Quick Value #195 - Worthington Industries (WOR)

11.27.23 - Upcoming spin-off: SteelCo and ProductCo

We’ve got another spin-off coming soon and I wanted to get a head start on what the pieces might be worth… my notes are below. Let’s see where initial trading shakes out this week.

Also, I’m running a nice little Black Friday promo so check that out for access to paid posts and all Quick Value write-ups (mostly the small/microcap ideas!):

Market Performance

Quick Value

Worthington Industries ($WOR)

Spins have taken a bit of a breather lately but this one is coming soon (early December regular way trading). Let’s take a brief look at what each piece does and what they might be worth…

First, a quick lay of the land…

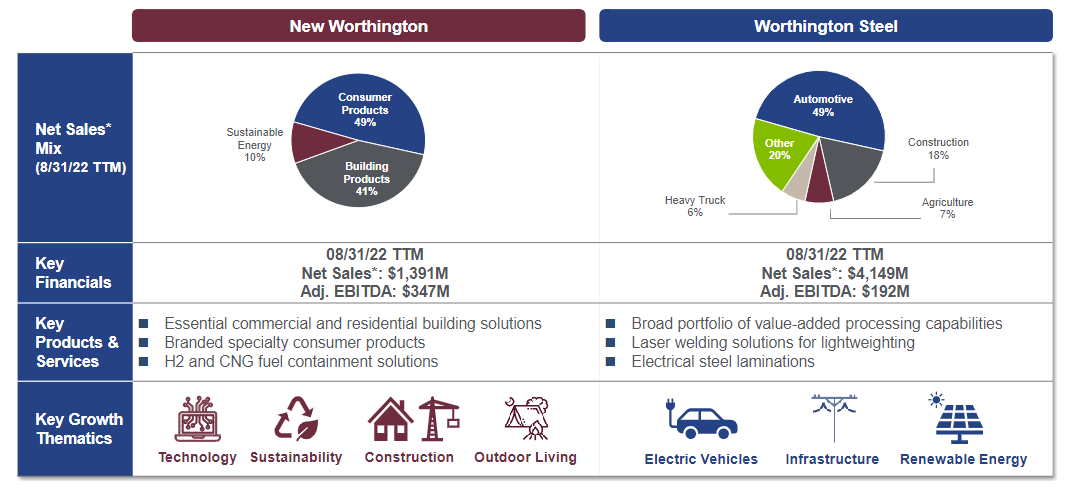

Pre-spin, Worthington has 4 segments — 1) steel processing, 2) consumer products, 3) building products, and 4) energy solutions. Steel represents ~70% of consolidated revenue and will become SpinCo. All other segments will make up RemainCo.

Below is a look at segment financials for 2022-2023 — with the exception of the energy business, these are all consistently profitable businesses.

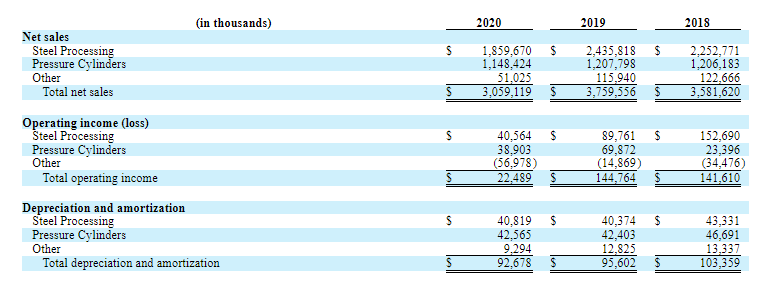

Here’s some additional info on what the segments looked like from 2018-2020:

Worthington Steel (SpinCo)

What they do…

The steel processing business is an intermediate processor of flat-rolled steel in the US. What does that mean? They buy rolls of steel from mills like US Steel, Cliffs, Nucor, etc. and process them to customer specifications. SteelCo also does welding, stamping, cutting, and various other value-add services. Auto makers use a lot of steel and that industry makes up >50% of SpinCo sales.

Think of this business as more of a service provider than commodity producer or manufacturer.

Over the last 12 months, SteelCo shipped 4 million tons of steel — 2.2m were purchased directly from mills, processed, and sold to customers; the other 1.8m were processed as a tolling agreement (i.e. on behalf of the customer with no inventory risk).

Management is bullish on the non-automotive growth opportunity, particularly in EVs and infrastructure.

What it might be worth…

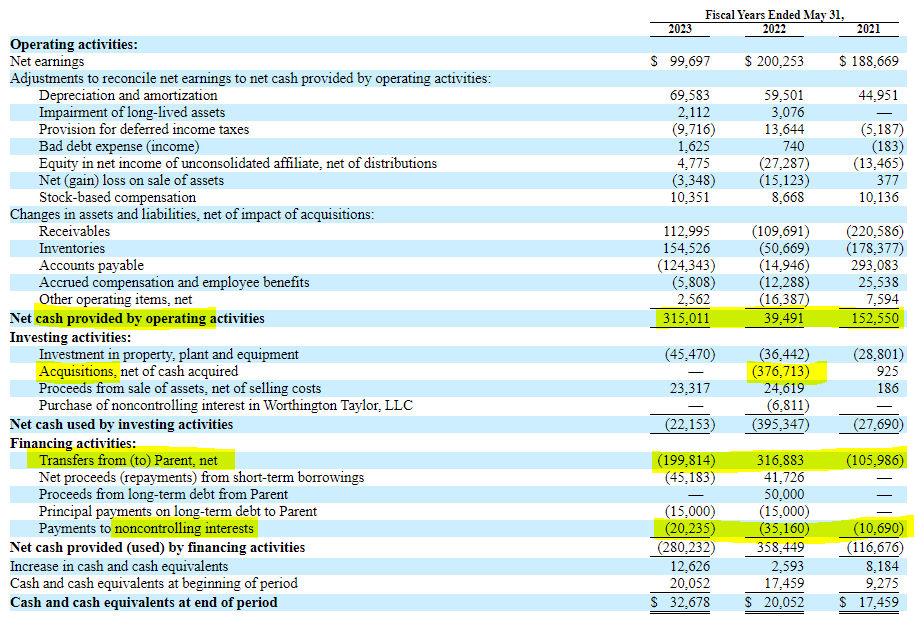

My favorite place to start with any spin-off is the SpinCo cash flow statement:

First thing I look for is the historic cash relationship with Parent… is SpinCo acting as a cash cow to fund other divisions? Or is it soaking up capital for M&A or growth capex? A couple of notes here:

Cash generative business with some working capital fluctuations

Large acquisition in 2022 — more than 2x average annual FCF

Historically distributes cash to parent (excluding large M&A in 2022)

Lots of JV’s = non-controlling interest is a real cash detractor and should be factored into valuation

Asset light; although capex has been growing (and expected to keep growing).

Sales spiked in 2022 partly from steel price spiking and partly from the Tempel acquisition which had ~$380m in trailing sales.

Revenue is leveling off (down 15% in August Q) but much slower than steel price declines (-45%)

Run-rate maintenance capex is expected to be $35-40m annually but there are 2 growth projects to expand the EV/transformer businesses that will increase annual capex to ~$100m per year for 2-3 years (vs. $45m in 2023).

EBITDA margins have averaged 6-7% since 2022 but management is targeting 10% margins in the long-term (no time period estimated).

Lastly, there are 4 JV’s that are consolidated in SteelCo financial statements (meaning >50% ownership stake) and one unconsolidated JV treated under the equity method. These are all factored into adjusted EBITDA numbers but it helps to consider the cash flow / valuation impact.

While less cyclical than a traditional steel maker, this business is still heavily influenced by both steel prices and automotive production. Mini-mills Nucor and Steel Dynamics are trading at their long-term median multiples of 7.2x EBITDA. Using that same multiple for SteelCo at a $240-250m EBITDA level = $1.7-1.8bn enterprise value. Net debt will be $120m at the time of spin so call it a $1.63bn equity value or $32.60/share based on a 50m share count. This is just rough math.

My expectation is that free cash flow will be minimal as organic capex consumes most of capital allocation. Even though leverage is low at ~0.5x net debt/EBITDA, management commented their desire to have low leverage and plenty of liquidity.

Worthington Enterprises (RemainCo)

What they do…

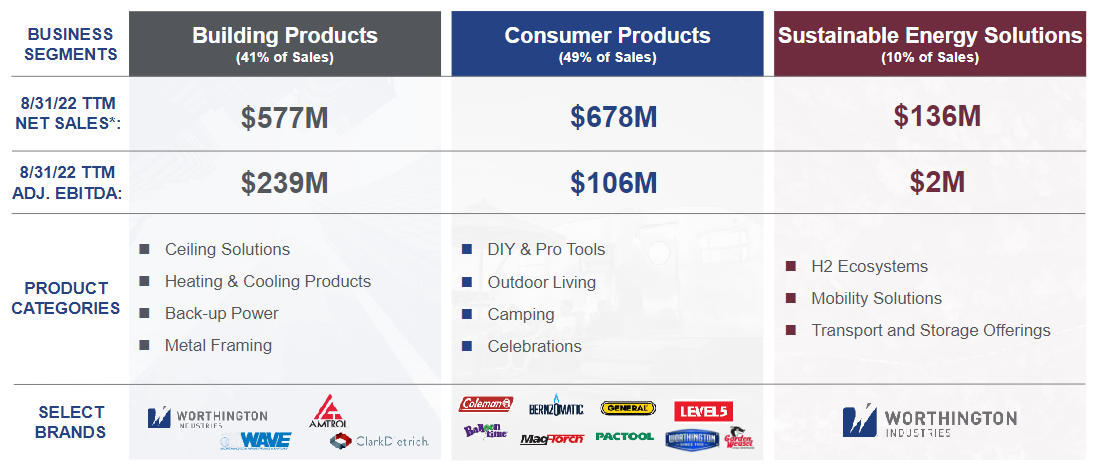

RemainCo will still be a mini-conglomerate of sorts with consumer products, building products, and energy solutions segments.

Consumer includes camping tools/stoves, torches, helium balloon tanks, and propane tanks for grills, RVs, etc. These are sold through big box retailers and distributors, plus a small ecommerce channel.

Building sells tanks for refrigerant, gases (i.e. propane), well water, etc. These are sold mainly through distributors. There are also 2 large JVs (not consolidated), WAVE and ClarkDietrich, which sell ceiling and framing structural building products.

Here are some historic metrics for those 2 segments (note the energy segment operates at or below breakeven):

What it might be worth…

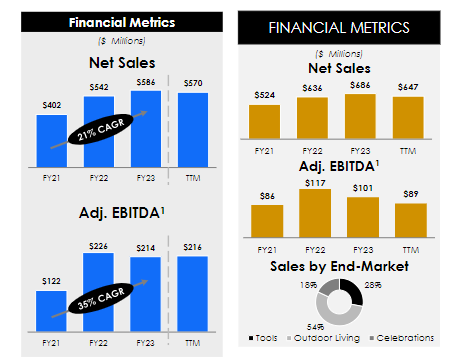

Here are some financial highlights for the past few years from a sales and EBITDA standpoint — overall growth and consistent 20%+ margins albeit some lumpiness.

And here’s where management intends to take the business:

Most industrial comps with a solid growth profile and 20%+ EBITDA margins tend to trade >10x EBITDA. They’ve even given us a nice little chart comparing financial metrics with other industrials; although there’s no real direct comparison to this mix of businesses.

Again, joint ventures are a big contributor to RemainCo earnings and cash flow. In the case for RemainCo, dividends received (cash inflows) are running >100% of equity earnings (on the P&L).

You could argue an EBITDA-based valuation approach undervalues these JVs; though it’s hard to say since we have limited disclosure and outlook around those individual businesses.

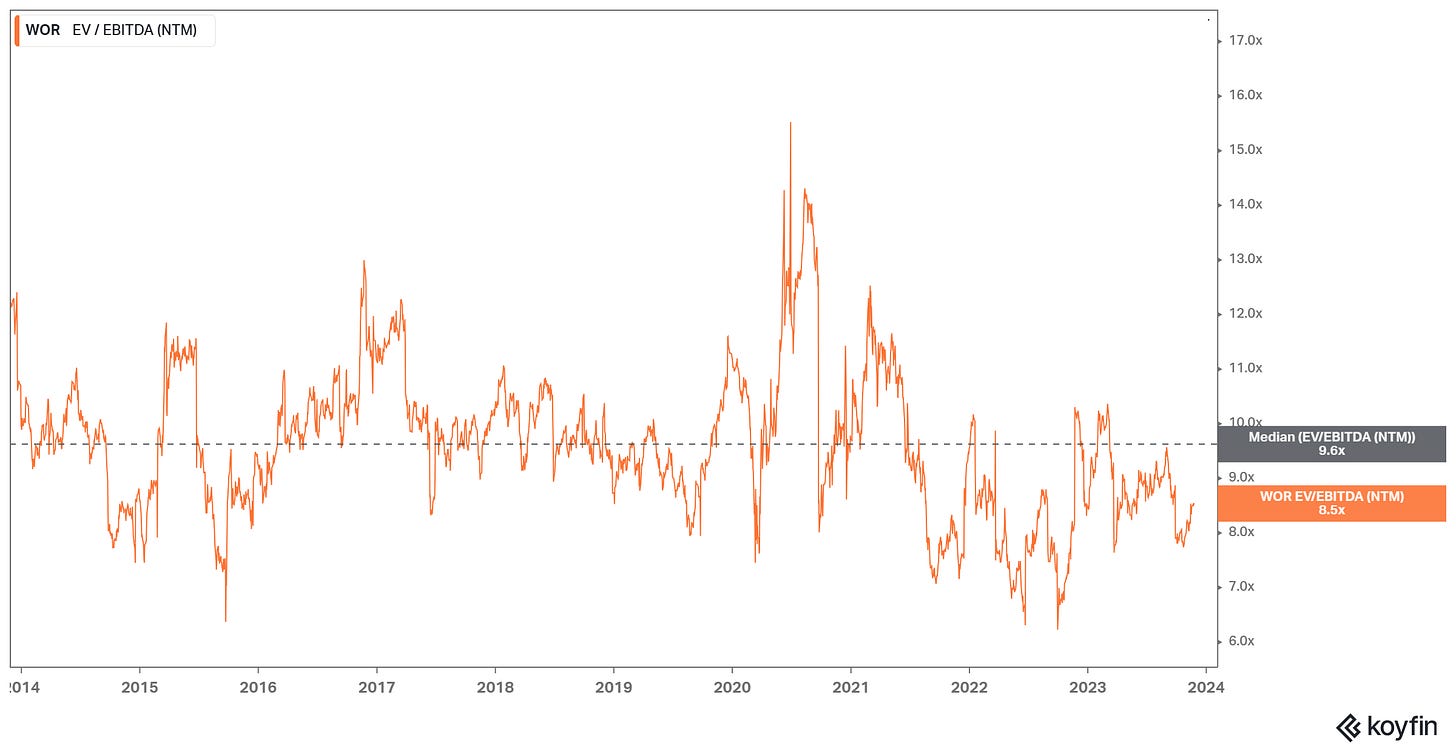

Consolidated Worthington has historically traded around 9.5x EBITDA; using that same multiple on trailing EBITDA of $285m = $2.7bn enterprise value. Back out $300m net debt and divide by 50m shares outstanding and we have a share price of $48 per share.

Summing it up…

This is an interesting setup… Worthington has dropped some previously wholly-owned businesses into joint ventures which seem to be working well; those JVs have over $3bn in sales and $500m operating income in the past year. Worthington has made plenty of acquisitions over the years including a pre-SPAC investment in Nikola that turned into a $600m gain.

As a simple shortcut I’ve used an EBITDA metric to value both of these pieces but that’s not likely the best path here… having substantial JVs can absolutely create enormous value but they make valuation a tad harder since we don’t get detailed financial statements for those entities.

I think you need to like the end-markets these pieces are exposed to. The steel business looks interesting with less commodity risk than a Nucor and growing use cases in EVs/infrastructure. RemainCo is harder despite the attractive margin profile… it looks like all/most of the value is tied up in JVs while the wholly-owned businesses are mostly tied to propane; maybe I’m mis-reading this situation?

Let’s see where these shake out in early spin trading…