Quick Value 1.4.21 ($AMCR)

Amcor ($AMCR) -- value in plastics and packaging...

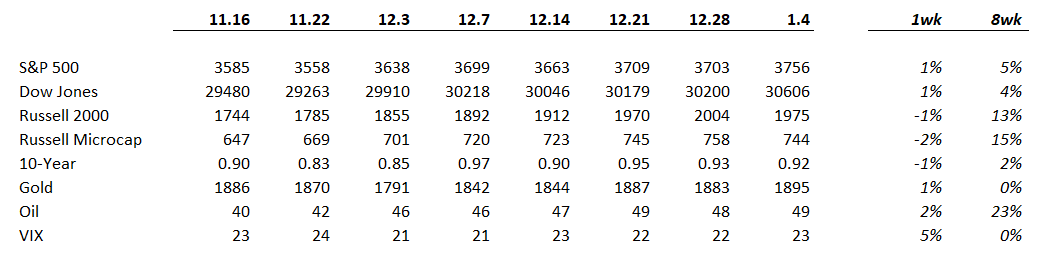

Market Performance

New Year kicks off with an S&P 500 starting point of 3756…

Returns for the year:

S&P 500 +16%

Dow +7%

Russell 2000 +18%

Market Stats

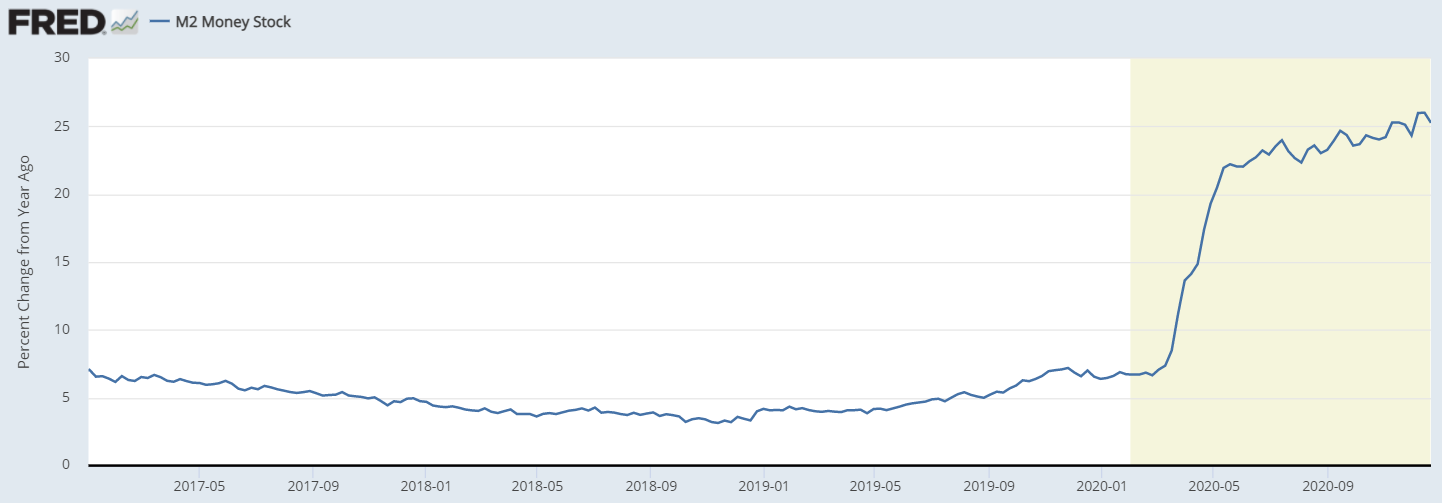

We’re kicking off 2020 with accommodative fiscal and monetary policies; is this a recipe for another year of strong returns?

The Fed has not let off the gas with money supply growth north of 25% year-over-year…

The CARES Act and recently passed stimulus bill mean we have a very supportive fiscal policy…

As mentioned in a past post — there have been winners and losers since COVID took hold and that continues to be the case. Some industries seem to have speculative valuations forming while others have been left in the dumpster.

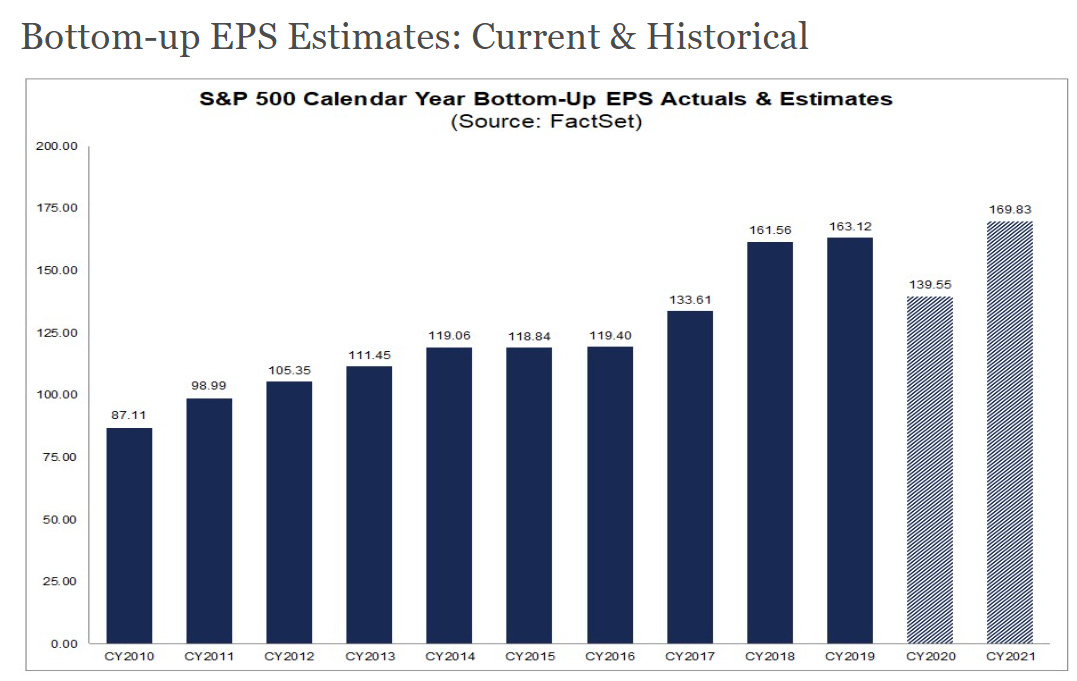

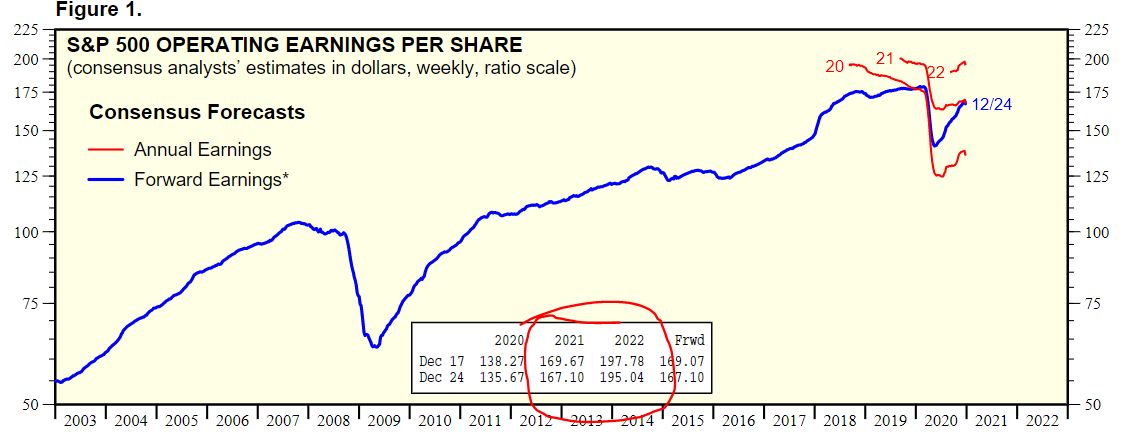

Let’s take a look at earnings estimates for the S&P for the rest of 2020 and the upcoming year…

S&P earnings should finish 2020 down about 15% or so from $163 per share in 2019. Between FactSet and Yardeni, 2021 looks like ~$169 per share which is 3-4% higher than the 2019 level. Yardeni has an early 2022 prediction of $195 or 15% growth from 2021.

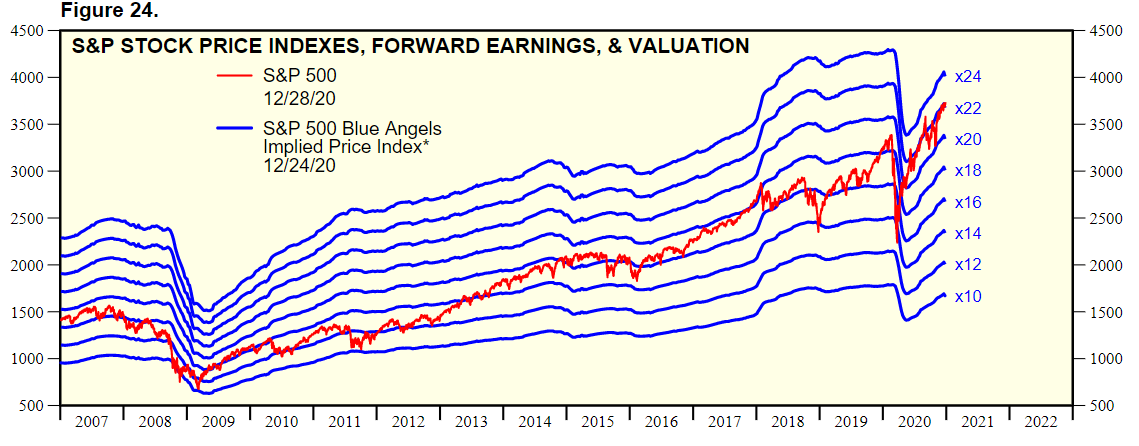

At a level of 3756 and operating earnings of $169 (estimated 2021) = 22x PE ratio. The blue angels chart below shows some serious multiple expansion over the last 10 years despite mostly flat earnings from the S&P (albeit 2018 saw a bump from tax reform).

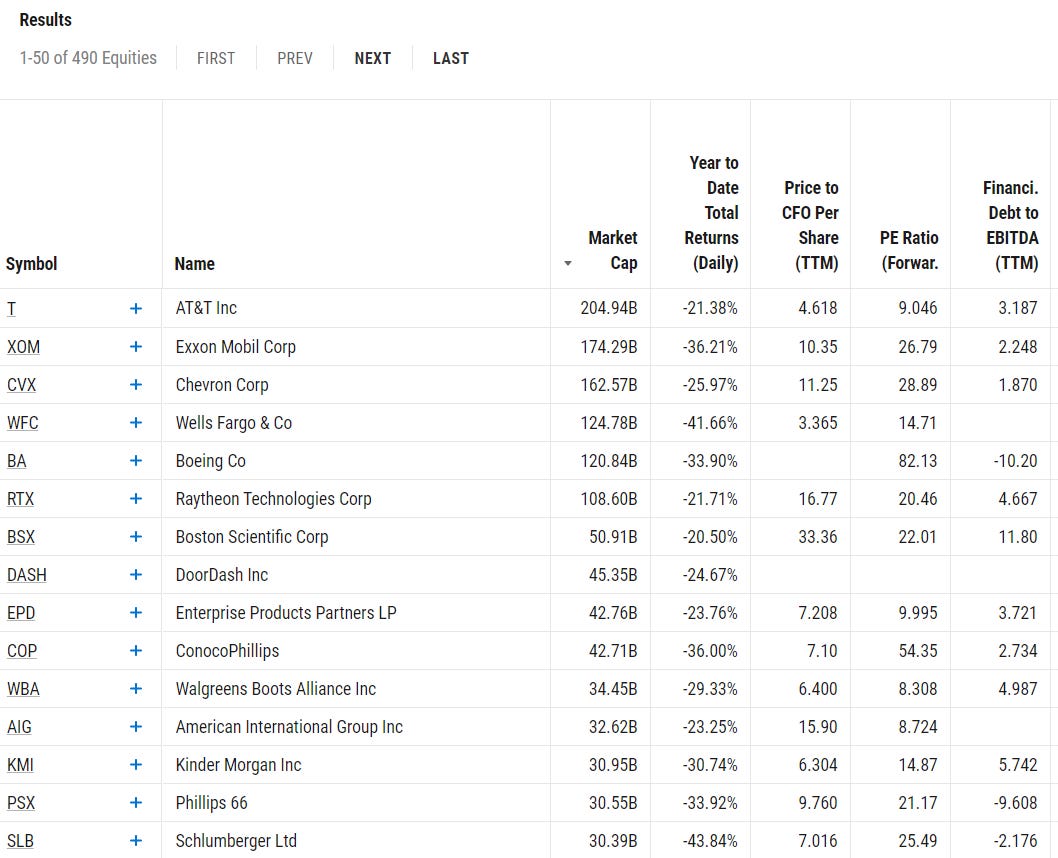

Even after decent overall market returns (some individual stocks with crazy good returns), there are still plenty of stocks out there that have been left behind… A screen of $250m+ companies down 20% or more yields ~500 results.

Quick Value

Amcor PLC ($AMCR)

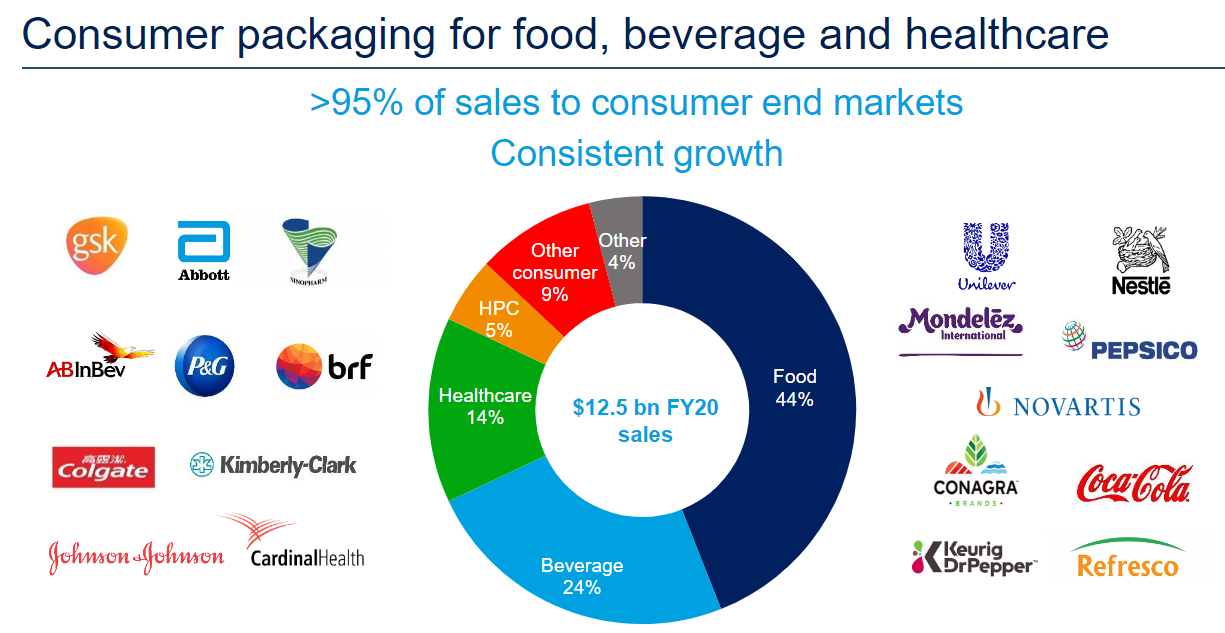

Amcor is a plastics packaging business making packages for snacks, beverage, pharma, and a variety of other consumer products.

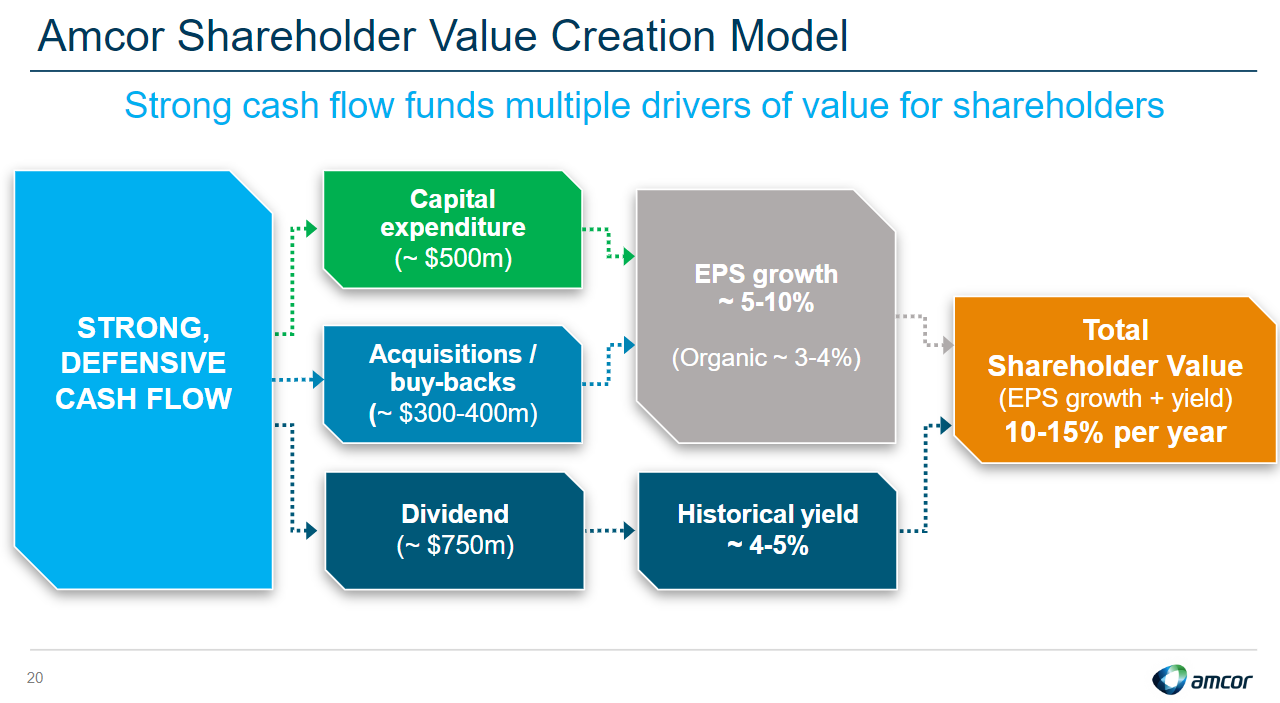

From the latest investor presentation — the company is shooting for 10-15% earnings growth + dividend yield (a rough proxy for total return to investors). This would be a pretty good outcome with a starting PE multiple of ~16-17x at today’s price.

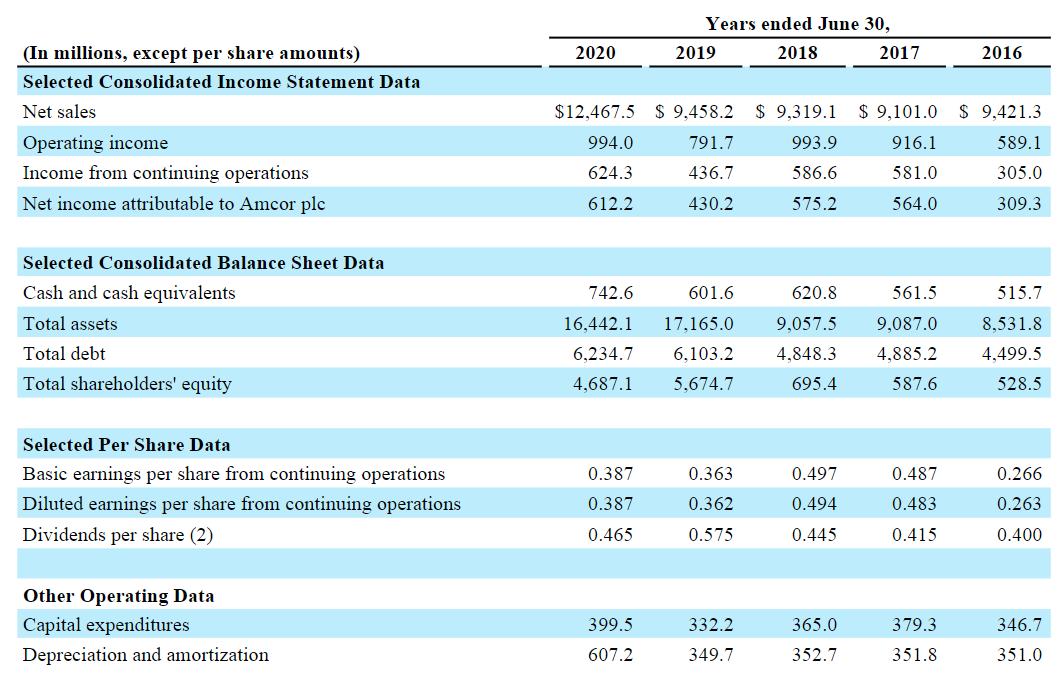

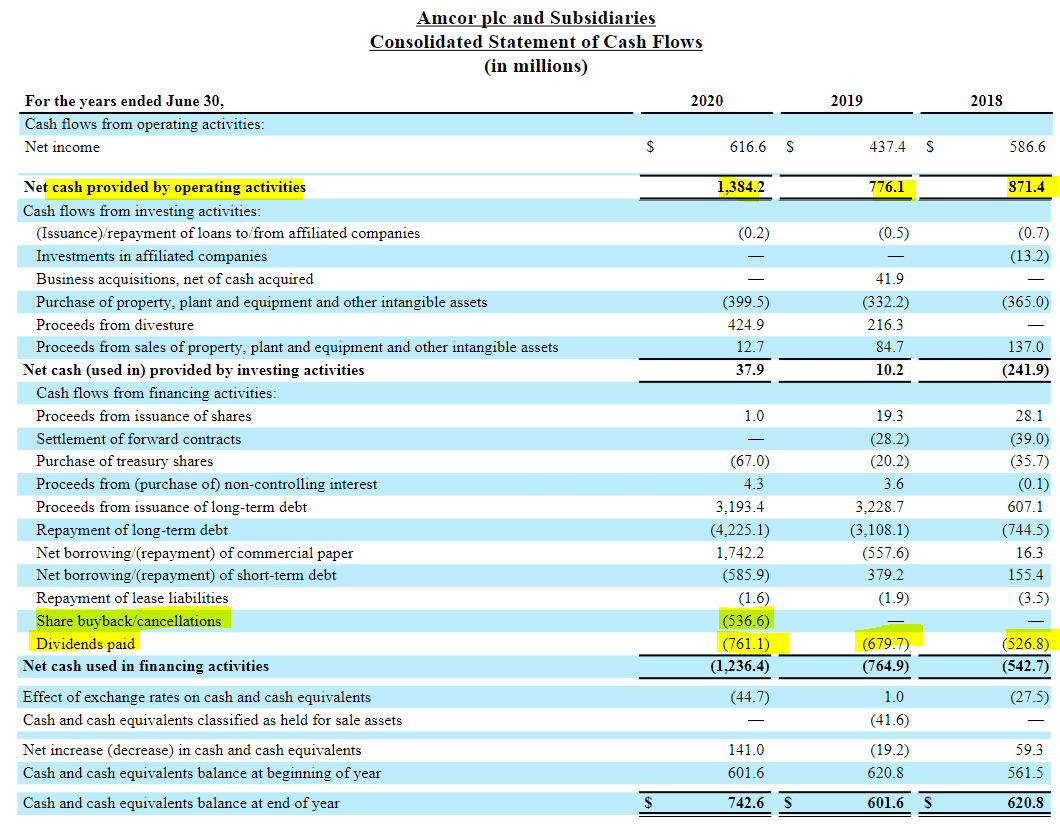

At $12/sh, Amcor is an $18bn company with a minor amount of net debt and ~$1.3-1.4bn in annual operating cash flow. Asset sales have helped to boost cash flow the psat 2 years and won’t last forever. The dividend is ~4% currently and as outlined above, the company hopes to see 5-10% earnings growth through capex, M&A, and buybacks.

The plastics and packaging industry can be very lucrative from a cash generation standpoint (I’ve written about competitor Berry Global in the past). But there are also some organic growth tailwinds at play here. International / emerging market sales are significant at Amcor at >60% of revenue. Environmental considerations play in with recyclable materials. And COVID may reinvigorate the need for single use / disposable products.

Amcor looks like a good starting point for a decent return investment.