Quick Value 1.9.23 ($OTEX)

OpenText - Market skeptical on major acquisition, shares at <10x FCF

Stocks are off to a decent start, bond yields are falling, oil is falling, and gold is doing well. If you fall somewhere on the value investing spectrum and love actionable idea generation, definitely subscribe!

Market Performance

Market Stats

Yield curve is heading lower into deeper inversion (recession signal)

Gold prices are underperforming inflation over the past 2 years which normally would be a surprise though gold prices are basically flat since 2012…

Quick Value

OpenText Corp ($OTEX)

I’m a generalist looking at a software company so take this week’s post with a heavy grain of salt… A major acquisition plus the fact that shares are flat over a 5 year stretch have me taking a look…

What they do…

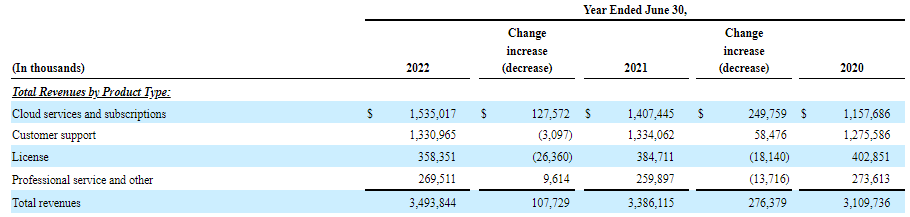

OpenText is a Canadian software company with a growth-through-acquisition approach. With all the acquisitions, there’s a large assortment of products and service offerings with a healthy mix of subscription revenue. There are essentially 3 streams of revenue here: cloud (i.e. subscription), support, and licensing.

OTEX is focused on building the cloud revenues which tend to be recurring and high margin:

OTEX has a mix of proprietary and reseller products (they partner with SAP, Google, Salesforce, etc.) with a strong emphasis on security related offerings.

Why it’s interesting…

1) Mega merger with Micro Focus — OTEX is paying $6bn in cash and assumed debt for Micro Focus (MFGP). As an $8.2bn market cap this is a big bet for OTEX!

MFGP is the combination of the old HP Software business and legacy Micro Focus. That legacy HP Software business was declining at a decent clip and the current MFGP is still seeing declining sales. Management seems very confident they can stabilize the business and return to growth, citing past acquisitions as a reference.

What does OTEX like about MFGP? It’s a high margin software business with declining sales and a low mix of “Cloud” revenue (5% vs. OTEX at ~44%). That translates to a low purchase price and upside from their heavy lifting.

The acquisition is set to close in January 2023 and likely going to be the key factor in whether this stock works over the next 1-2 years…

2) Fundamentals — The below table shows the fundamental picture of OTEX leading up to the Micro Focus deal (yet to close)… A few comments:

Excellent revenue growth — though mostly from M&A

Share count mostly flat so deals are mainly debt-funded

Invested capital growing a lot

FCF and FCF/share growing at a decent rate since 2015

Capital allocation is mostly M&A with a small but growing dividend and buybacks starting in 2021-2022

Virtually no growth in earnings/FCF since 2019 despite ~$700m added revenue

3) Major de-valuation in 2022 — OTEX has historically been trading >10-11x EBITDA but saw a major sell-off in 2022. It looks like part of that sell-off coincides with the MF announcement in August 2022 which makes sense given the declining nature of MFGP and the additional debt to finance it.

Comps are all over the place and probably vary from product line to product line. I looked at the following tickers: IBM, ORCL, ADBE, GEN (formerly NLOK), CSU.TO, CTSH and saw EBITDA multiples >10x (except for CTSH). That’s close to where OTEX historically has traded.

With 270m shares x $30.50 = $8.2bn market cap. Net debt is currently $2.5bn but will jump to ~$8.5bn following closing for an enterprise value of $16.7bn. Before synergies, combined EBITDA is $2.2bn… At 10x, the stock would be worth $50/share. That’s a good amount of potential upside, especially considering it ignores $400m in cost synergies and any potential debt paydown.

A lot could go wrong in achieving those numbers — mainly the rapid sales decline at MFGP. It looks as if investors are waiting to see how things play out the first few quarters after closing…