Call it a $33.9bn enterprise value.

The underlying eBay business isn’t half bad either… reasonable revenue growth, share count on the decline, and $3bn or so per year in operating cash flow.

With the sale of all these non-core assets, how does eBay plan to use the proceeds and ongoing cash flow? They’re clearly trying to amplify top-line growth but beyond that the #1 priority appears to be share buybacks. Buybacks have been $3-5bn per year for several years now and the latest buyback authorization was just upped to $7bn / 17% of the current market cap.

One concern is likely to be the recent drop-off in active buyers and gross merchandise volume (level of transacted product on their marketplaces). E-commerce as a whole has seen some falloff relative to 2020 so this isn’t a total surprise…