Quick Value #197 - Unit Corp ($UNTC)

Big dividends announced this weekend (40% of share price) - what's it worth?

Enjoy my back-of-the-napkin math on this microcap energy company which just announced some jaw dropping dividends over the weekend… Is it worth buying pre-dividend? What about the stub security? Let’s have a look…

Sign up for the full newsletter if you haven’t already! Next week’s post is for paid subscribers:

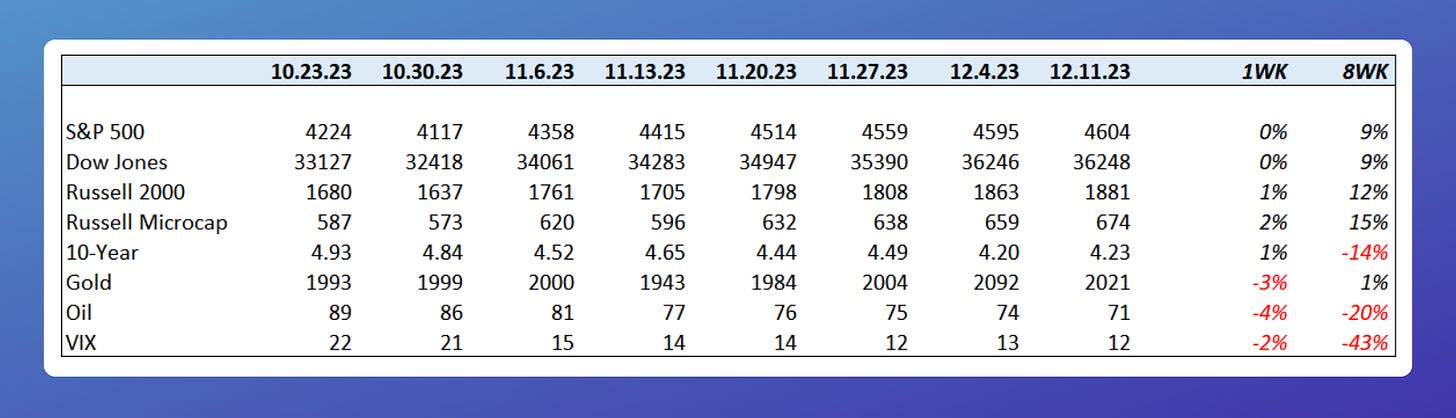

Market Performance

Quick Value

Unit Corporation (UNTC)

UNTC announced this past Friday (12/8) a series of 3 dividends expected to payout before end of year:

$2.50/share regular quarterly dividend

$15/share one-time special dividend

$5/share dividend conditional on an asset sale

That’s $22.50/share on a $56 stock! More than a 40% return of your investment. The ongoing dividend at $2.50 per quarter ($10/year) is also a hefty 18% yield.

I’m trying to get a jump on this name to see if I should be buying shares on Monday’s open.

What they do…

UNTC is an energy company which emerged from bankruptcy in September 2020. There are 2 lines of business:

Oil & gas wells in Texas/Oklahoma

Contract drilling for other energy companies

There was a midstream segment which operated processing and treatment plants for natural gas through a 50%-owned JV; but that business was sold in April 2023 for $20m.

Unit Corp has been a slow-motion liquidation since emerging from bankruptcy in 2020. They divested $80m assets in 2021, $69m in 2022, and another $30m through 9M23. Asset sales total $180m since 2021 and span every segment.

Why it’s interesting…

I can’t tell if UNTC is flat out selling everything and slowly winding down the business; regardless, the remaining assets are performing well.

Investing today, your bet would be:

Big upcoming capital return (40% of price),

Shareholder friendly management with ongoing ~18% yield,

Clean balance sheet with ~$37m net cash (assuming the $15 + $2.50 dividends)

Profitable remaining segments in non-official run-off mode

Mainly for my own benefit, let’s see what this could be worth and whether the stub company (following the big special dividend) remains undervalued.

1) Contract drilling segment (oilfield services)

Sales/EBIT over the past few periods:

2021 — $76m / $19m

2022 — $147.7m / $44.2m

TTM — $183.2m / $82m

Onshore drillers like HP/PTEN are trading at 3.5-4.5x EBITDA. These are cyclical and capital intensive businesses climbing out of pandemic lows. At 4x TTM EBIT = ~$330m for the drilling segment.

Alternatively, management suggested that replacement cost for each rig would be ~$35m. With 14 rigs, that’s $490m (estimated) replacement cost.

2) Exploration and production segment

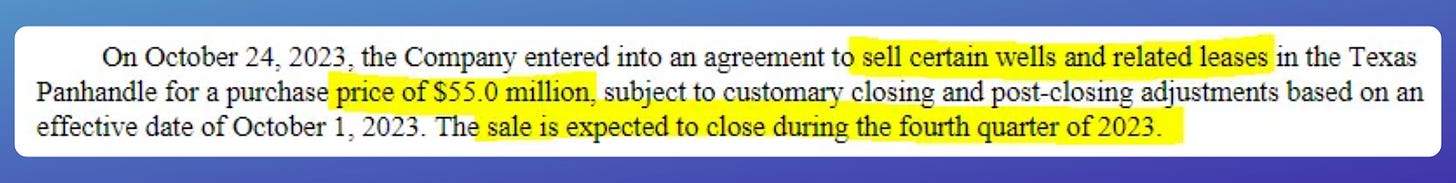

First, the company is selling assets in the Texas Panhandle for $55m in Q4. If this closed prior to 12/27 then it’ll turn into the bonus $5/share dividend mentioned above. If it closes later it’ll turn into cash on the balance sheet. Either way, it’s worth ~$5.50/share.

Lots of asset sales have occurred the past few years making the earnings stream a bit harder to analyze. The past 2 quarters saw segment EBIT of $15.9m and $13.9m… D&A looks in-line with estimated capex so this seems like a good proxy. For reference, this segment earned $164m and $220m in 2021 and 2022.

Hedges are keeping a lid on performance too… realized oil prices were $60/bbl during the first 9 months of 2023 vs. oil prices >$70/bbl currently. Hedges roll off by end of 2023. This will have a modest boost since UNTC Is mostly a natural gas producer.

I’m estimating 7-10 years of remaining reserves for oil/NGL/gas based on recent production levels.

Onshore producers are trading around 4.5x EBITDA. I’ll estimate $60m segment EBITDA (latest 2 quarters annualized = $60m + $10m D&A less $10m for asset sales). At 4.5x = $270m segment value.

Taking those asset values of $330m + $270m = $600m for the operating businesses. Add in the $22.50/share (~$217m) for the upcoming dividends and you have a total of $85/share in value vs. $56/share closing price last Friday.

This is overly simplistic and makes a lot of implicit assumptions about decline curves, commodity prices, capex, etc.

One last way to consider this…

The regular quarterly dividend is $10/share or ~$96m per year. EBIT for the 2 operating businesses total $130m ($80m for drilling and $50m for E&P). G&A is running right around $20m per year and you get $110m pre-tax earnings. NOLs should prevent any tax bill for another year or so.

If you collected $10/share in dividends for 8 years while the wells fully depleted you’d have $80/share and be left with whatever the drilling segment is worth. This might be a stretch given production declines and taxes. But it’s a simple way to think about it.

Summing it up…

This seems like a decent bet given the clean earnings profile and shareholder friendly management team.

Whether it’s worth buying in light of the dividend announcements depends on the opening price point. What about the stub? Let’s say the stock opens at $65 (indicated price as of this morning) less $22.50 in dividends = $42.50/share. If the operating assets are indeed worth $600m then you’d have $62/share in business value ex-dividends. Might be worth waiting for the dividend dust to settle!

Full disclosure: I may purchase some shares today depending on price action.

You used peer multiples of ev/ebitda . But this company has no “i”. I don’t know if other peers usually have a lot debt, but if they do, using ev/ebitda would undervalue this company a bit, I think?