Quick Value #190 - 10.23.23 ($FHN)

Failed deal with TD sends FHN from $25 to $10... stock is cheap at <1x TBV and 8x earnings; what next?

A slew of financials and bank stocks have been pretty beat up with the latest market selloff. First Horizon (FHN) has been on my list since their deal to be acquired by TD Bank broke and the stock sold off from $25 to $10.

With changes in the rate environment, we can’t simply rely on historic multiples and earnings to value these things; so is FHN still interesting?

Sign up below for access to the archives and if you’re not already a premium subscriber, I highly recommend subscribing for some excellent upcoming write-ups!

Market Performance

Quick Value

First Horizon Corp ($FHN)

What they do…

First Horizon is a regional bank with $85bn in assets (3Q23) and a 400-branch presence mainly in the Southeast (Tennessee, North Carolina, Florida, Louisiana, etc.).

It’s a plain vanilla lender with a ~$61bn loan portfolio split between — $33bn commercial & industrial, $14bn commercial real estate, and $14bn residential mortgages.

The sharp drop in share price from $25 to $10 in Feb-May 2023 was a previously announced takeover by TD Bank which was terminated:

FHN received a deal break fee, the share price fell, and then we stumbled into a banking crisis… let’s find out what’s going on…

Why it’s interesting…

Starting with the balance sheet…

Again, it’s a fairly plain vanilla bank…

Loan growth 2.3% annually since 2020 (COVID plus significant merger)

Tangible book value per share has grown 3.3% annually since 2016 — though stalled since 2021 (like most banks)

Conservatively financed with >10% equity/assets

No significant AFS/HTM issues meaning FHN doesn’t need to “ride out” substantial long-term losses in HTM holdings

Though declining quickly, non-interest bearing deposits were $17.8bn or >26% of total deposits at 3Q23

What are normalized earnings?

With changes in the rate environment, earnings are falling at most banks in 2023 and likely into 2024. Using trailing earnings numbers will give you a skewed sense of valuation…

The latest quarter at FHN saw: 1) a big drop in net interest margin / income from higher funding costs; and 2) a one-off credit charge of $72m as a customer declared bankruptcy.

If we take loan provisions down to a “normal” $50m vs. $110m, then I get earnings of ~$180m or $0.32/share in 3Q23… annualized, that would be $1.28/share EPS. That compares to adjusted EPS of $1.68 in 2022 and $2.07 in 2021. This seems more accurate than a TTM number considering the funding cost changes industrywide.

What about capital allocation?

Currently, shareholders are getting a $0.15/share quarterly dividend which is good for a 5.7% dividend yield. Management isn’t buying shares given the macro uncertainty.

However, on the latest earnings call they noted a strong capital position and a “long-term” capital ratio target of 9.5-10.5% vs. 11.1% today — this indicates some excess capital of maybe $800m or $1.40/share.

On the other hand, they seem to be a bit skittish about the market and want to temporarily hang onto a bit more capital. This leaves the door open for some buybacks in 2024 but probably not at a meaningful level.

With $1.28/share in earnings and a $0.60 dividend = $0.68/share or ~$380m in excess capital annually assuming no friction costs like restructuring charges. If FHN can maintain that >11% capital ratio, then it’s likely a portion of that $380m could be available for buybacks which would be accretive at today’s prices below book value.

What’s it worth?

First Horizon currently trades at 0.94x TBV and ~8x forward earnings.

Historically, FHN traded at a significant premium to book value and tangible book value mainly from their above average returns on equity. Regional banks operating in the Southeast or of a similar asset size are trading >1x P/TBV.

It’s interesting… well before the TD Bank acquisition offer, this stock was trading at a significant premium to peers and since the deal break, it’s consistently trading at a sizable discount to peers…

Fundamentals are no different and the loan book doesn’t look sketchy.

Using an old industry heuristic where ROE and P/B are linked (i.e. 10% ROE = 1x P/B), FHN should trade at 1.14x P/TBV valuation or $12.80/share. [$1.28 EPS on $11.21 TBV = 11.4% ROTE.] This valuation could expand if they: 1) grow TBV through repurchases or retained earnings; and 2) if they can return to historic ROTEs in the mid-teens.

Summing it up…

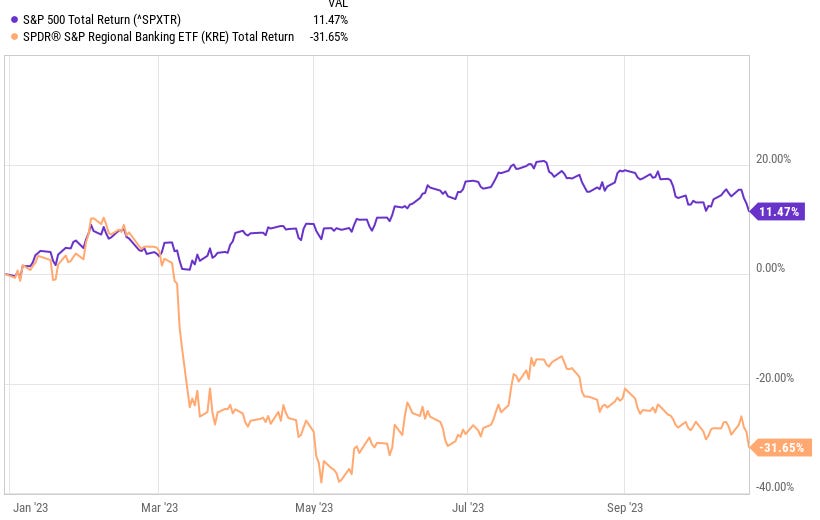

It would be an understatement to say that banks are having a hectic year in 2023. While not quite at May 2023 drawdown levels, the regional bank index ($KRE) has given back most of the summer gains and sits down ~32% YTD vs. the S&P 500 up ~11.5%.

So why own this bank (FHN) vs. any other bank down significantly this year?

The deal break aspect is clearly very interesting but that alone isn’t a good reason to buy this stock. Insiders (though not management) were buying stock in May as the price fell too.

It’s clear that earnings are still in for some YoY declines and ROEs will be impacted. But perhaps prices are already reflecting that? Maybe I’ll need to review some other banks big and small to get a better picture of what’s happening elsewhere in the industry…